Potential signal:

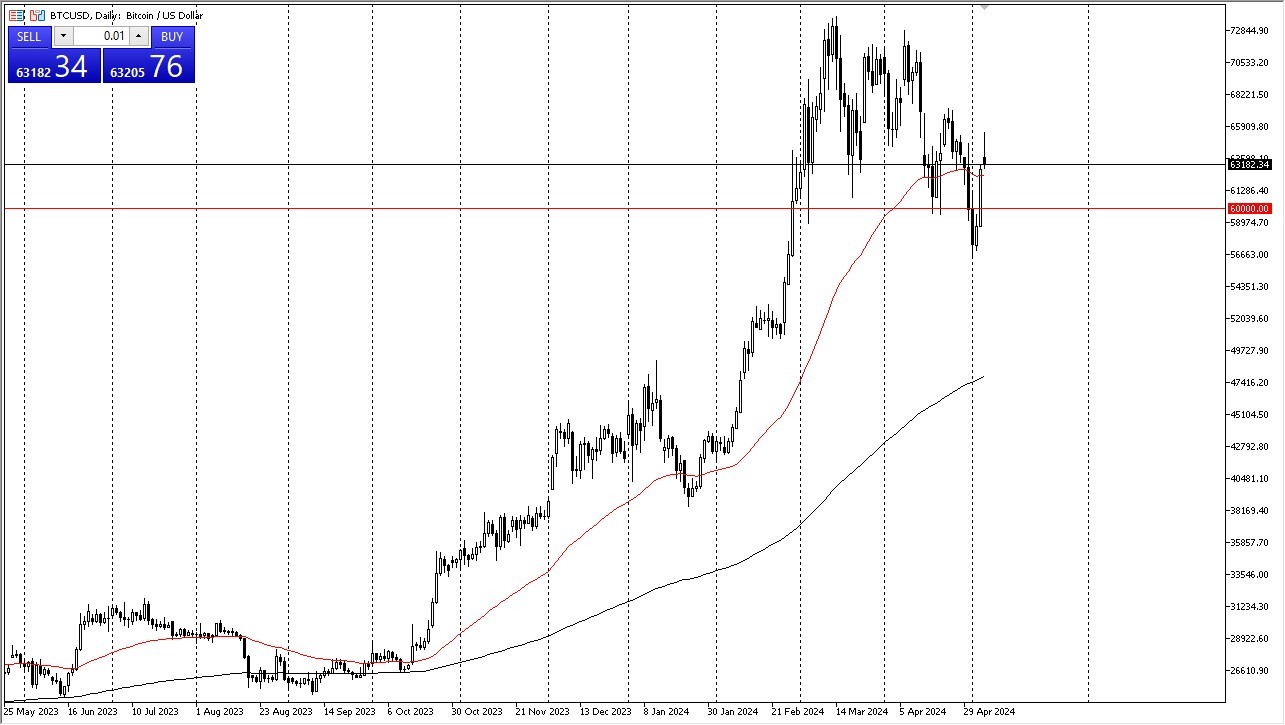

I would be a buyer of Bitcoin on a move above the $66,000 level, but you would have to have a stop loss at the 50 day EMA. At that point, the target would be $73,000 above.

- Bitcoin initially tried to rally during the trading session on Monday but seems as if it is giving back quite a bit of the gains.

- At this point, we could test the 50 day EMA for support, and then after that, I would anticipate that the next major support level is probably found around the $60,000 level, as it has been historically important.

- Furthermore, you would have to assume that there are a certain number of options placed in that area that could cause a bit of market memory and support overall.

- With this, I suspect that the $60,000 level will continue to be very important.

Top Forex Brokers

We did break down below it recently, but at that point in time, we then turned around to show signs of strength near the $57,000 level. Anything below there then opens up a rush lower to the 52,000 level, possibly even down to the 200 day EMA. The alternate scenario. The alternate scenario would be a simple continuation of the bullish pressure that we had seen previously, meaning that we would break above the $66,000 level.

The Upside Shot…

If that happens, then it's likely that this market will go back to the $73,000 level again, where we had peaked recently. You will need to keep an eye on the interest rate markets in the United States, because if rates start to rally again, that could put downward pressure on Bitcoin as it is essentially a bet on central banks out there loosening monetary policy.

While the Fed doesn't look likely to loosen anytime soon, there are plenty of central banks out there that could sooner, due to the fact that other economies are certainly slowing down much quicker than the US economy. However, you need to keep in mind that the Federal Reserve is by far the most important central bank in the world and has an outsized effect on crypto, as well as specifically Bitcoin.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best MT4 crypto brokers in the industry for you.