- The Bitcoin market initially tried to rally during the trading session on Tuesday, only to turn around and show signs of weakness.

- At this point in time, I think you do need to be cautious about Bitcoin due to the fact that the market is currently waiting to see if interest rates will drop again, and that's what the trading action of the last couple of days had been all about, quite frankly.

Bitcoin desperately needs low interest rates in order to flourish. That's the exact reason that it exists. It was to get away from fiat money printing and low interest rates. Oddly enough, we have both money printing and high interest rates in America. And I think, quite frankly, that is going to throw chaos into the markets overall. And Bitcoin of course, being a speculative asset is going to feel it more than anything else.

Top Forex Brokers

This Doesn’t Mean Short BTC

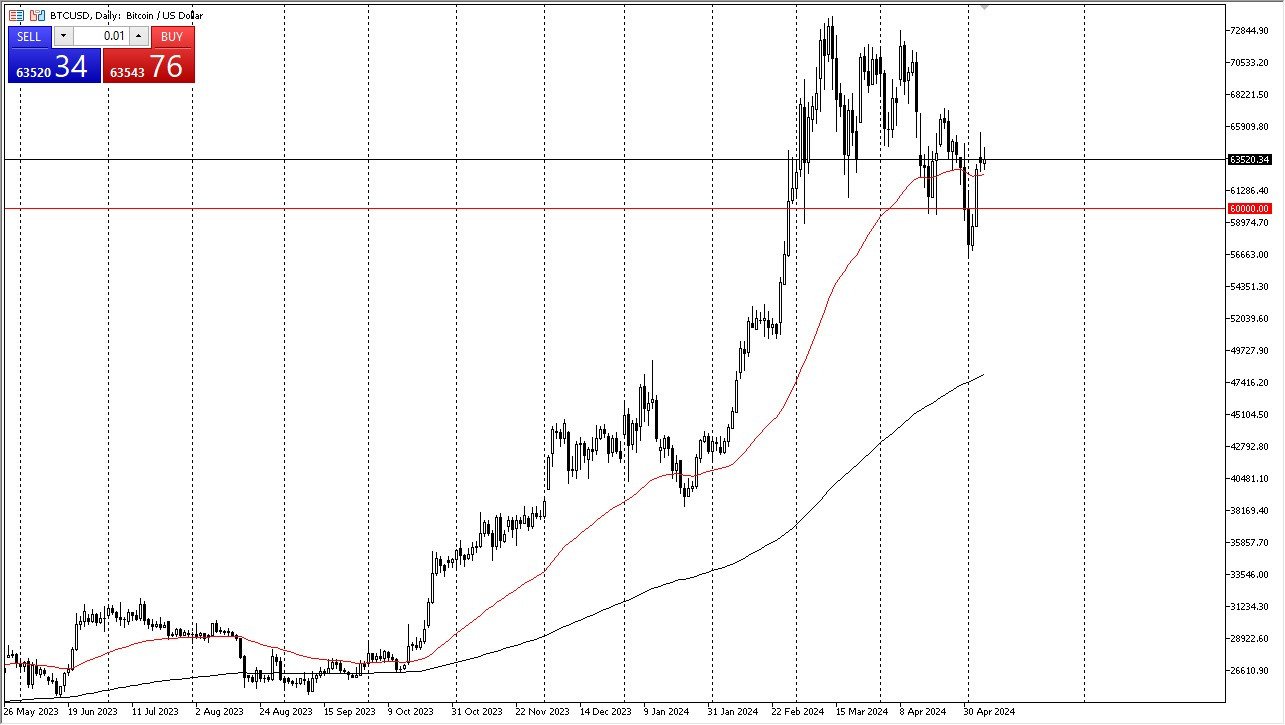

I'm not necessarily calling for shorting Bitcoin, but I do expect to see some trouble. The $60,000 level will continue to be crucial for this market, and an area where you would need to see buyers come into the picture. If we turn around and break above the 50 day EMA after dipping below it, I think that would be a very positive sign.

If we break above the $66,000 level, then it's likely that the market will go looking to the $73,000 level next, which was the most recent high. You can make an argument for some kind of sloppy bullish flag, but you can also make an argument that Wall Street just got involved and may have pumped this asset up in order to hand their bags to other traders.

That's the literal playbook of Wall Street. It's their job to sell stocks or possibly ETFs, and other assets to investors and the retail public. So, I do think that a correction isn't out of turn here. And if the ten year yield in America breaks 5%, I'm almost positive that Bitcoin will plunge. That doesn't mean that you have to short it. It just means that you'll have to be watching the bond markets.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.