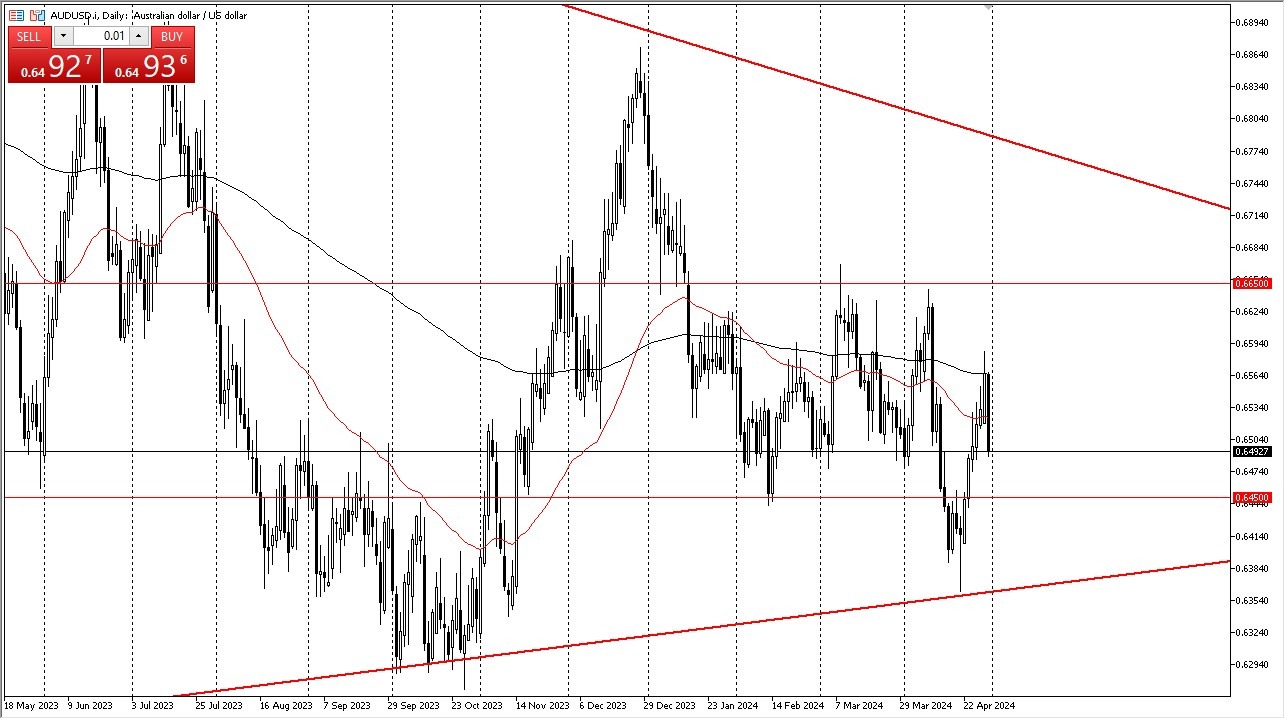

- The Aussie dollar fell significantly during the course of the trading session on Tuesday, breaking down below the 0.65 level before it was all said and done.

- Ultimately, this is a market that I think given enough time will probably have to sort out whether or not we have support at the 0.6450 level.

- That is an area that previously had been resistance and support, so I think it gives me a bit of a target on the short side and considering that the candlestick has been so negative for the day, one would assume that typically there would be a bit follow-through.

Wednesday is FOMC

Keep in mind that Wednesday features the Federal Open Market Committee meeting, which of course is the interest rate decision coming out of America. Furthermore, we also have a news conference and a monetary statement. All things being equal, this is a market that I think will continue to be very noisy, but at the end of the day, you will also have to pay close attention to the fact that whether or not there is risk appetite out there willing to take on the currency like the Australian dollar. After all, it is highly tied to the commodity markets, and of course global growth, as well as the Chinese economy.

Top Forex Brokers

At this point, I think that a lot of this will come down to whatever it is the Jerome Powell decide to say during the press conference, and whether or not he sounds hawkish. If he does sound hawkish, that could send this pair much lower. On the other hand, if he sounds extraordinarily dovish, the Australian dollar might end up being one of the big winners against the greenback.

The size of this bar does suggest that perhaps nobody is really willing to hang onto the Aussie dollar ahead of this important event, which does make sense considering that Jerome Powell has a history of causing a lot of issues through verbal mishaps. Ultimately, I think the only thing you can count on is a lot of volatility at this point in time.

Ready to trade our daily Forex forecast? Here’s some of the top Australian fast execution forex brokers to check out.