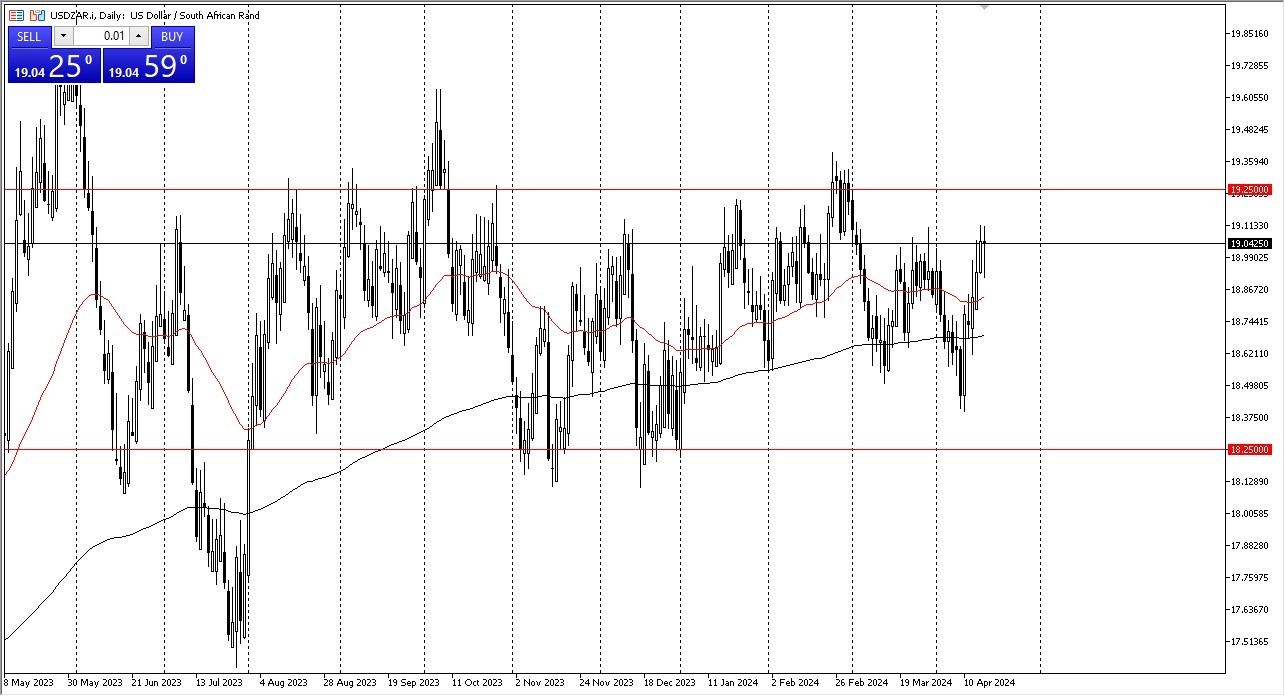

- The US dollar initially pulled back against the South African Rand during the trading session on Wednesday but has found support below the 19 Rand level in order to get involved.

- By turning around the way we have, we have ended up forming a bit of a hammer.

- If we can break above the highs of the last couple of days, it’s likely that we could go looking to the 19.25 ZAR level.

Keep in mind that the interest rate situation in the United States continues to strengthen, therefore it makes a lot of sense that we would see the US dollar pickup strength against some of these emerging market currencies. Even though South Africa offers a bit more in the way of interest, the reality is that South Africa is not a place people want to invest in, and therefore in a situation where we have a lot of “risk off behavior”, the market is likely to favor the greenback over the South African Rand as it is most certainly a “risk on currency.”

Top Forex Brokers

Technical Analysis

The 50-Day EMA sits below current trading, near the 18.85 level, and should offer a significant amount of support. In fact, we have seen it offer support for the last couple of days, and I think that should continue to be the case. If we were to break down below there, then it’s likely that the 200-Day EMA comes into the picture to offer support as well. In general, this is a market that I think will see a lot of volatility, because of all of the geopolitical concerns and everything else going on around the world. With this being the case, I think you need to be cautious with your position sizing, but I also recognize that the US dollar is most certainly favored at the moment.

That being said, if we suddenly get a huge “risk on move”, it’s likely that this market could fall from here, perhaps reaching down to the 18.25 level. This is a market that I think continues to see a lot of noise, but at the end of the day, I think you are still looking to pick up “cheap US dollars”, at least until we see some type of huge shift in the overall attitude.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers with ZAR accounts to choose from.