- The Australian dollar has been back and forth during the trading session on Tuesday, as we got through the latest Reserve Bank of Australia meeting and its interest rate decision.

- As suspected, they didn’t do much and now we are just simply trading back and forth near the top of a larger consolidation region.

- That being said, the market is likely to continue to see a lot of volatility in, but that’s nothing new as the Australian dollar so highly levered to global growth and of course commodities.

The Range

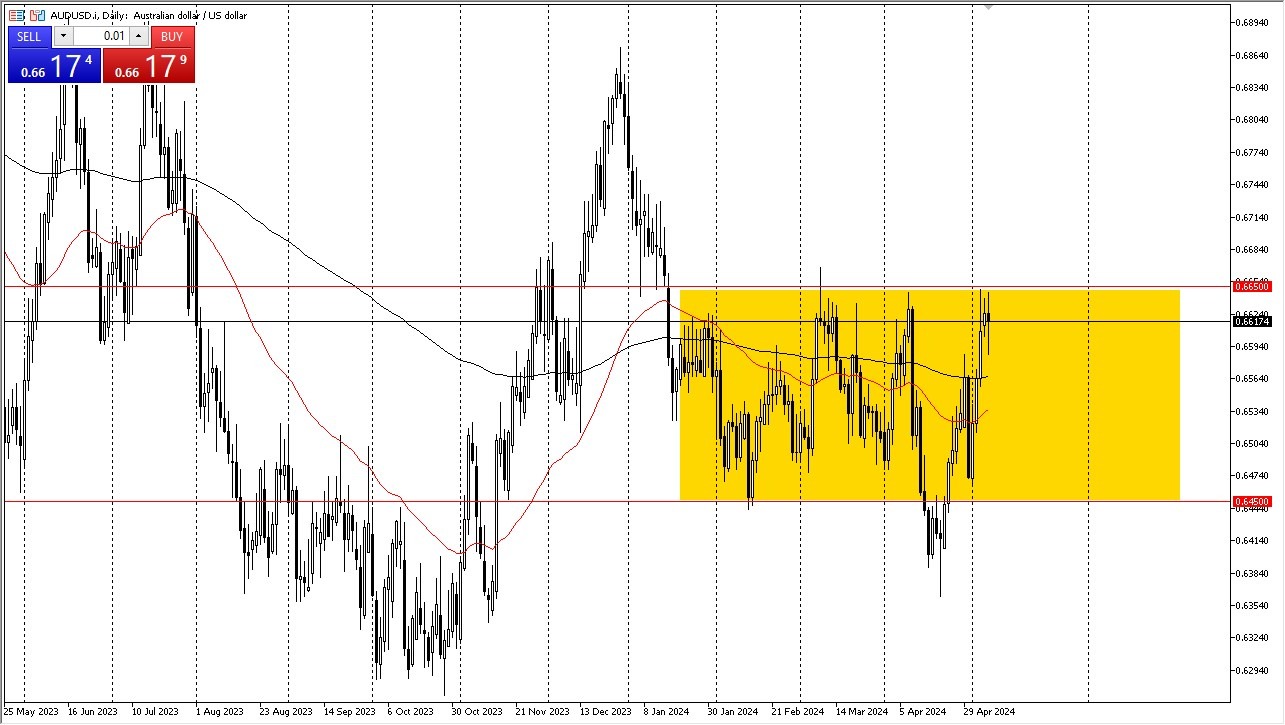

The range currently features the 0.6650 level at the top of the range, with the 0.6450 level underneath being the support level. As we are struggling near the recent resistance, it does make a certain amount of sense that we could see a bit of a pullback. Initially, but that is exactly what we saw during the day on Tuesday, but we have since bounced as the Americans will typically sell their own currency. If we break down below the bottom of the candlestick for the trading session on Tuesday, then I think we have a real shot at breaking down and perhaps dropping toward the 200-Day EMA, followed by the 50-Day EMA, and then eventually down to the bottom of the range at the previously mentioned 0.6450 level.

Top Forex Brokers

Interest rates in America continue to go back and forth than they are historically high, so that’s part of what we have seen reflected in the Forex markets, as there has been US dollar strength. However, the Australian dollar has been much more resilient against the greenback than many other currencies, so that something that you might want to keep in the back of your mind. If we can get a daily close above the 0.67 level, then it’s likely that this entire range will have been violated, and the Aussie dollar will find its way much higher over the next few weeks. That would more likely than not coincide with US dollar weakness across the board, something that I think is a bit of a stretch at this point in time as we have seen so much greenback strength.

Ready to trade our Forex daily analysis and predictions? Check out the largest forex brokers in Australia worth using.