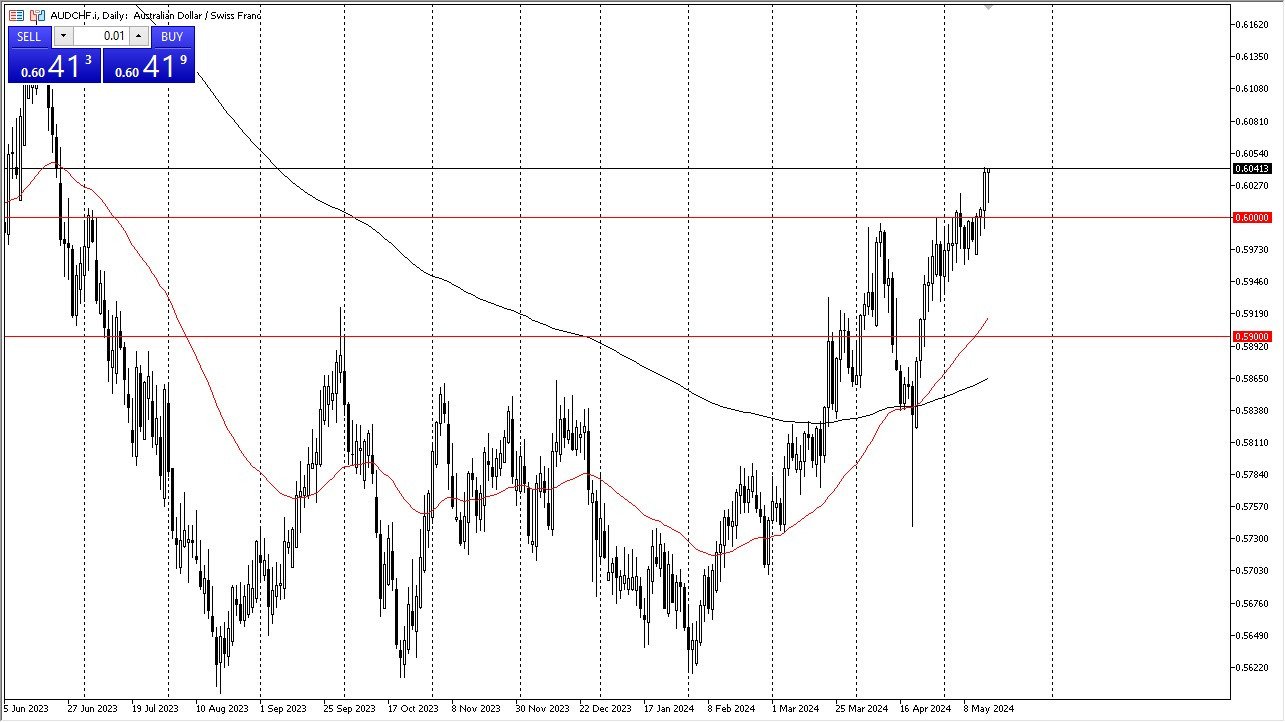

- The Australian dollar initially fell during the trading session on Thursday but has seen a complete turnaround as we have rallied to test the top of the breakout candlestick from the Wednesday session.

- Now that we appear to be well above the 0.60 level, I suspect that this pair could continue to be very bullish, especially as the interest rate differential favors the Australian dollar so drastically, and of course the Swiss National Bank has recently cut its rates, so that only adds more fuel to the fire as it were.

Aussie Over Franc

I think at this point in time it’s obvious that the Australian dollar is favored over the Swiss franc, and therefore we have to look at it as a potential opportunity to take advantage of not only the swap, but also the momentum, as the market breaking above the 0.60 level is a big deal. Given enough time, I think that the Australian dollar may strengthen against multiple currencies, but the Swiss franc is a funding currency in most circumstances, and I think that is most certainly the case here due to the fact that you get paid to hold this position.

Top Forex Brokers

If we were to turn around a break down below the 0.5950 level, then it’s possible that we could send the market down to the 50-Day EMA, or perhaps even the 0.59 level, which is a large, round, psychologically significant figure, and an area where a lot of people will be paying close attention to. Ultimately, this is a market that I think has much further to go, perhaps as high as the 0.6450 CHF level above. In general, I believe that short-term pullbacks continue to be buying opportunities, but I’m perfectly fine buying this pair, because I recognize how much swap there is to be had, and of course the fact that we have seen the Swiss franc get beat up on by several different currencies.

Potential signal

- I am a buyer of this pair right here, right now.

- I would have a stop loss at the 0.5950 level, and I would be looking for a move to at least the 0.62 level, if not the 0.64 level.

- I will more likely than not also be a buyer every once in a while, one we did, in order to build up the position.

Ready to trade our free Forex signals? Here are the best Forex brokers to choose from.