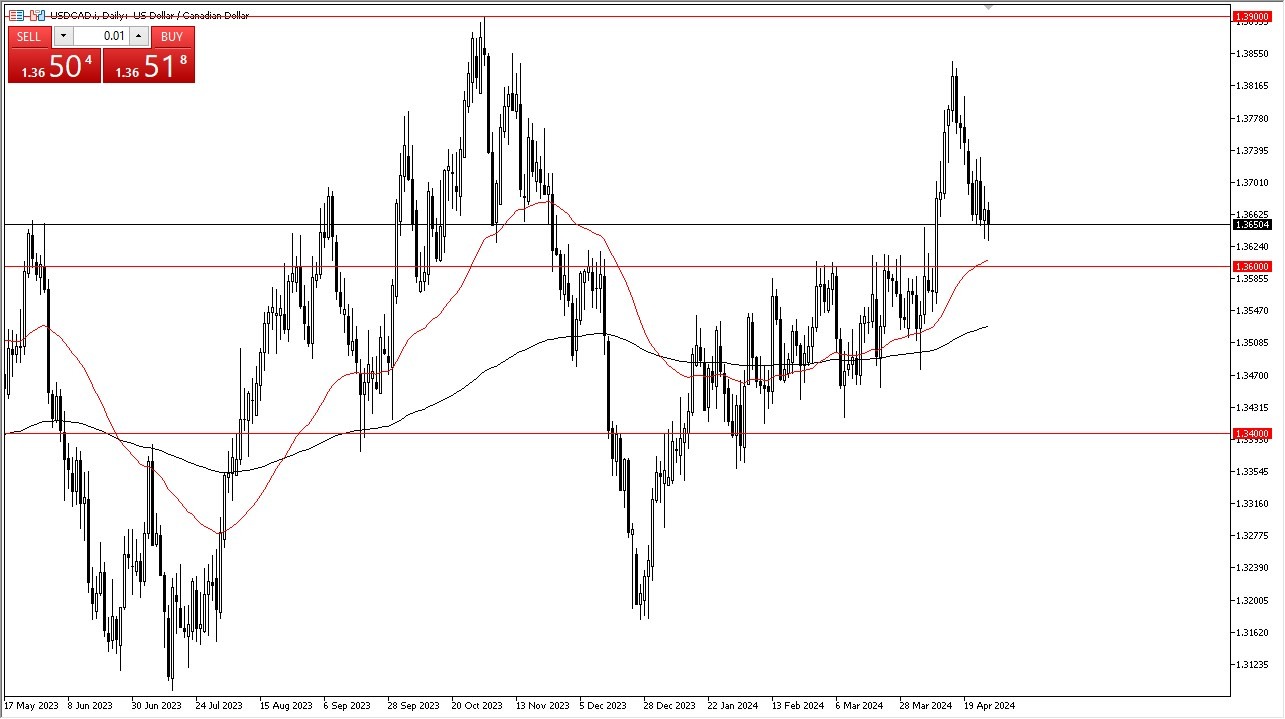

- The US dollar has initially fell during the trading session on Monday but has continued to find support near the 1.3650 level.

- This is an area that I think has a lot of interest that extends down to the 1.36 level, where the 50-Day EMA presently sets.

The 50 day EMA of course will attract a lot of attention from a technical analysis standpoint, but at the same time is also sitting at what was once major resistance. Because of this, I would anticipate that there is a lot of market memory in this area that could move things along.

Crude Oil

Keep in mind that crude oil typically does have a major influence on the Canadian dollar, but against the US dollar it might be a bit different. After all, the United States is producing a massive amount of oil these days and is one of the world’s biggest producers. With that being said, I think this is a situation where it remains a buy on the dip opportunity as we are building base patterns after a major break out. Keep in mind that the market has been very tight for some time, at least until we break above the 1.36 level, so I do think this is an area that a lot of people will be paying attention to.

Top Forex Brokers

Over the longer term I anticipate that this market could go looking to the 1.3850 level above, which is where it recently had seen a lot of resistance. Granted, the pullback has been somewhat ugly, but I still think there are plenty of buyers underneath it will be willing to take advantage of “cheap US dollars.” Beyond that, it’s probably worth noting that the Canadian economy itself has quite a few issues that has to deal with, not the least of which would be the housing situation.

All things being equal, I think this is a market that you are trying to take advantage of any value that you get. Keep in mind that this pair does tend to be very choppy and sideways overall, so it’s not a surprise that it’s taken quite a bit of time for the market to stabilize. If you are patient enough, I suspect that the buyers will be rewarded.

Ready to trade our Forex daily analysis and predictions? Here's a list of the best Forex Trading platform in Canada to choose from.