- Bitcoin fell a bit in the early hours on Tuesday as we continue to see a lot of noise.

- This does make a lot of sense because the market has been very noisy over the last two and a half months.

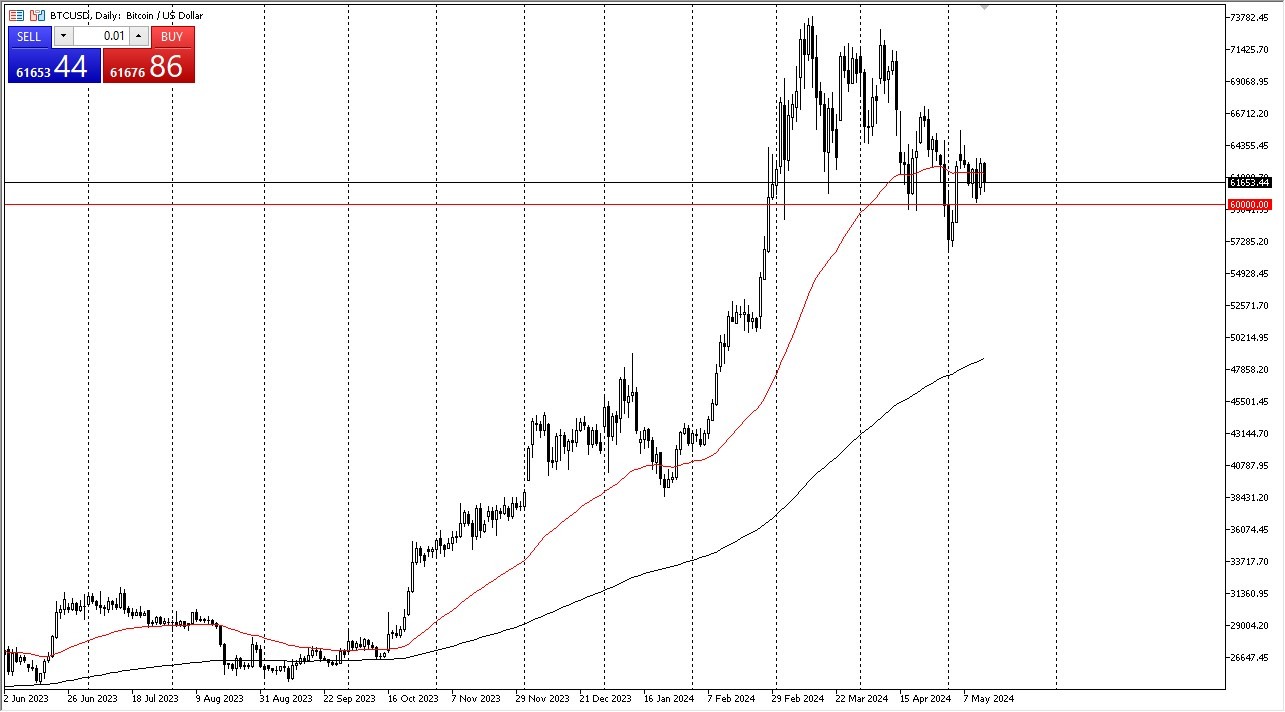

- Keep in mind how we got here. We rallied 92% in six weeks and then have spent the last 10 weeks or so just grinding back and forth perhaps trying to absorb all of that inertia.

This would be normal market behavior, and therefore I don't read too much into it, other than it's a market that needs a new catalyst. The last catalyst, of course, was the ETF that Wall Street released, and therefore institutions threw money at it immediately. Whether or not they stay in there remains to be a question that traders will have to pay attention to, but I do think of long term.

Top Forex Brokers

Is the Bitcoin Market Now an Index-Like Asset?

The BTC/USD market is probably more or less going to behave like an index. It might be a little bit more volatile, but at the end of the day, now that institutional money is in it, they don't want it swinging 15% in 24 hours, so you will see that tamper down quite a bit. The $60,000 level currently looks like it is a major support barrier that people will have to pay attention to if they are trying to short this market.

Even if we break down below the $60,000 level, it's likely that we will see plenty of support come back in around the $57,000 level. Anything below that opens up the possibility of a move down to the $52,000 level, which has the potential to be truly consequential, as it was where we launched from in the final impulsive phase higher, and an area where we are starting to see the 200-day EMA approach rather rapidly. Either way, this is more or less going to be a buy on the dips type of market from everything I see.

Ready to trade Bitcoin to the dollar? We’ve made a list of the best Forex crypto brokers worth trading with.