- The Aussie dollar rallied slightly during the early hours on Wednesday, as we continue to see a lot of noisy behavior.

All things being equal, this is a market that has been stuck in consolidation for a while, and despite the fact that we sold off quite drastically on Tuesday, I don’t necessarily know if anything is changed. It is possible of course, but at this point in time I think it has a lot more to do with the perception of Jerome Powell speech and press conference after the interest rate announcement on Wednesday.

Top Forex Brokers

Technical Analysis

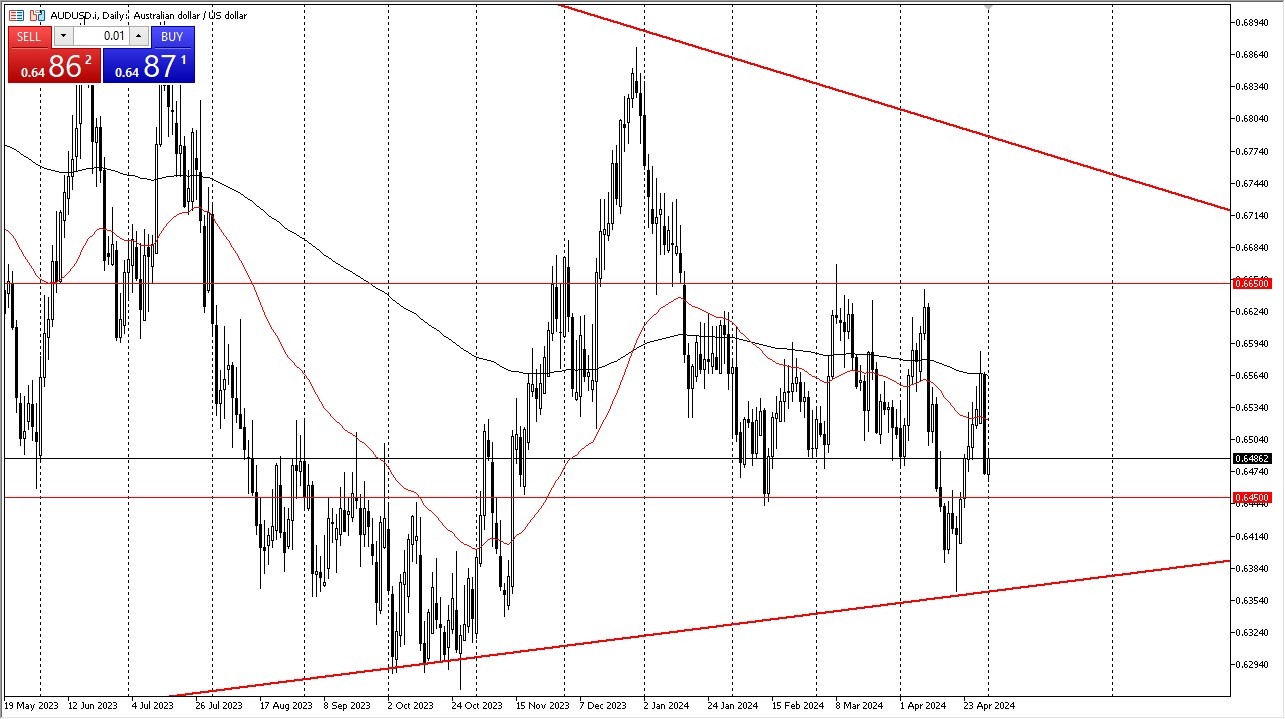

The technical analysis for this pair is quite droll. Quite frankly, it looks like the 0.6450 level is going to continue to be supported, while the 0.6650 level above is going to be resistance. We are closer to the bottom then we are the top, so it does make a certain amount of sense that we would get a bounce from here. That being said, there is also the 50-Day EMA about halfway through the length of the candlestick from the Tuesday session, and then of course the 200-Day EMA at the top of the candlestick from Tuesday. Both of those could be problems. If we can break above there, then eventually we will go looking to the 0.6650 level.

Furthermore, when you look at the longer-term charts you can make an argument for a bit of a triangle forming, and therefore we are squeezing and will have to make a longer-term decision. Historically speaking, you can make more of an argument for a rally than a selloff, but fundamentally speaking, that’s not true at all.

Position sizing is going to be crucial going forward, and therefore Wednesday won’t be any different. This will be especially true late in the day when Jerome Powell starts speaking and computer start trading on each and every word he says. Ultimately, as a retail trader you are probably better off letting the dust settle and recognize that we are simply range bound at the moment. If that changes, then obviously you can make a bit of a bigger trade.

Ready to trade our daily Forex forecast? Here’s some of the top forex online trading Australia to check out.