Signals for the Lira Against the Dollar Today

- Risk 0.50%.

Bullish Entry Points:

- Open a buy order at 32.30.

- Set a stop-loss order below 31.10.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 32.80.

Bearish Entry Points:

- Place a sell order at 32.77.

- Set a stop-loss order at or above 32.98.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 31.95.

Turkish lira Analysis:

USD/TRY trading rose in early Thursday trading, as the pair seeks to break through resistance levels that have held this month at 32.50 and close above them daily. Recently, investors are following the IMF's World Economic Outlook report on the Turkish economy's 2024 forecasts. IMF experts expect the dollar to reach 45 Turkish lira before falling further in 2025 to 60 lira per dollar. As for inflation expectations, inflation is expected to fall to 45% by the end of 2024. Before reaching 28.5% by the end of next year.

This comes at a time when Turkish Treasury and Finance Minister Mehmet Simsek commented on current account data, saying that the decline in the current account deficit has helped to reduce inflation and support foreign exchange reserves. Also, the Minister of Finance added that he expects the current account deficit to continue to decline in the coming months, as the ratio of the current account deficit to national income is expected to be less than 2.5% by the end of 2024.

In other news, the Turkish Minister of Labor and Social Security issued a statement on the approval of a temporary increase in the minimum wage. Furthermore, the statement stressed that this increase is not on the agenda of the ministry. Also, the statement added that the differences resulting from inflation will be reflected in July. Ultimately, it is worth noting that raising the minimum wage earlier this year has pushed inflation up again.

Top Forex Brokers

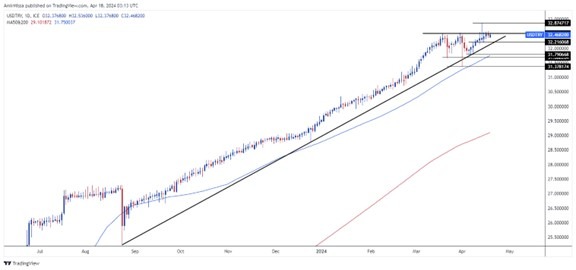

USD/TRY Technical Analysis and Expectations Today:

On the technical side, the dollar rose against the Turkish lira, trading around strong resistance levels centered at 32.50 lira per dollar. At the same time, the pair maintained their trading above the upward trend line on the daily time frame, as shown in the chart. Also, the price moved above the 50 and 200 moving averages on the daily time frame and the four-hour time frame, which intersect positively upwards in an indication of the control of buyers within the general upward trend recorded by the pair in the long term. If the pair retreats, it targets support levels centered at 32.25 and 31.99, respectively. On the other hand, if the price rises, it targets resistance levels centered at 32.75 and 32.87, respectively. Finally, Turkish lira price expectations include a rise for the pair as long as it remains above the upward trend line.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Turkey to check out.