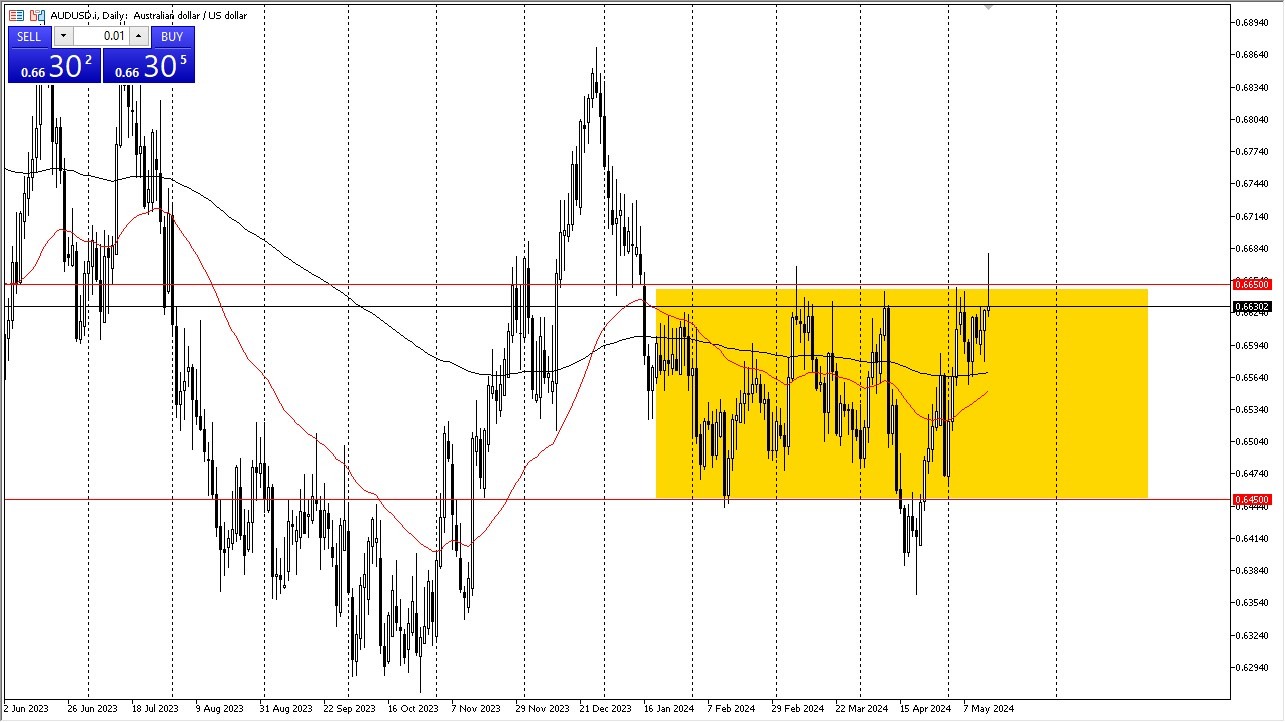

- The Australian dollar shot straight up in the air during the early hours on Wednesday but has given back quite a bit of the gains as we have seen a lot of resistance near the crucial 0.6650 level.

- This is an area that’s been important multiple times in the past, and therefore it’s not a huge price to see that there is a little bit of a pushback in this region. What is particularly telling about this though is the fact that we fell so hard and so quickly.

Technical Analysis

While the day isn’t done as I write this, I cannot help but notice that the 0.6650 level repudiating the bulls so viciously tells me that it’s not quite time to bank on some type of Australian dollar break out. This is an area that matters based on the last several months, and therefore it’s not a huge surprise to see that it is so difficult to get beyond. That being said, if we were to break beyond this level, it’s likely that the Australian dollar could take off rather rapidly, perhaps reaching the 0.6850 level rather quickly.

Top Forex Brokers

That being said, the fact that we have turned around so quickly makes me wonder whether or not we are going to revisit the 200-Day EMA underneath, which of course is a technical indicator that a lot of people will pay close attention to, and therefore I would anticipate that we could see a little bit of support in that region.

Commodities

Commodities of course have a major influence on the Aussie dollar, so it’ll be interesting to see whether or not that continues to push the Australian dollar higher, which I suspect is what’s been going on for some time. With this being the case, I expect a lot of volatility but I certainly would be cautious about buying the Australian dollar here, due to the fact that we have seen such a vicious reaction to resistance that has been so obvious for several months now.

Ready to trade our daily Forex forecast? Here’s some of the top forex online trading Australia to check out.