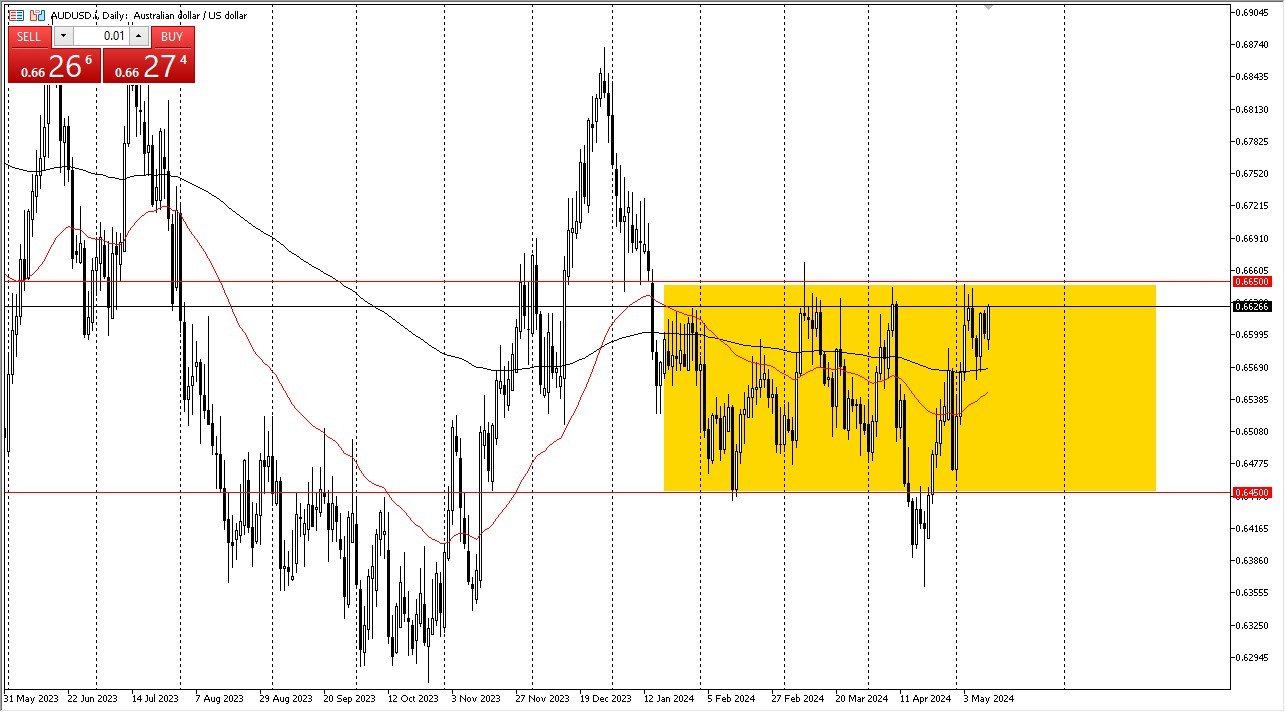

- The Australian dollar initially pulled back just a bit during the early hours on Monday, but later on in the day, we have made a somewhat significant attempt to reach the highs again.

- If we can break out above the crucial 0.6650 level, that could send the Aussie dollar screaming higher.

However, it's probably worth noting that this is an area that's been very difficult to overcome and I think ultimately that is probably something that you need to pay close attention to in the AUD/USD pair. Signs of exhaustion would almost certainly get sold into as it could offer signs that the US dollar is going to pick up strength again. However, if we were to break above the 0.6650 level, then it opens up a move to the 0.6850 level. The one thing that they could, use to push this higher is the commodity markets seemingly just ripping to the upside, and of course the Australian dollar is considered to be a commodity currency. China isn't necessarily a good enough reason to get long of the Aussie at the moment, although it can have a major influence as well. Underneath we have the 200-day EMA offering support near the 0.6550 level, followed by the 50-day EMA.

Top Forex Brokers

If We Break Above…

In general, the AUD/USD market looks like it's trying to break out, but it has shown that breaking out to the upside is very difficult. So that's why I'm not overly concerned about it. I wouldn't have an issue at all shorting this market on signs of exhaustion, but if the trade goes against me, then obviously something's changed, and the Aussie dollar goes higher, and then I just simply get long there. At that point in time, and not only would I get long of the Australian dollar, but I would probably become aggressively so. I also would have to pay close attention to the US dollar around the Forex world, because it might be time to start shorting the greenback against almost everything. However, until then it’s a market that I am simply watching.

Ready to trade our Forex daily analysis and predictions? Here are the best currency trading platforms Australia to choose from.