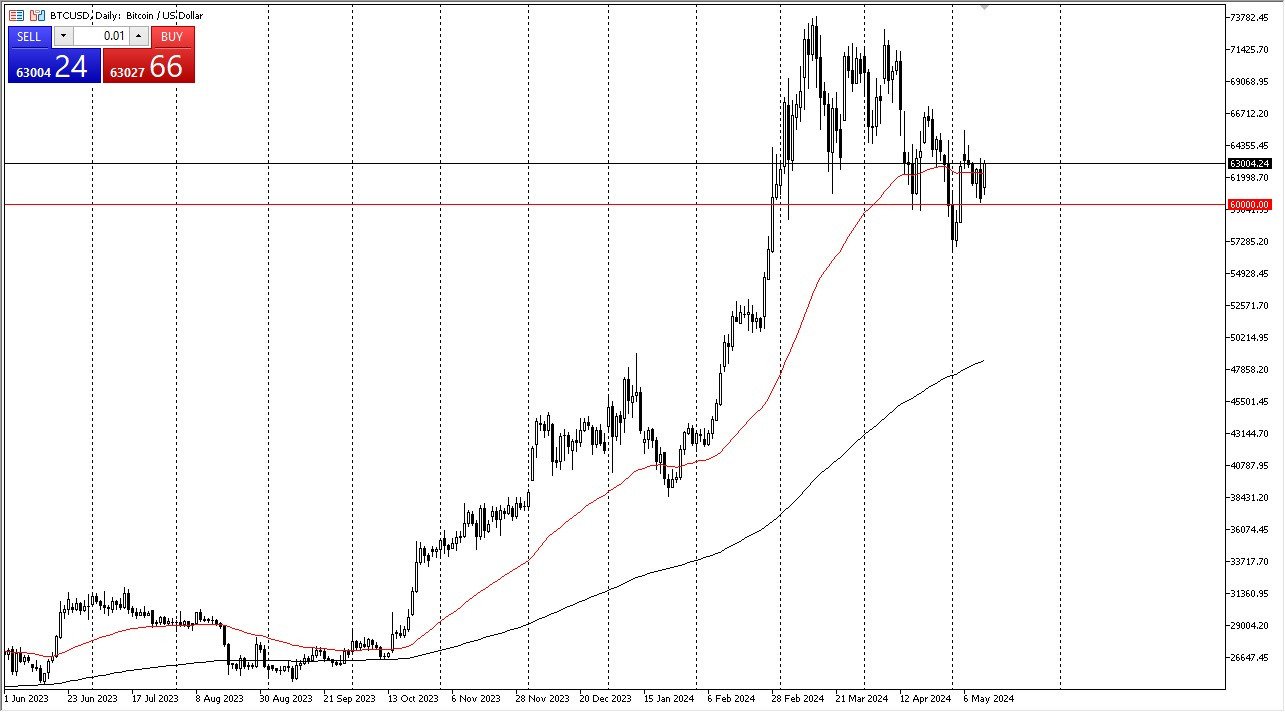

- Bitcoin has rallied pretty significantly during the early hours on Monday as we continue to see a lot of support near the $60,000 level.

- We did break down below it about a week ago, but quickly turned around to show signs of strength again as the buyers came in to pick up the cheap coins, as it were.

- That is the general attitude of this market overall, to simply step in and “buy the dip.”

In general, I think this is a market that is going to remain bullish, but you also need to keep in mind that now Wall Street is heavily involved in it and therefore it's going to behave a bit differently than it did in the past. I suspect it probably behaves more like an index and the correlation between Bitcoin and the NASDAQ will probably only increase at this point, thereby making it a naturally bullish asset, but one that is subject to nasty corrections every once in a while. This is typical for cryptocurrency’s in general, but now that Wall Street has their hands on Bitcoin, you could get a sudden “rush to the exits” occasionally.

Top Forex Brokers

BTC/USD Technical Analysis

The Bitcoin technical analysis right now suggests that the 50 day EMA flattening out and us breaking above there, at least temporarily, does suggest that perhaps we could go higher, but the $66,000 level above, I think continues to be a bit of a barrier. If we can clear that, then it opens up a move to the $73,000 level, which is where we had pulled back from previously.

If we were to drop below the $57,000 level, which of course was the latest swing low, then Bitcoin might be due for a deeper correction. At that point, we could go looking to the $52,000 level, which should be backed up by the 200-day EMA rather shortly. That will more likely than not be a buying opportunity, and I think that most of Wall Street probably would agree.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.