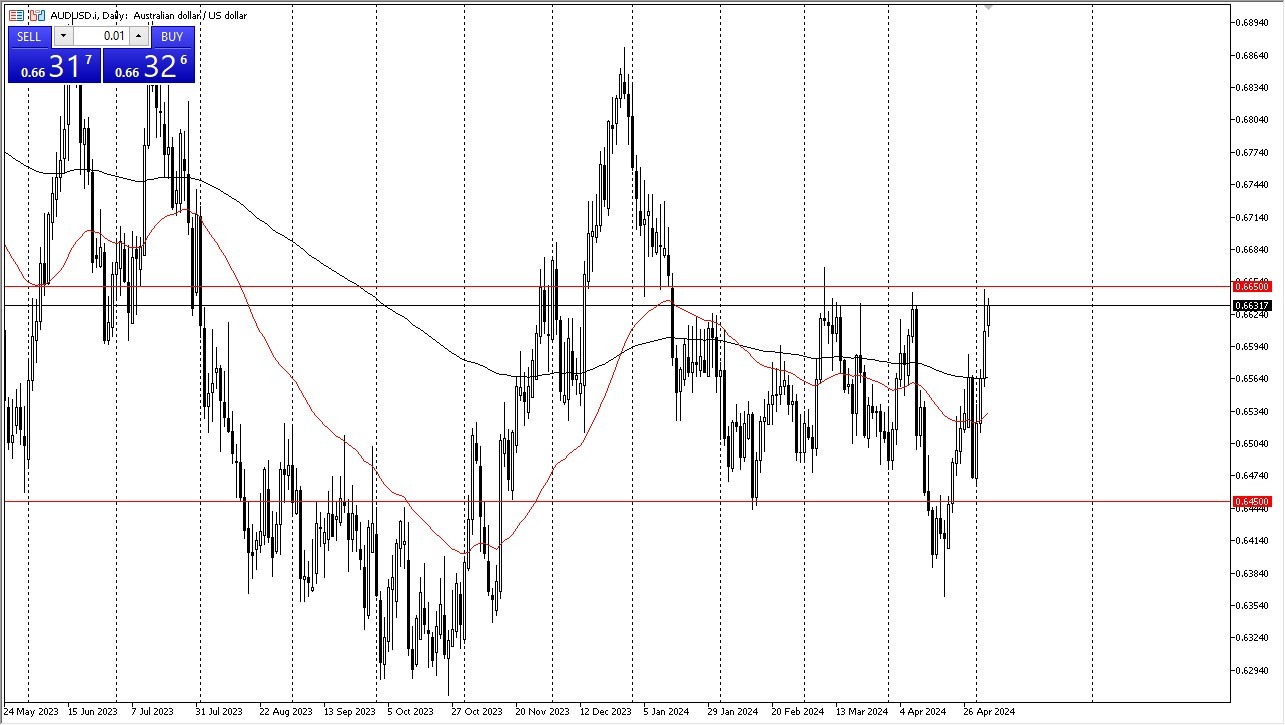

- The Australian dollar has rallied early during the trading session on Monday, as it looks like we are trying to threaten a major resistance barrier just above.

- The 0.6650 level is a huge barrier that has seen a lot of action over the last several months.

- If we were to take that out, it would obviously be a very big deal.

This is an area that has been important for some time, and this is probably the most important area on this chart from both a short-term perspective, as well as long-term.

This Area has Offered a Ceiling Before

Top Forex Brokers

But we saw a lot of selling pressure on Friday in that area, and I think that continues to be more likely than not. After all, we do have the Australian interest rate decision early Tuesday, and that will throw volatility in the market, but unless they sound hawkish, this could be the top. At this point, we could very easily drop down to the 0.6550 level, which is essentially where the 200-day EMA sits.

If we break down below there, then we could get a move to the 0.645 zero level. That being said, breaking out from here to the upside opens up the possibility of a move to the 0.67 level, followed by the 0.6833 level. In general, this AUD/USD market is going to remain volatile. And of course, we'll be very noisy during the central bank decision, but I also believe that it's going to rely heavily on risk appetite and the bond markets. If interest rates in America start to pick up again, that obviously favors the US dollar just as a huge risk off move would as well.

Expect choppy noise, expect a lot of headaches, but at this point in time, I think you are just banging your head against the ceiling, and you have to at least wait for the daily close after the interest rate decision to start buying. If we see weakness immediately, it's probably an easier trade to take in the short term.

Ready to trade our daily Forex analysis? Here's a list of the best brokers FX trading Australia to choose from.