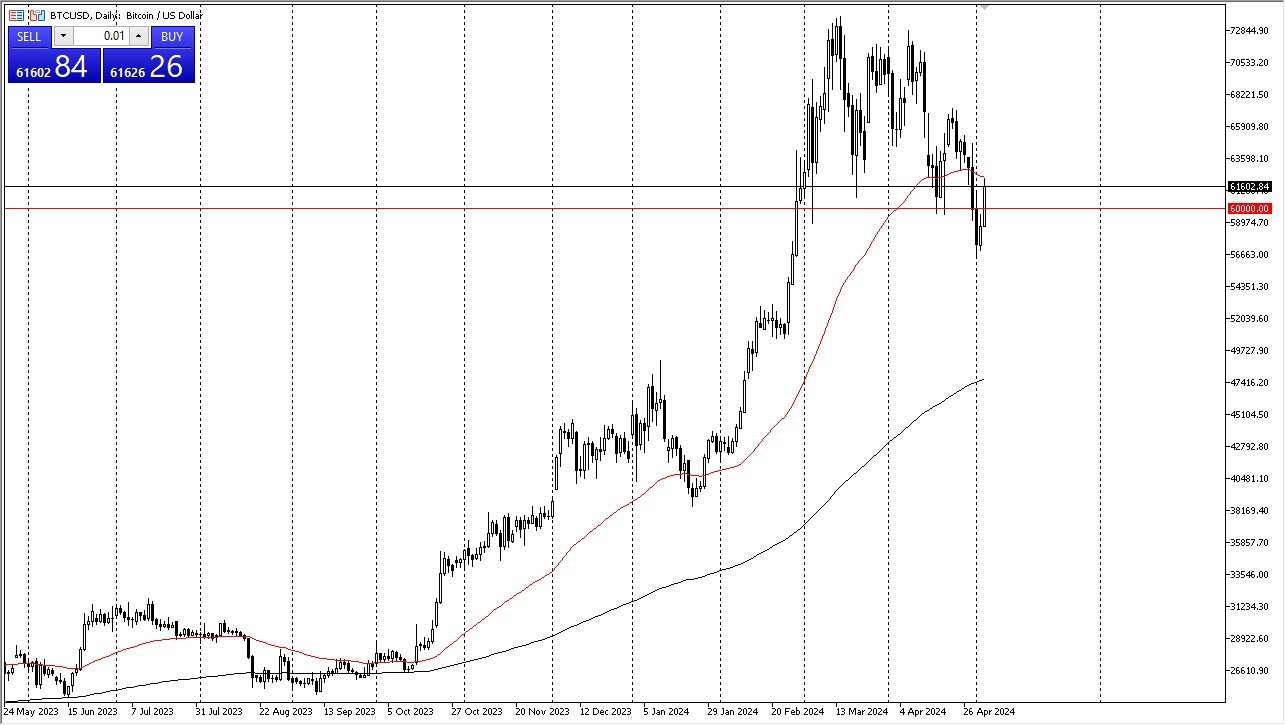

Potential signal: I am a buyer of Bitcoin above the 50-Day EMA. I would have a stop loss near the $58,500 level, with a target of $70,500 above.

- At this point in time, it looks like Bitcoin is trying to come back and break higher as the overall uptrend looks to be reasserting itself.

- The $60,000 level, of course, is an area that a lot of people should be paying attention to.

- The fact that we have broken above there suggests that we are ready to go higher.

- However, as usual you will have to be careful as the markets are volatility to say the least, and therefore it makes sense that we will see choppy behavior no matter what move is next.

Top Forex Brokers

However, the 50 day EMA stands in the way and of course we have recently sold off, so it'll be interesting to see just how much momentum jumps back into the market and therefore sends the market higher. If we do go higher, the $73,000 level is likely to be a target. This doesn't mean that the Bitcoin market is suddenly going to take off to the upside, just that the overall longer term of trends should continue. The size of the candlestick on Friday certainly is bullish, but again, we had broken through a major support lever, so we will have to see whether or not it ends up being ignored. Longer term, if we can break above the $74,000 level, then it's possible that the market could go looking to the $80,000 level.

A Breakdown is Value?

A breakdown below the lows of the past week could open up a move down to the $52,000 level, which is where we had seen previous support and resistance. Furthermore, the 200-day EMA should come into the picture somewhere around that same area if we do break down. With the jobs report on Friday being so weak, it's possible that traders are starting to focus on the idea that perhaps the Federal Reserve will have to do something monetary policy wise and therefore it makes quite a bit of sense that bitcoin should flourish in that type of environment.

Ready to trade Bitcoin USD? Here are the best MT4 crypto brokers to choose from.