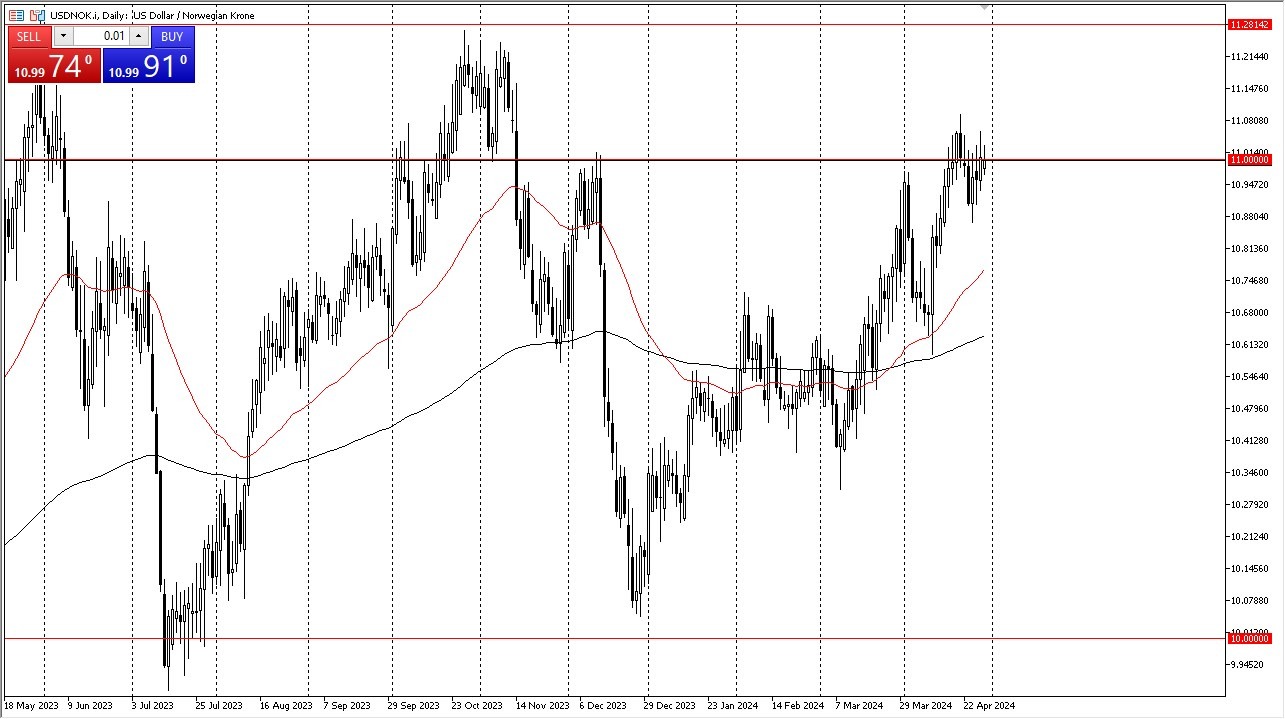

- The US Dollar continues to pressure the Norwegian krone, but it continues to sit around the 11 NOK level and seems to be looking for some type of momentum.

- In general, this is a market that continues to be very noisy, but I also would point out at this point in time we have a lot of concerns out there, and of course the crude oil market, a major driver of the Norwegian krone is not going to be as influential on the greenback, considering that the US dollar represents an economy that is now a major crude oil producer as well.

Interest Rates

Interest rates between the 2 currencies are fairly similar, so I think at that point in time it somewhat eliminates this, although there is a slightly positive carry for holding this pair long, but it’s not enough to get overly excited about. Ultimately, I think this is a play on European growth or weakness, due to the fact that Norway sends a massive amount of crude oil into the EU.

Top Forex Brokers

If we break above the highs of last week, then the US dollar could go looking to the 11.25 NOK level, followed by the recent high at the 11.28 level. In general, I do think this is more or less a “buy on the dips” pair, and I would also point out that perhaps we are trying to form some type of bullish flag. If that ends up being the case, then you have to look at this as a market that does eventually go higher, but when you pull back from here, there are plenty of areas I might be interested in buying it. The 10.88 NOK level is an area that I think offer support, followed by the 50-Day EMA near the 10.80 NOK level.

It’s not that I don’t have a scenario where I would short this pair, but I would need to see the US dollar end up losing a lot of momentum across the board in the Forex world before I would short this particular pair. In other words, I would need to see the euro, British pound, Japanese yen, etc. all start to accelerate against the greenback, something that just isn’t happening at the moment.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.