Signals for the Lira Against the Dollar Today

- Risk 0.50%.

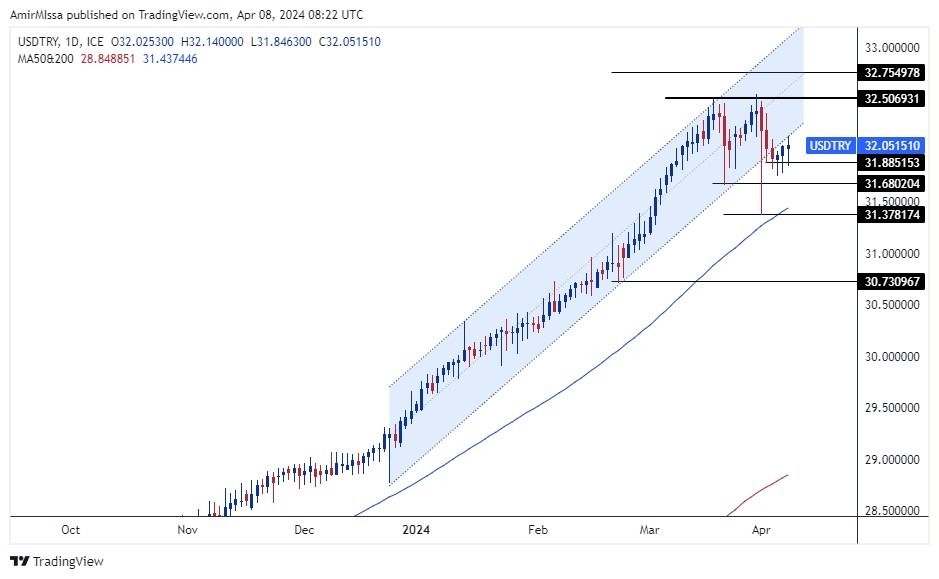

Best Buying Points:

- Open a buy order at 31.50.

- Set a stop-loss order below 31.15.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 32.50.

Best Selling Points:

- Place a sell order at 32.32.

- Set a stop-loss order at or above 32.67.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 31.50.

Turkish lira Analysis: The USD/TRY pair rose during early Monday trading, marking its third consecutive day of gains while remaining within a limited range below last month's peak. The country's central bank continued to adopt measures to ease regulatory requirements for banks, including canceling mandatory government bond purchases and reducing the securities retention rate from 4% to 1%.

Clearly, such move aims to alleviate lending institutions' obligations and support overall market mechanisms and financial stability, according to a statement from the central bank. This action represents a significant shift from previous policies aimed at maintaining extremely low interest rates favored by President Erdogan, indicating a departure from previous policies aimed at addressing market disruptions without resorting to rate hikes.

Meanwhile, this move represents a significant step in reversing measures taken under the previous leadership of the Turkish central bank, which included mandatory bond purchases and other regulations aimed at keeping interest rates extremely low, as preferred by President Erdogan. Furthermore, these adjustments indicate a shift away from previous policies of addressing market turmoil without resorting to raising interest rates.

In other news, Fitch Ratings agency revealed in a report that Gulf Cooperation Council (GCC) banks operating in Turkey may benefit more from the ongoing shift in Turkey towards traditional economic policies. Moreover, the forecast points to a confirmed decline in inflation, which will positively impact the net cash losses of GCC bank subsidiaries and mitigate the negative effects on capital due to the decline in the currency value. According to Fitch, Turkish companies linked to GCC banks recorded a net cash loss of $2.6 billion in 2023. However, with the expected decline in inflation in Turkey, this loss is expected to decrease to about $1.4 billion next year, compared to $2.8 billion this year.

Top Forex Brokers

USD/TRY Technical Analysis and Expectations Today:

The pair rose slightly during the early trading today, continuing its modest gains for the third consecutive day. The price is currently retesting the lower bound of the ascending price channel on the daily time frame, shown in the chart, which it had previously broken earlier this month. Concurrently, the pair is trading above the 50 and 200 moving averages, which are positively bullish on the daily time frame. Obviously, that’s the indication for the overall bullish trend is dominating the pair, while the price is moving between these averages on the 4-hour time frame, demonstrating stability in the medium term.

Technically, If the pair rises, the nearest resistance levels will be at 32.25 and 32.37 respectively. In contrast, if the price falls, it will target the support levels at 31.75 and 31.50 correspondingly. Ultimately, the Turkish lira price forecast is for the pair to decline after testing the lower bound of the broken channel, targeting the support levels at 31.50. Decisively, we recommend adhering to the mentioned recommendations and maintaining capital management rules.

Ready to trade our Forex daily analysis and predictions? Here are the best Turkish brokers to choose from.