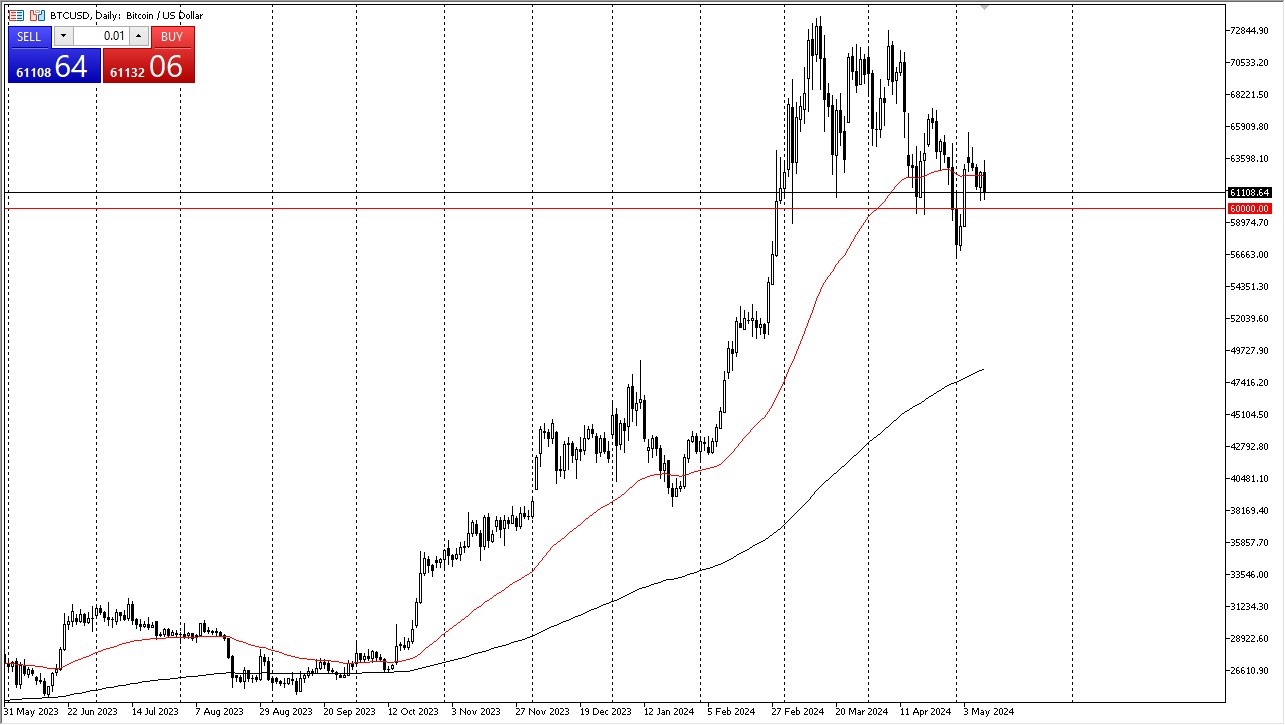

- Bitcoin initially tried to rally during the trading session on Friday but has since fallen apart.

- Part of this is due to the fact that the University of Michigan consumer sentiment number in the United States came out much weaker than anticipated.

- I think at this point in time, people are basically selling anything they have gains in to cover other positions.

- You have to keep in mind that now that Bitcoin has become a commodity on Wall Street, the reality is they will sell winners to cover losers.

Remember, Bitcoin has Changed Permanently

Top Forex Brokers

Bitcoin will start to have new correlations. With that being said, it still looks like the $60,000 level underneath should offer a certain amount of support. And if we turned around at this point in time, it wouldn't be a huge surprise. I should also point out that the support not only is found at the $60,000 level, but it could be extended down to the $57,000 level.

Ultimately, this is a market that I think you are looking for dips to buy, and we may be getting one. However, if we dip below the latest swing low, we could see Bitcoin go down to the $52,000 level. This would make a certain amount of sense, considering we had gotten so overdone, and of course, Wall Street has their ETF now, so they can hand their bags over to retail traders, which is essentially what Wall Street does. It builds products, it sells them to the unsuspecting public, and then it collects its profits. With that being said, I don't know if that happens with Bitcoin in a major sense, but I do think that the ETF has thrown an entirely new layer of complexity and noise in this market.

With that being the case, the long gone are the days where we get 16% gains in 12 hours, and the “crypto bros” are going to be a thing of the past as well. This should help eventually solidify Bitcoin as being something that people will hang onto for use in utility, but it is going to be a very noisy process.

Ready to trade BTC/USD? Here’s a list of some of the best crypto brokers to check out.