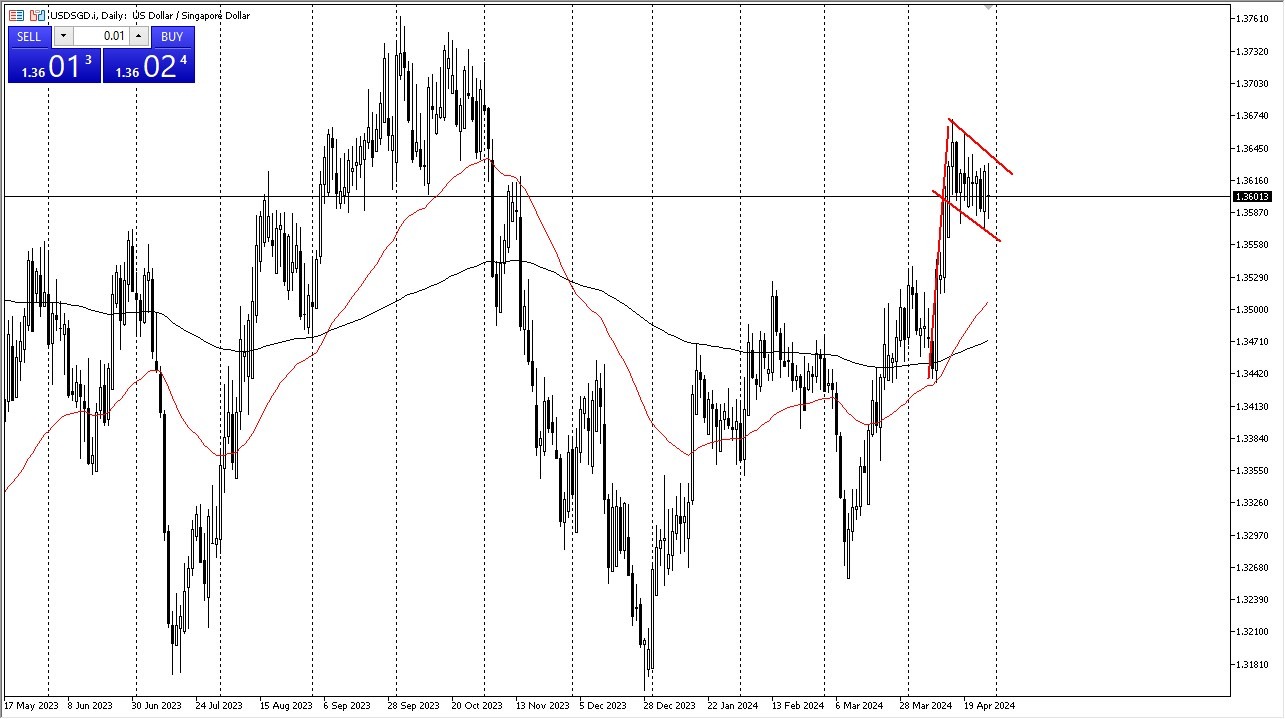

Potential signal:

I am a buyer of this pair above the 1.3650 level. If we can break that level on a daily close, I will have a stop loss at 1.3550, as well as a target of 1.38 above.

- The US dollar has been going back and forth against the Singapore dollar for a couple of weeks now, and it looks at this point in time like we are trying to form some type of bullish flag.

- A bullish flag of course is a highly sought after technical signal by retail traders, and some institutional ones.

- While I don’t necessarily put a ton of my money into a particular pattern, I do recognize that this is a market where traders will put a lot of money to work if we do in fact break above the top of this bullish flag.

Top Forex Brokers

The 1.3650 level would be my trigger price, and based upon the “measured move”, I would anticipate that this market goes looking to the 1.3850 SGD level. Overall, I do think that could happen and quite frankly wouldn’t be overly surprising considering that the US dollar has been like a bull in a China shop for some time. I also recognize that this is a market that tends to be a little slower than many others as the Singapore dollar is essentially the “Swiss franc of Asia.” It doesn’t mean that we can’t take off to the upside or plunged rapidly, just that typically this is a more measured pair. In fact, I think it’s an excellent one for beginning traders to be involved in as it tends to trend for long periods of time.

Buying On the Dips

I think buying on the dip is going to continue to be the way forward here, but if we were to break down below the 1.35 level, then I would have to think about this pair in other terms. While that hasn’t happened yet, I do think that it is a possibility but that would almost certainly be attached to the idea of the US dollar plunging against almost everything. While that does look very likely at the moment, I do consider this a pair that is worth being involved in, but like anything else, it’s going to be worried about geopolitical events globally.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best Forex trading brokers in the industry for you.