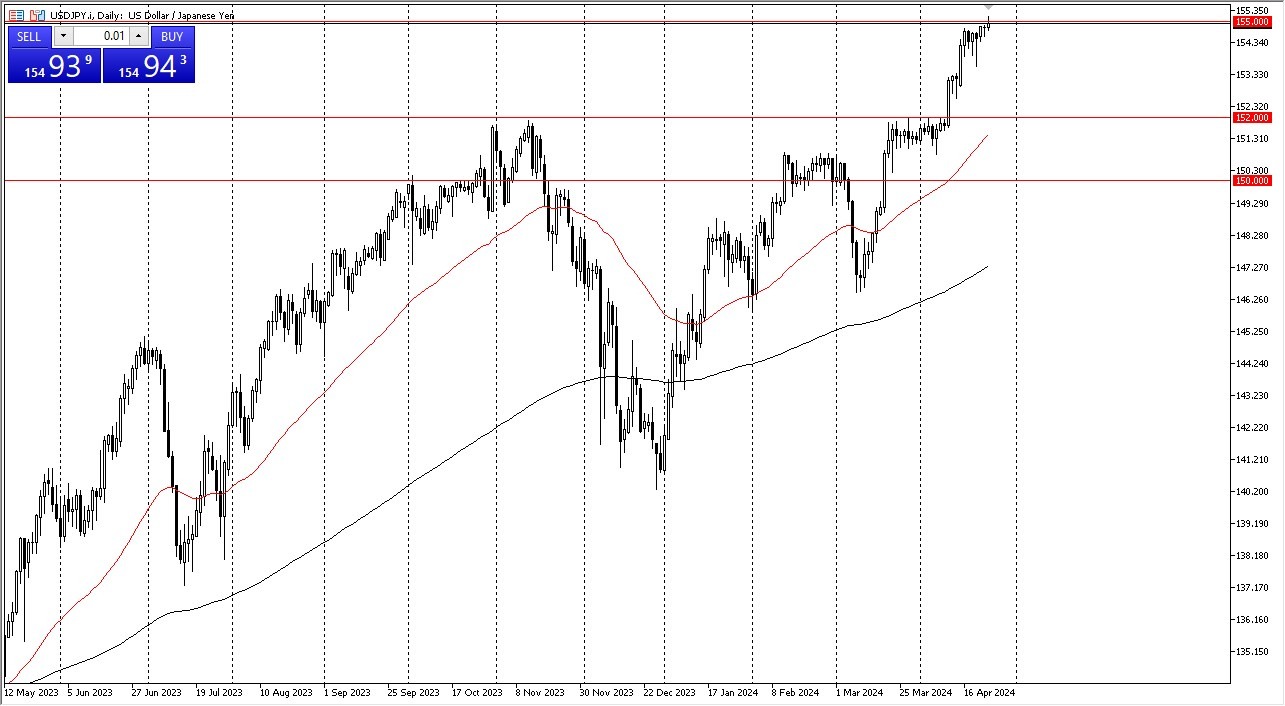

- The US dollar rallied significantly during the early hours on Wednesday, but then stalled here at the ¥155 level.

- The question is, can we slice through this like we did the ¥152 level? It's possible because there is so much in the way of noise.

But we also have the Bank of Japan meeting on Friday, and there is the possibility the people, quite frankly, are just a bit nervous about staying long ahead of that potential intervention statement. That being said, if the BOJ does in fact do something, it's only going to invite more buying. There is not much that they can do right now at this point in time to protect the yen.

Top Forex Brokers

Many Support Levels Under Here

The ¥154 level underneath continues to be support, right along with the ¥152 level. With this being the case, anything like this is a market that will continue to see a lot of upward action. But the question is, do we get a pullback between now and then. It's possible. But you have to look at any pullback as a potential buying opportunity.

After all this is a market that has an interest rate differential that you could drive a truck through. And with that being the case, you get paid to hang on to it. And while retail traders typically don't make a ton of money doing that institutional traders most certainly do. And that's who you are following. The 50 day EMA is approaching that crucial ¥152 level.

So, I think that is starting to become a bit of a flaw in the market. There's, at least at this point, literally no way I short this market. You are either on the sidelines or you are long in this pair. There is no way that you can try to bet against this trend, and of course pay for it via swap. This is a market that will continue to be looked at through the prism of finding value in general. The market continues to be positioned to the upside but also will be watching Tokyo on Friday.

Ready to trade our Forex daily analysis and predictions? Here are the best Asian brokers to choose from.