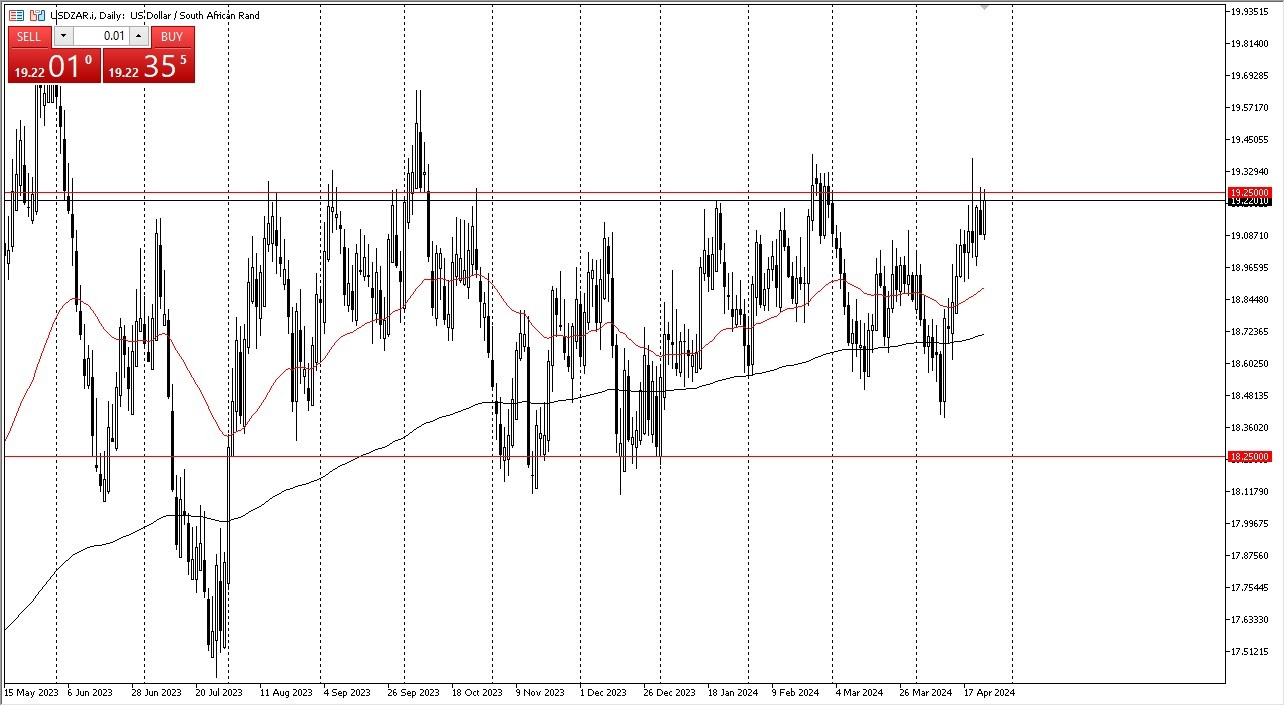

- The US dollar rallied a bit during the trading session on Wednesday, as we continue to threaten a major resistance barrier in the form of 19.25 ZAR.

- This is an area that previously has been significant resistance, and it extends all the way to the 19.33 level, so it’s not a huge surprise to see that we are stalling a bit at this point.

- However, this is also a market that is going to be paying close attention to what interest rates are going in the United States, as there is a lot of upward pressure on those rates, and of course people are starting to worry about geopolitical issues.

South African Rand is an Emerging Market Currency

The thing about the South African Rand is that it is most certainly an emerging market currency, so this is a pair that will have a lot of external influence on it in the form of risk appetite. Simply put, people do not wish to buy the South African Rand when they are concerned about geopolitics, the global economy, or commodities, which is a huge part of the South African economy. While the interest rate differential does favor South Africa, the reality is that the US dollar is considered to be a safety currency.

Top Forex Brokers

We previously had formed a massive shooting star in this area, and if we can break above that from last week, then I think the market truly starts to take off, perhaps reaching to the 19.50 level, and then possibly to the 19.80 level after that. I have no interest in shorting this market, but I do recognize that this resistance could be difficult to get above. If we do pull back from here, I think there’s plenty of support to be found at the 19 level, and then again at the 50-Day EMA underneath there, which is an area that had shown itself to be important a couple of times in the past.

There is a lot you can extrapolate from other markets in the form of risk appetite, so pay attention to stocks. If they start to pull apart, that will most certainly send the US dollar higher, and it will certainly punish emerging market currencies such as the Rand.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers with ZAR accounts to choose from.