The USD/PKR has been moving at a snail’s pace this week, but interestingly enough the currency pair did track upwards in a slight fashion yesterday and speculators may believe more upside is available.

- Price action in the USD/PRK this week has been like watching paint dry. Even as the U.S inflation data yesterday via the Consumer Price Index served up a surprise to global financial institutions the USD/PKR nearly stood in place.

- The Pakistan government regulates the trading of the currency pair and simply put the USD/PKR is not correlating to the global Forex market.

If you are a trader of the USD/PKR via an offering from your broker, please make sure that you are not being charged an outrageous participation fee. If you have a genuine feeling about the direction of the USD/PKR per the official rate from the Pakistan government, and are speculating it is assumed that you have experience and the capability of holding onto a position until you have achieved the direction you are wagering.

Support and Resistance and an Absence of Volume

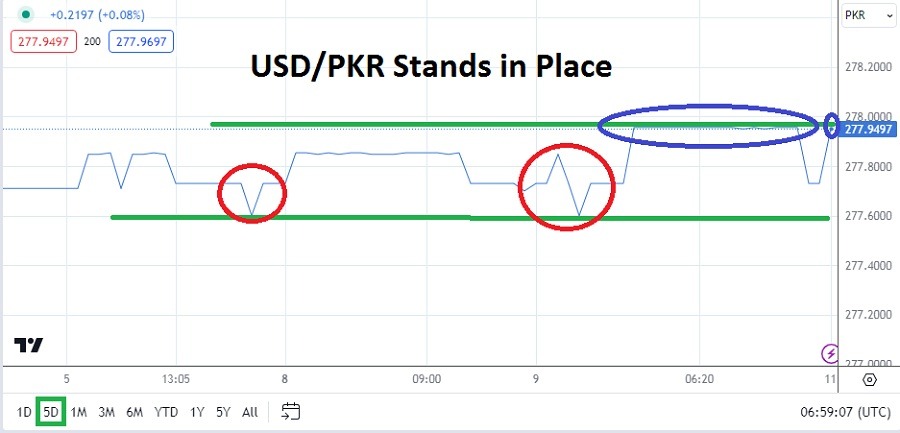

Essentially the USD/PKR had one of its quietest weeks in Forex when a technical chart is looked upon in a while. The currency pair is valued near the 277.9497 ratio as of this writing; this mark is a high that was achieved yesterday too. And yes the USD/PKR did trade slightly higher yesterday after having been recorded at a depth of nearly 277.7300 to begin the day.

On Tuesdays a low around the 277.5950 ratio was touched, which tested a low seen on Friday the 5th of April. Traders with the ability and desire to believe that an upwards movement is going to suddenly continue in the USD/PKR are free to their opinions. In fact this opinion, if the USD/PKR were a ‘floating’ currency pair would likely be correct. However, traders must understand they are trying to guess the opinion and dictates of the State Bank of Pakistan as they publish the official exchange rate according to their needs.

Top Forex Brokers

Higher Value Published and Speculative Intrigue

Betting on the trend which is going to develop in the USD/PKR is not something inexperienced traders should do unless they make careful risk management strategy part of their game plan. The upwards movement in the USD/PKR yesterday and the sustained value near the top of its short-term resistance is enticing, but betting on the continuation of upwards traction being maintained carries risk.

- The USD/PKR has enjoyed a significant downwards trajectory the past one and three months via technical charts. This doesn’t correlate to the strength of the USD in the broad Forex market.

- If the State Bank of Pakistan wants to keep a reasonable semblance of reality within the USD/PKR, they should allow the currency pair to move upwards, but policy decisions from within the central bank may have other governmental considerations.

Pakistani Rupee Short Term Outlook:

Current Resistance: 277.9640

Current Support: 277.8700

High Target: 278.0100

Low Target: 277.7005

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Pakistan to check out.