Today's Potential signal:

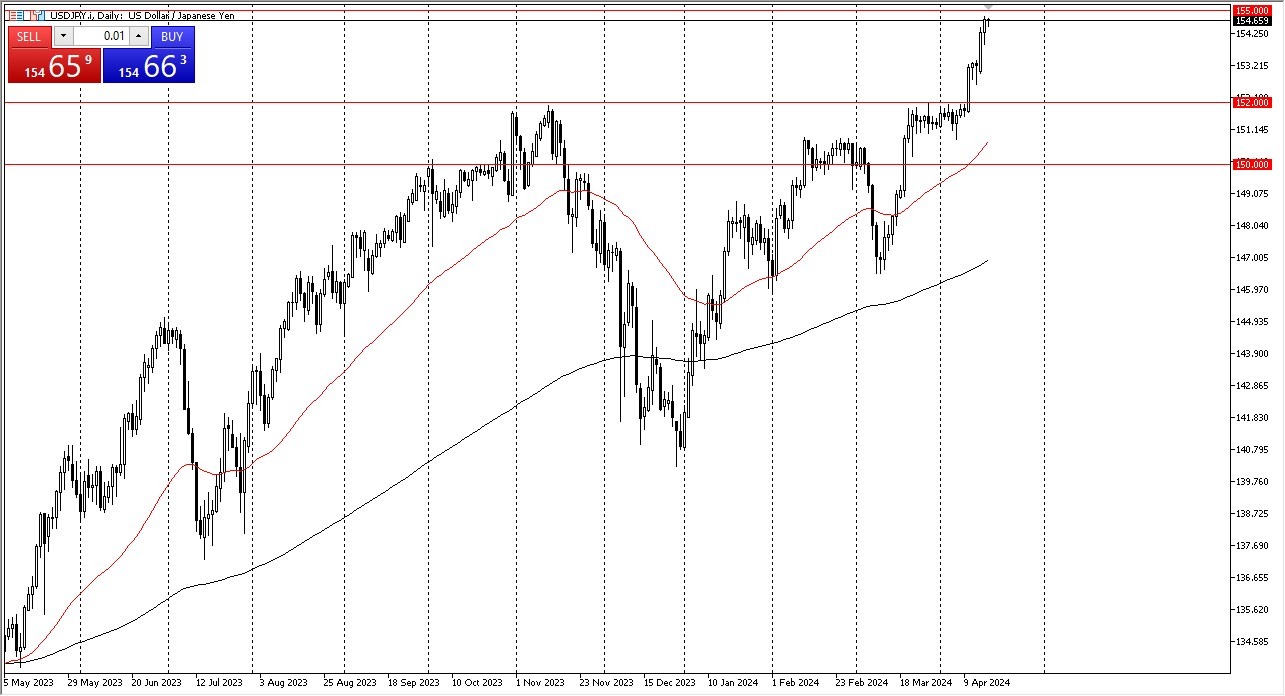

I am still very bullish of this pair and now I am paying close attention to the ¥155 level. If we can break above there, I will be a fire again, adding to an already existing position. The stop loss for this position would be at the ¥153.80 level, and the target would be the ¥157.5 level at the very least, perhaps even as high as 159.25 above.

- The US dollar initially pulled back during the trading session on Wednesday but found buyers underneath to continue to pick it up.

- Ultimately, this is a market that I think will continue to strengthen over time, as you get paid to hang onto it.

- Remember, a swap is a serious thing for institutional traders, and longer-term decisions are quite often made due to interest rate differential.

It’s probably worth keeping in mind that the Bank of Japan recently tried to raise rates, but quite frankly the Japanese can only offer 0% due to the fact that the Japanese economy is so heavily indebted. Ultimately, this is a market that I think given enough time we can probably see a lot of negative pressure on the Japanese yen, and in fact we could probably even extend the move given enough time. That being said, the ¥150 level above is a major resistance barrier, and if we can break above there, it’s likely that we could then see a lot of “FOMO trading” coming into the picture in order to continue quite a bit of upward pressure.

Top Forex Brokers

Buying on the Pullbacks

This is a market that I think continues to see a lot of buyers on pullbacks, as the ¥152 level underneath will continue to be a significant support level, as it previously had been a major resistance barrier. In fact, it then could be thought of as “market memory” coming into the picture, especially as the 50 day EMA is starting to rise toward that area, therefore I think value hunters will certainly be attracted to this pair anytime we do see a little bit of a dip.

Furthermore, you should also keep in mind that Wednesday is “triple swap”, therefore a lot of people will be looking at this through the prism of getting paid to hold it. Regardless, I have no interest in shorting this market, and therefore I think it’s just a matter of time before we see opportunities to add to an already long position. In fact, it’s not until we break down below the ¥150 level that I even begin to question the uptrend still being intact.

Ready to trade our daily Forex signals? Here’s a list of some of the top 10 forex brokers in the world to check out.