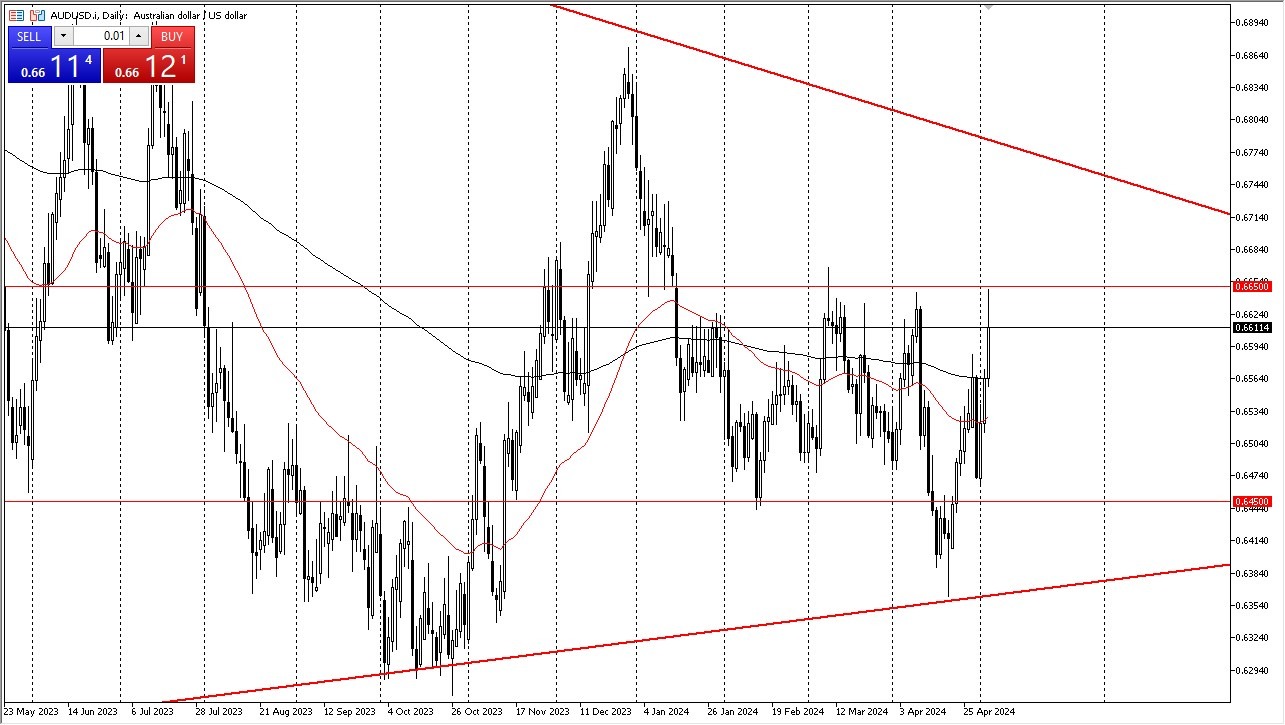

- The Aussie dollar rallied during the early hours on Friday to show signs of strength as we reached the 0.6650 level.

- The 0.6650 level is an area that's had massive resistance multiple times in the past.

- Therefore, it's not a huge surprise to see that we have pulled back from there.

The jobs number in the United States came in lower than anticipated and I think that was part of the initial surge. But at this point in time, I don't necessarily look at this as a market that is going to focus on that for the long term. After all, the federal reserve just had a press conference. So, unless this drastically changes the outlook for the fed, it's almost impossible to imagine that the market is just going to blow through the top of the consolidation area.

Top Forex Brokers

Fed Might Not Care….

Therefore, I think you have to assume that if we can't do that, then we will probably stay within the overall consolidation range, and that might be part of what we are seeing. After all, just a few hours after the announcement, we have given up 40 pips, and although that's not a lot, in the scheme of the trading range, it is substantial. Because of this, the next few days could be more important then the initial reaction, as the trading communities would have plenty to time over the weekend to think about the overall trajectory of markets.

Keep in mind that the 0.6650 level is significant resistance, but at the same time, we also have significant support near the 0.6450 level. We also have the 200-day EMA and the 50-day EMA indicators right in the middle of that. So, I don't know that anything's changed other than we continue to see a lot of volatility. That might be the overall theme for major currency pairs this year, that we have a lot of volatility a lot of choppiness, but ultimately just stay range bound as nobody has anywhere to be anytime soon.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.