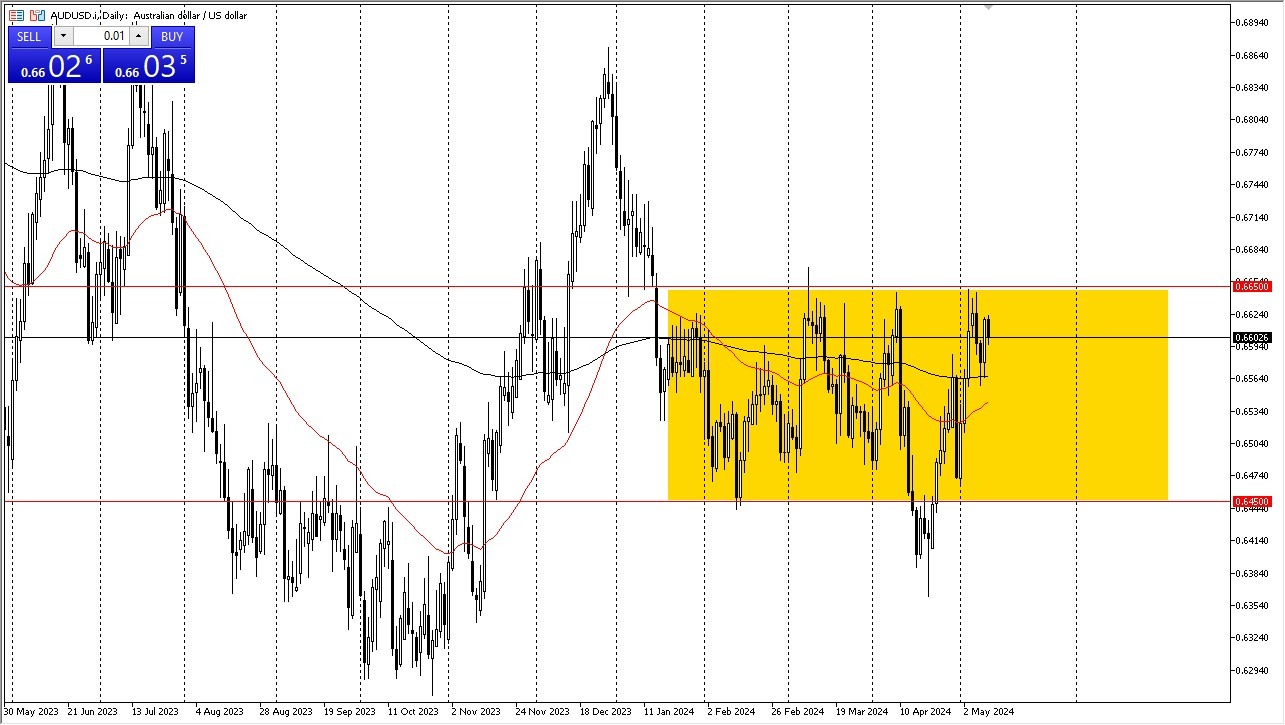

- The Aussie dollar pulled back just a bit during the early hours on Friday as we continue to see the overall consolidation area hold.

- The 0.6650 level above has been a major barrier and it looks as if the market is going into the weekend thinking that it should remain so.

- With that being the case, there’s an obvious set up here, but you also have to be cautious with your position size because of we were to turn around and take off to the upside, we could see a massive, short covering rally.

The 0.6650 level being broken would be a major coup for the AUD/USD bulls, but at this point in time, I just don't see that happening very easily. If we were to break above the 0.6650 level, then it's possible that we could go look into the 0.67 level, followed by the 0.6850 level.

A Pullback is Likely

Top Forex Brokers

More likely than not, we could see a pullback towards the 200 day EMA underneath, which is closer to the 0.6575 level. After that, then we could go looking to the 0.6450 level. Regardless, this is a market that I think will continue to be very choppy overall, so I'm not necessarily looking for anything major here as far as covering serious real estate is concerned.

If that's going to be the case, then I think you will continue to trade this as a range and recognize that it is going to be fairly choppy. Keep in mind that the Australian dollar is extraordinarily sensitive to growth and commodities, so that does help at times, but at the same time, we have a lot of geopolitical concerns out there and high interest rates in America that continue to make the US dollar somewhat attractive. After all, it’s obvious that there are still a lot of problems around the world, and therefore it makes perfect sense that we remain held prisoner as markets go back and forth from the latest shiny object that they are chasing.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.