- The dollar yen initially pulled back a bit during the trading session on Friday as traders got out of the path of the Bank of Japan meeting.

- That being said, we have seen a complete turnaround from that pullback after the Bank of Japan stated that the depreciation of the yen is not something that they're overly concerned about.

- I find this amazing, and quite frankly would love to know what the average Japanese person thinks, but I digress.

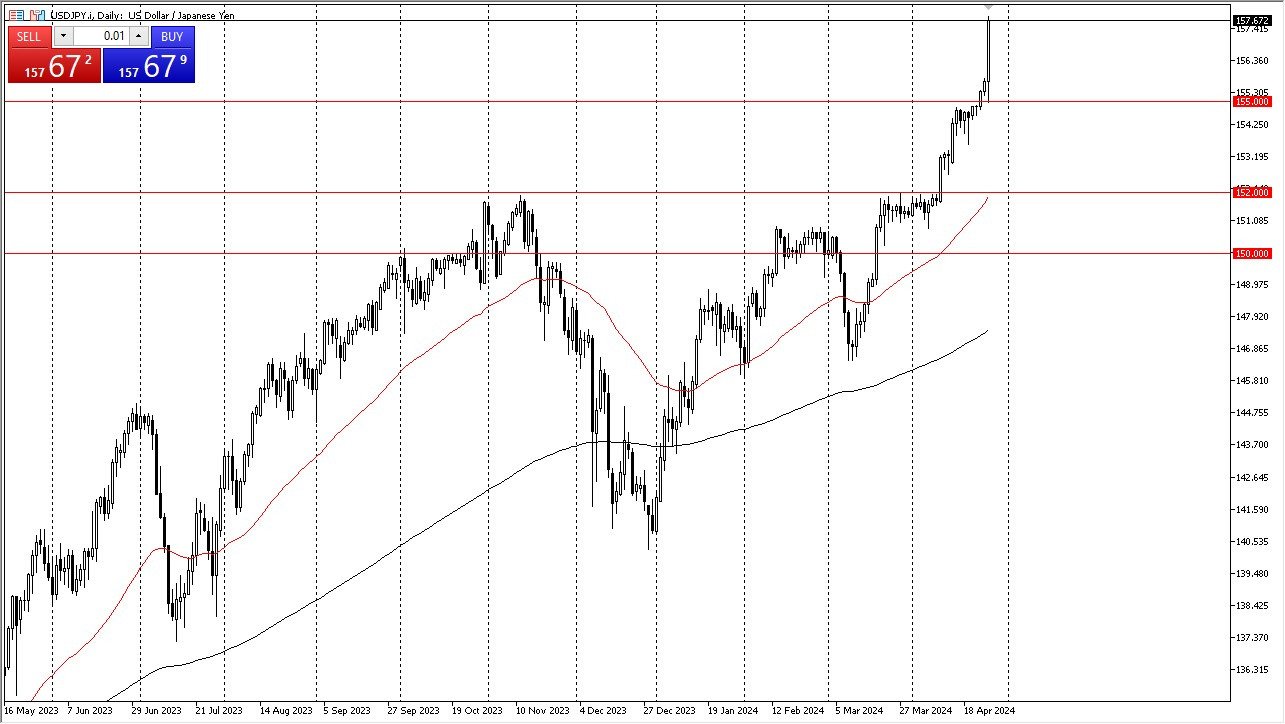

This flies in the face of everything that everybody had thought and it also contradicts what they had said previously, so people have jumped in and shorted the yen. Driving the dollar much higher against it. At this point, I think it's very obvious that any pullback at this point in time is going to end up being a buying opportunity. As traders continue to look at this through the prism of trying to find value, the one hour chart as you can see, has pulled back to the ¥155 level and just took off like a rocket.

Top Forex Brokers

Longer-Term

Longer term, I think we could go looking into the ¥160 level, although that may take some time to get there. Whether or not we continue to go straight up in the air like we have remains to be seen. But I think any remotely significant pullback you have to start scaling back in. If we were to give up the ¥155 level to the downside, it's possible that we could go down to the ¥152 level, which is where the 50 day EMA is sitting at.

We are definitely stretched at this point, so be very cautious. You don't want to just jump in blindly and start buying hand over fist, but you can clearly not short this market. The USD/JPY market will be interesting, considering that the market has been so strong, and likely to have a massive pullback as the momentum will eventually run out. If the market sees a massive sell off, I will certainly be interested in trying to get involved.

Ready to trade our Forex daily analysis and predictions? Here are the best Asian brokers to choose from.