- The US dollar initially plunged overnight against the Japanese yen as the Israelis attacked the Iranians.

- People were starting to flatten positions and that of course caused a spike in the Japanese yen value as that currency has been sold quite drastically.

- The subsequent action has been driven by the stretched positioning, as therefore we have to look at this through that lens.

The Reaction Was Overdone

Nonetheless, as time went on, we started to see that there was less in the way of damage and scope of the attack than people thought. And as a result, traders put their position back on. Value hunting certainly was a key to this move. And remember, you continue to get paid to hold on to this via swap.

Top Forex Brokers

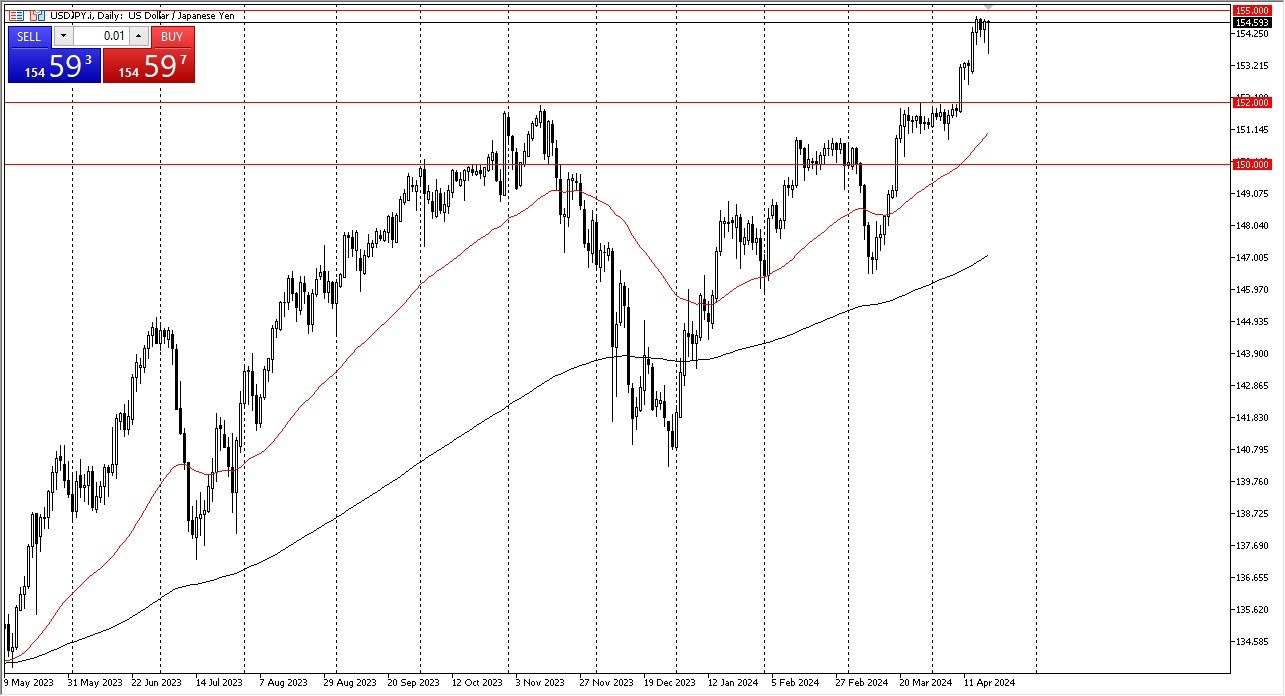

With this, I think the market eventually finds the momentum to break above the 155 yen level perhaps sometime next week. There is a serious lack of economic news out there next week, and with that being the case, we may just simply continue to drift forward and to the upside. I think this is the most likely of outcomes, as the market has simply been stronger than anything else.

Every time there is a short-term pullback, I am a buyer of this pair. I have been for months, and quite a bit of my gains have actually been realized due to the interest rate that you get paid at the end of every session. Imagine being an institutional trader then it becomes much clearer why you would be behind this market because quite frankly, it becomes an investment. If we can break above the 155 yen level, then the US dollar is likely to go looking to the 157 yen level. On pull backs, I think there's plenty of support all the way down to at least the 152 yen level. This is an area that I think a lot of people will pay close attention to. This could be the “floor in the market” going forward as we have seen a lot of previous resistance in this area.

Ready to trade our Forex daily analysis and predictions? Here are the best Asian brokers to choose from.