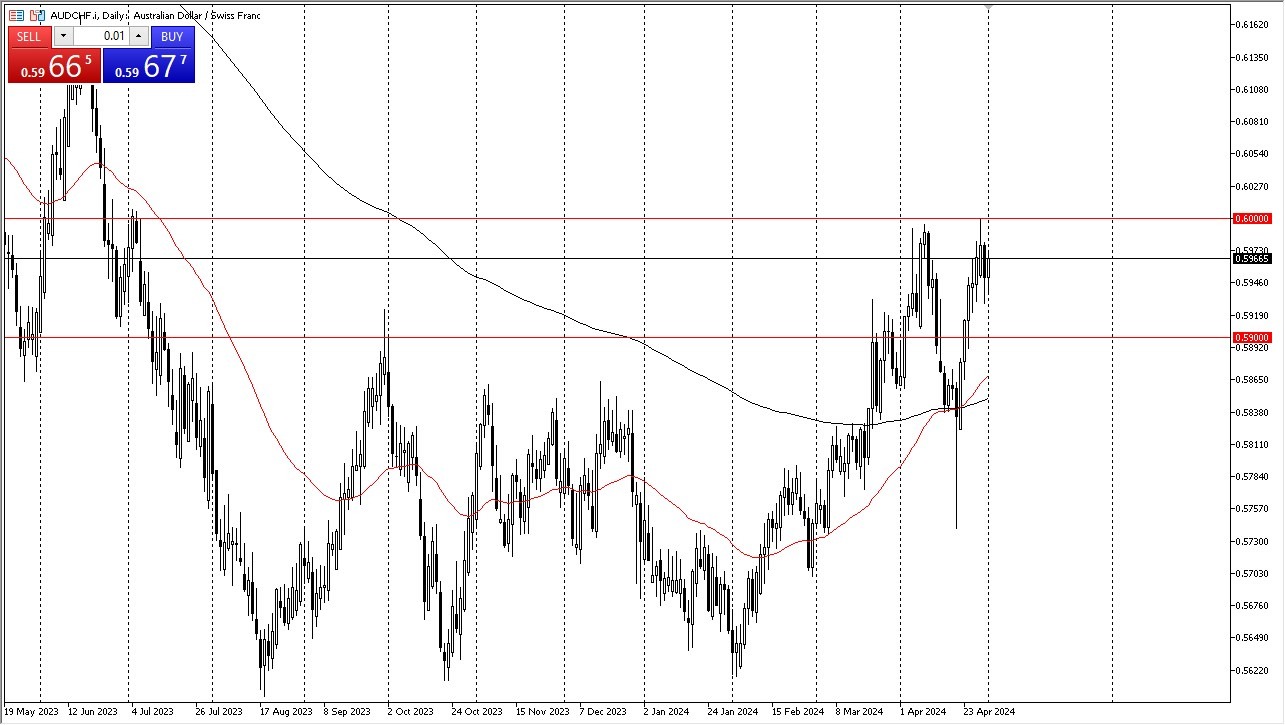

Potential signal: the Australian dollar is likely to continue to grow in value against the Swiss franc, just as other currencies were. Because of this, I am a buyer on a daily close above the crucial 0.60 level, with a stop loss at the 0.5925 level. I would be aiming for the 0.62 level at the very least. In fact, I would probably add on each and every dip to my position.

- The Aussie dollar initially pulled back just a bit during the trading session on Wednesday to show signs of hesitation against the Swiss franc.

- However, the Swiss franc is in its own world right now and it certainly looks as if most currencies are doing everything, they can to break out above major resistance against the Swiss currency.

- In the case of the Australian dollar, it is the 0.60 level.

Top Forex Brokers

That being said, I would also point out that the US dollar, the British pound, and the euro are all among some of the currencies that I've been watching for a potential breakout against the franc. While the Swiss National Bank has recently cut rates, it looks as if the Swiss also don't care so much about the exchange rate, and that comes from a power of strength. The Swiss franc is historically strong at the moment, so therefore the SNB is perfectly fine with watching it deteriorate a bit. This contrasts quite drastically with the Japanese who are also seeing a weakening currency and use of their currency as a funding currency, but the Japanese yen has been in a tailspin.

Swiss National Bank Agrees

So, in this particular case, you won't have the central bank trying to do what it can to fight potential trend change. In fact, I wouldn't be overly surprised to see if the Swiss National Bank encourages it. With that being the case, I'd like shorting the Swiss franc against almost anything and the Australian dollar won't be any different. Underneath, we have the 0.59 level as potential support right along with the 50-day EMA. If we can break above the 0.60 level, then it would not surprise me at all to see the Australian dollar travel to the 0.62 level and further over the longer term.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.