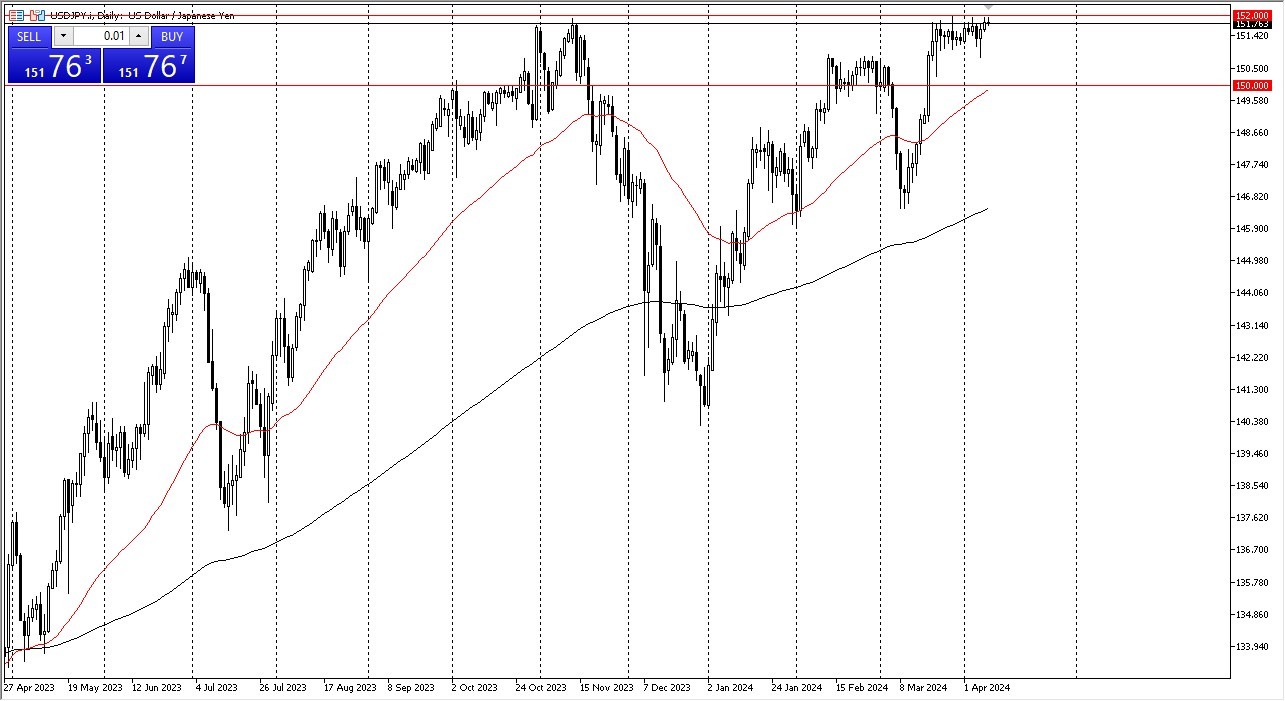

- The US dollar continues to grind back and forth in general against the Japanese yen as we continue to pressure the 152 yen level.

- The 152 yen level has been a bit of a massive resistance barrier and I suspect an area that the Central Bank of Japan is currently defending.

That being said, they can only do it for so long before the market overwhelms them. It's worth noting that the Japanese yen is getting hit against multiple other currencies, so it's probably only a matter of time before we truly take off. Short-term pullbacks at this point in time continue to be buying opportunities in an environment that clearly favors the US dollar due to the massive amount of interest rate differential between the two currencies.

Potential Massive Support Just Below

Top Forex Brokers

The 150 yen level underneath should end up being a significant support level, especially with the 50 day EMA coming into that picture as well. In general, I like buying dips, and once we rip through the 152 yen level, I think it's likely that we will go much higher, perhaps reaching towards the 155 yen level rather quickly.

Regardless, I have no interest in shorting this USD/JPY pair and I do think that the market is starting to come into the idea that perhaps the Federal Reserve might only cut a couple of times this year, not necessarily three. Remember, there was a point where they thought there would be six cuts. So, with all that being said, it certainly looks like the US dollar will eventually take off.

The natural trajectory of this market should continue to be higher, and therefore I think you need to look at it through the prism of perhaps taking advantage of “cheap US dollars” when you get the opportunity. With this being the case, I just don’t have the interest in buying the Japanese yen, because you are going to be fighting the interest rate differential, and you will be paying at the end of every day for the honor of doing so.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.