- The Friday session should be very interesting for the USD/CAD pair as the day will feature both the American and Canadian employment figures.

- Because of this, I think you have a situation, or we are going to see a lot of volatility, this might be “Ground Zero” for the Forex world during the day.

- After all, the 200-Day EMA is starting to show signs of support is something worth paying attention to but quite frankly I think this is a market that is just killing time before we get more information that we can take advantage of.

Technical Analysis

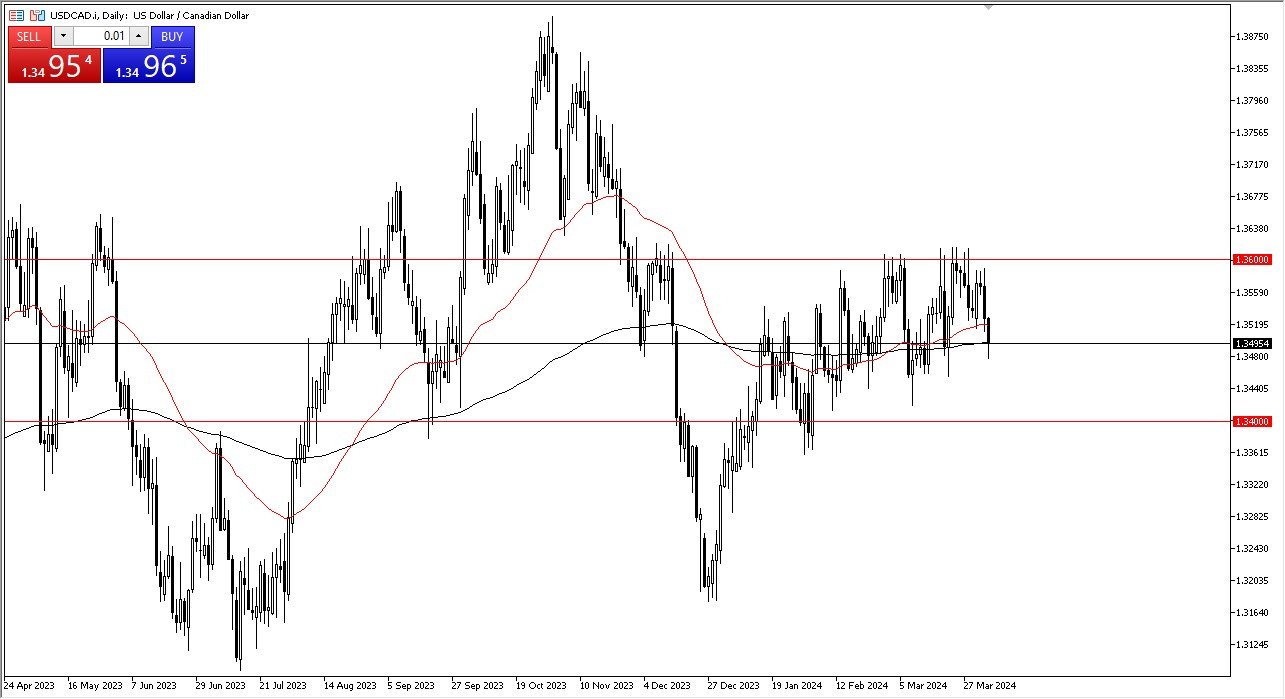

The technical analysis for this pair is one of sideways consolidation from the longer-term standpoint, with a 1.34 level underneath offering a massive amount of support, while the 1.36 level above offers significant resistance. The 200-Day EMA and the 50-Day indicators both come into the picture’s offer potential noise. With this being said, I think you have got a market that is going to continue to just bounce back and forth but you have to pay attention to both of those levels as a breakout from that range could be a major turn of events.

Top Forex Brokers

If we were to break above the 1.36 level, then it is possible that we could go to the 1.3850 level. If we break down below the 1.34 level underneath, then it opens up the possibility of a move down to the 1.3250 level. Either way, if we break out of this trading range, I think it becomes a huge potential move. Otherwise, then we will just simply bounce around in this area and continue to use those 2 levels as boundaries for your trading.

Keep in mind that the employment figures come out at the same time, so this will cause a massive amount of volatility that you have to be aware of. Do not put big positions on, but once we break out of this range then you could start to add to a position if it’s already working out in your favor. Expect a lot of noise, but hopefully we’ll get a little bit of clarity.

Ready to trade our Forex daily analysis and predictions? Check out the best currency exchange broker Canada for you.