Potential signal

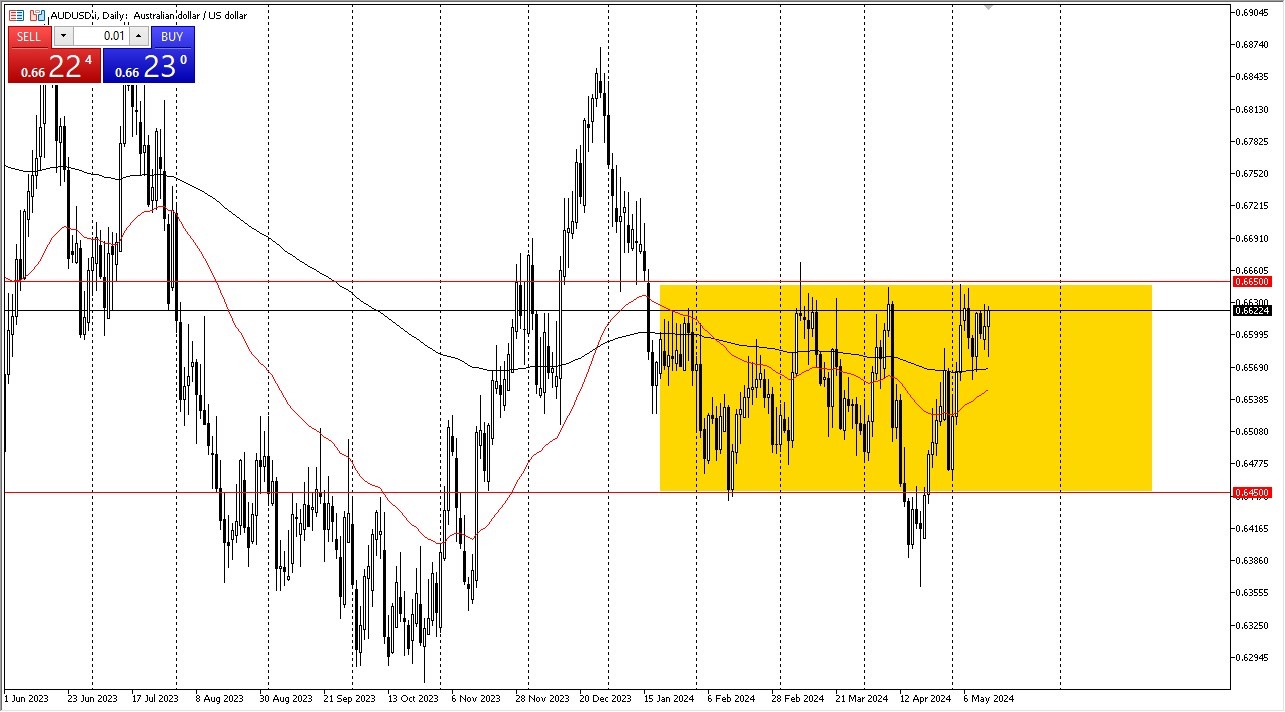

Tthe Australian dollar breaking above the 0.6650 level on a daily close would be reason enough for me to get long. I would have a stop loss at the 0.6550 level, aiming for the 0.6825 level above.

- The Australian dollar initially fell during the day on Tuesday but has seen a complete turnaround by the time the Americans got on board.

- At this point, it looks like the Australian dollar continues to threaten the crucial 0.6650 level above, which has been a major barrier for resistance going all the way back to the beginning of the year.

The question now is whether or not we can break above there. If we do, and by breaking above there, I mean on a daily close, we could see this market going to reach the 0.6850 level. This would be a little bit of an anomaly as the US dollar is so strong against so many currencies, but you should also keep in mind that the Australian dollar is highly levered to commodities.

Top Forex Brokers

Pay close attention to commodities such as copper, which has been ripping to the upside. With that being the case, there is more demand for the AUD/USD. From a central bank point of view, it's difficult to really get overly excited because the Federal Reserve is likely to stay tighter for longer and the Australians don't look like they will be raising rates anytime soon. So, with that, I think the central bank question, at least in this pair, is probably not as big of a deal.

From a technical analysis perspective, the 0.6650 level is crucial, just as the 200-day EMA sitting below current pricing is. The 200-day EMA is near the 0.6550 level, and I think offers a formidable support floor, at least in the short term. As things stand right now, it looks like we are trying to build up enough pressure to finally break out.

We just don't have the momentum quite yet. That being said, it is most certainly something worth paying close attention to, as a move higher would certainly put a lot of upward pressure on this pair and we could see somewhat of an explosive amount of momentum enter this market in that environment. It’s not that I necessarily think it’s going to happen easily, but it is something that certainly is a real possibility.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.