Signals for the Lira Against the Dollar Today

Risk 0.50%

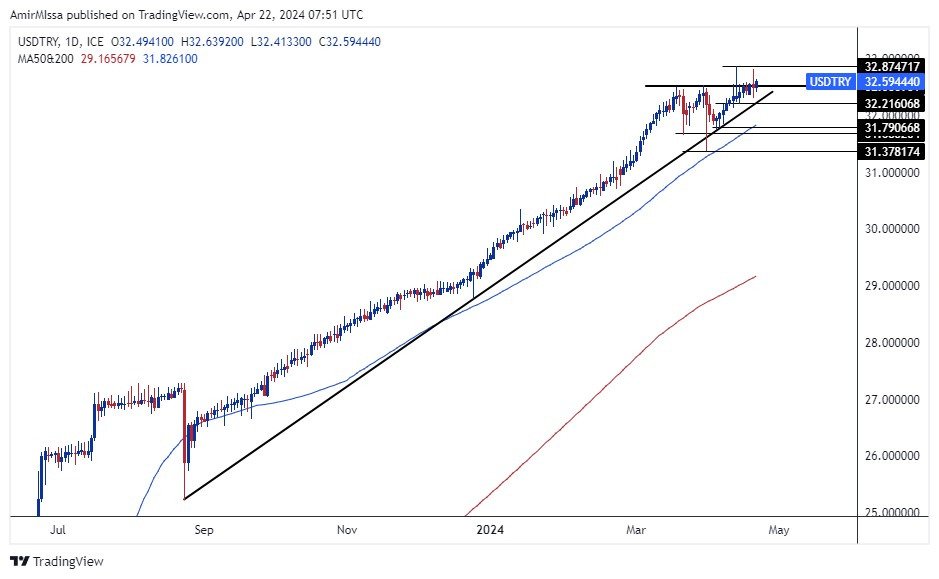

Bullish Entry Points:

- Open a buy order at 32.40.

- Set a stop-loss order below 31.20.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 32.80.

Bearish Entry Points:

- Place a sell order at 32.77.

- Set a stop-loss order at or above 32.98.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 31.95.

Turkish lira Analysis

Trading of the US dollar against the Turkish lira “USD/TRY” rose during the beginning of the week's trading, where the pair traded above the strong resistance levels of 32.50. The pair maintained its movements within a limited range, although it tended to rise throughout the current month.

Investors followed the statements of the International Monetary Fund (IMF) on the Turkish economy. Where the bank expressed its support for the economic reforms being followed by the economic team, in this regard the bank said that there is a major change in economic policy on both sides (fiscal and monetary) which supported the weaknesses of the Turkish economy. Also, the bank announced that there are currently no discussions about providing any support program for Turkey. At the same time, the bank expects that reducing inflation will take a long time. Moreover, it is worth noting that the IMF issued a report on Turkey last week that included expectations for inflation to decline by the end of this year, and continuously over the years 2025 and 2026. At the same time, the expectations of IMF experts included a decline in the Turkish lira to levels of 45 liras per dollar.

In other news, on the fiscal policy front, the Ministry of Finance in Turkey announced measures that will tighten control over the movement of bank accounts in order to combat tax evasion, which is done by collecting revenue through bank transfers. Ultimately, the measures include tightening control over the accounts of commercial establishments and their owners, their relatives, and employees of those establishments.

Top Forex Brokers

USDTRY technical Analysis and Expectations Today:

The US dollar against the Turkish lira pair recorded a rise during the European trading this Monday morning, where the price moved above the strong resistance levels at 32.50 liras per dollar. Also, the pair settled above the upward trend line on the daily time frame shown in the chart. Correspondingly, the price moved above the 50 and 200 moving averages on the daily time frame, and on the four-hour time frame, which intersect positively upwards in an indication of the control of buyers within the general upward trend recorded by the pair in the long term. Technically, if the pair retreats, it targets support levels concentrated at 32.30 and 32.09 respectively. On the other hand, if the price rises, it targets resistance levels concentrated at 32.75 and 32.87 respectively. Decisively, Turkish lira price expectations include a rise for the pair as long as it remains above the upward trend line.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Turkey to check out