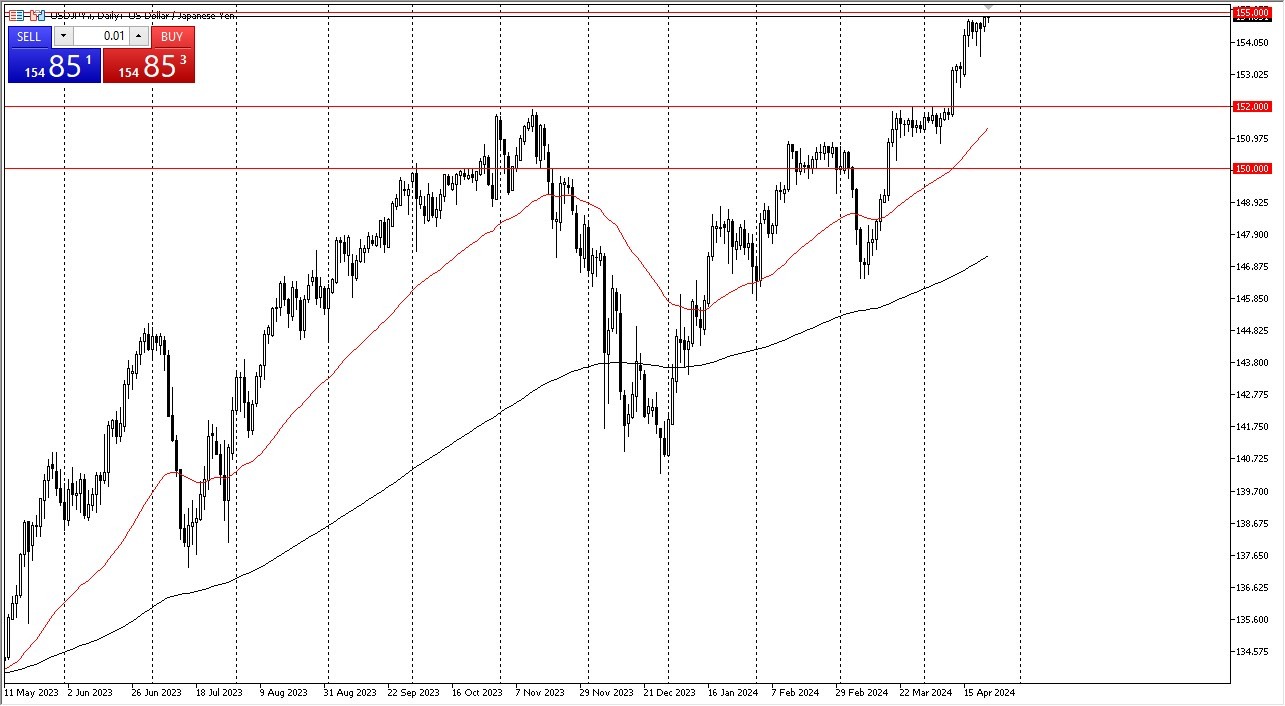

- The US dollar continues to squeeze higher against the Japanese yen, as the interest rate differential continues to be a major driver.

- We do have the 155 yen level above that could offer a significant barrier, and if we could break above there, then I think we have a real shot at the market truly taking off to the upside.

- At that point, I would anticipate a bit of short covering by whoever is trying to keep the market down and then maybe a bit of FOMO trading as traders come in and try to reach towards the 157 yen level.

Short-term dips at this point in time continue to be buying opportunities and that's something I've been doing adding to a longer term trend. The 154 yen level underneath is significant support.

The 152 Yen Level

Top Forex Brokers

Right after that then we have the 152 yen level which i think is the floor in the market especially now that the 50-day EMA is starting to come back into the picture. In general, it's likely to be a scenario where value hunters continue to come in and pick up US dollars because they get paid at the end of every day to hold onto this pair. The Bank of Japan is nowhere near being able to tighten monetary policy, and it looks like the Federal Reserve is going to have to stay tight for longer. And that, of course, has a major influence on this market as well. All things being equal, I am a buyer only, and I look at each dip as an opportunity to pick up cheap US dollars.

The USD/JPY pair will continue to be a major area of investment and holding for myself, as it is the gift that keep on giving. Ultimately, even if the Bank of Japan were to raise rates, they are limited in doing so to 0.10% increments, meaning that they really won’t be able to do much, especially as the Federal Reserve will continue to see the need to stay “higher for longer.”

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.