- The Aussie dollar has gone back and forth during the course of the trading session on Monday as we continue to suggest that maybe the market's getting a little bit overdone.

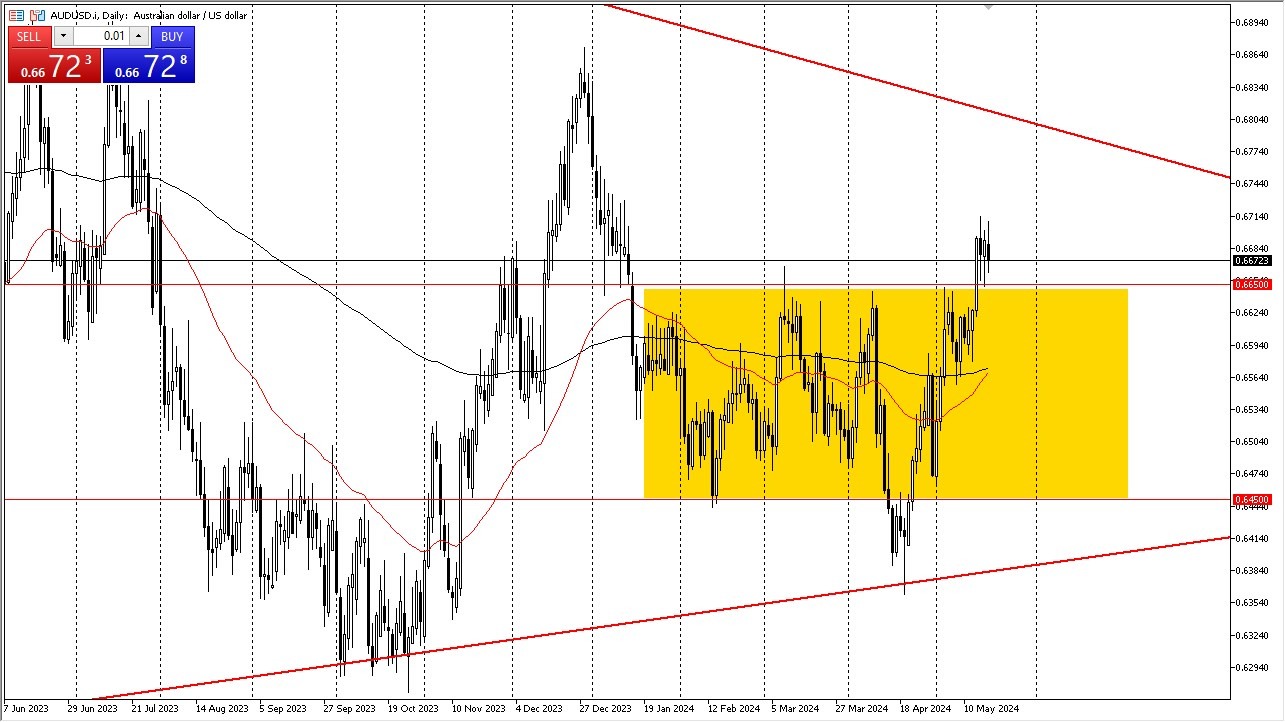

- We have broken above the 0.6650 level and now we are trying to determine whether or not we are going to pick up enough momentum to go higher.

- The 0.67 level above being broken opens up the possibility of a move to the 0.6775 level.

- On the downside, if we were to break down below the 0.6650 level on a daily close, then this might end up being the same type of throw over that we had seen last month, but in that case, it was to the downside.

Are we simply challenging the consolidation area?

This does happen occasionally where the market just has to challenge both sides, either of a rectangle or a consolidation area to determine whether or not that consolidation area needs to be held. Keep in mind that there are a lot of different fundamental things going on at the same time, not the least of which would be geopolitical concerns. That will favor the US dollar.

Top Forex Brokers

However, the commodity markets, especially hard assets, are going like gangbusters right now. That favors the Australian dollar. If there is a pickup in Chinese economic activity, that also favors the Australian dollar. So that's something worth paying attention to as well. Regardless, I think you do have choppy and somewhat sideways behavior, but we do have a couple of levels on this chart mentioned previously that are worth paying attention to and perhaps could open up smaller moves. I'm not expecting huge moves in this AUD/USD pair, but obviously anything is possible.

Because of this, you need to be very cautious with your position sizing, but I do think at this point in time the Australian dollar could be a bit of a barometer as to what people think China is going to do and of course whether or not there will be further strengthened the commodity markets going forward.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.