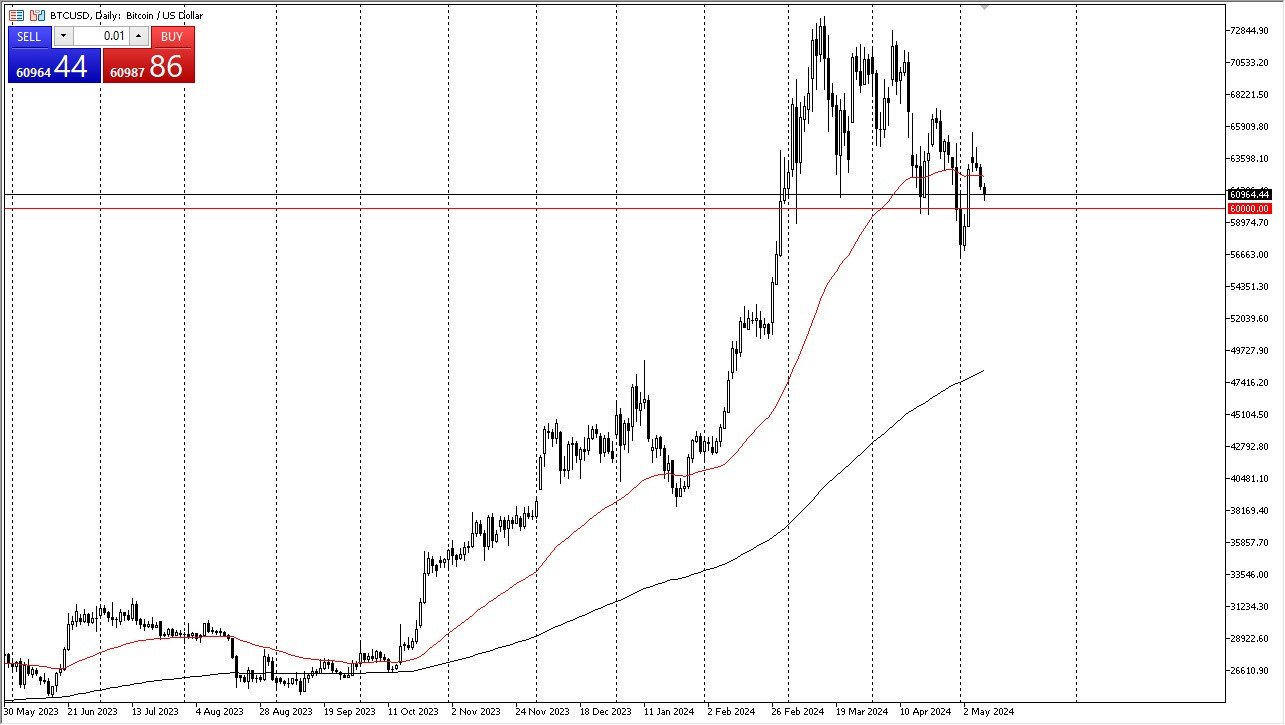

- Bitcoin pulled back just a little bit during the trading session on Thursday, as we continue to look at the $60,000 level as a potential support level.

- All things being equal, this is a market that I think a lot of people are looking to pick up cheap Bitcoin if and when they can, and we are most certainly in an area where we could see a lot of interest in this area.

That being said, we did break down below the $60,000 level just a week or so ago and then went all the way down to the $57,000 level. In general, this is a market that I think continues to see a lot of buyers come into pick up Bitcoin, but if we were to break down below that last swing high, I think it does open up the possibility of Bitcoin dropping down to the $52,000 level.

Top Forex Brokers

Just Below, We Have Other Support Possible

That also could put the 200 day EMA underneath in focus as well. Regardless, this is a market that I think is going to be very difficult to get your hands on because it is directly influenced by interest rates in the United States, which have been climbing. Remember, Wall Street now has a big chunk of Bitcoin, and therefore it's going to behave like a Wall Street asset.

Essentially dollar up, Bitcoin down. That's not always going to be the case, but on the whole, that's what you're looking at here. So ironically, what got everybody celebrating may be one of the biggest problems with Bitcoin. It's now part of the financial system at least as far as speculation is concerned. That being said, if we were to turn around and take out the shooting star from the Monday session, I think at that point you could have Bitcoin really start to rally and go looking to the $73,000 level, but we obviously need some type of catalyst to make that happen.

Something that we just don't have right now. Now the market did gain roughly 92% in just six weeks. So, a pullback or even sideways consolidate and of course was always going to happen.

Ready to trade our Bitcoin to the dollar daily technical analysis? We’ve made a list of the best Forex crypto brokers worth trading with.