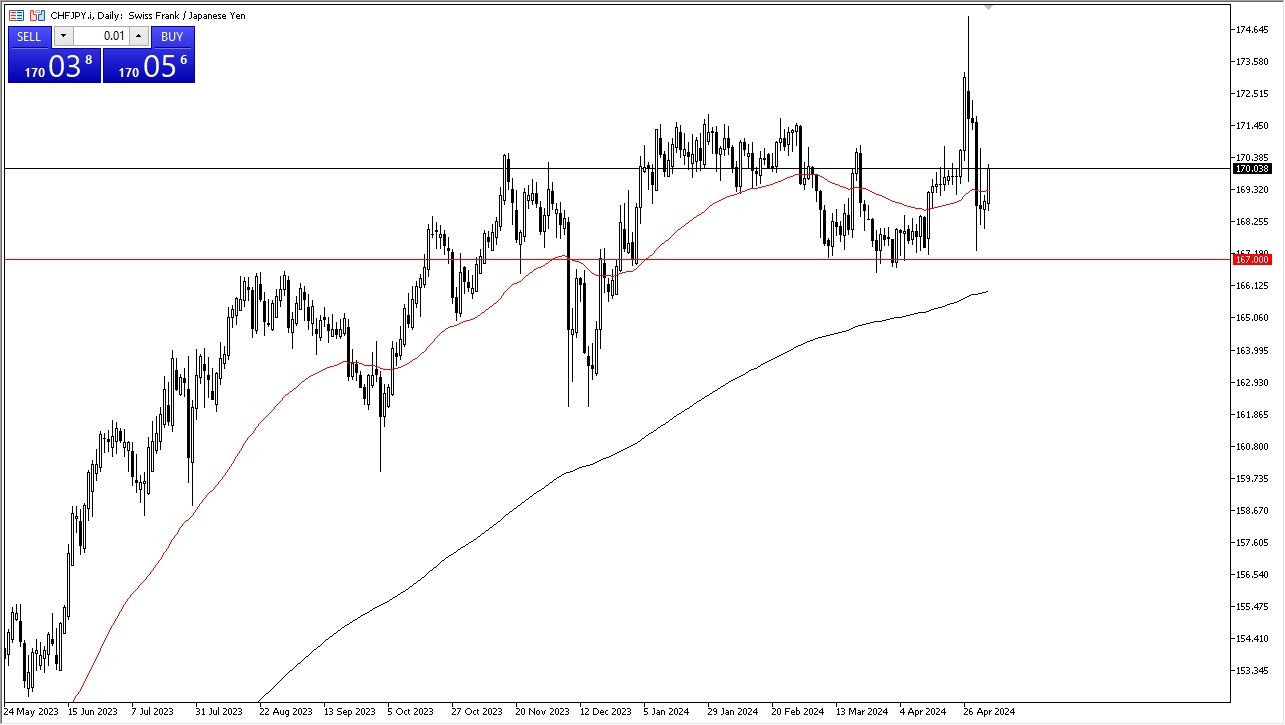

- The Swiss franc has rallied against the Japanese yen again on Monday, as it looks like the Japanese yen is losing strength across the board.

- This is one of my favorite pairs to watch right now, due to the fact that both are major funding currencies and therefore it's important to know which one to go short with.

- For example, if this pair continues to go higher, it shows me that the Swiss franc is stronger than the Japanese yen, and therefore all of my short Japanese yen trade ideas should, at least in theory, be more profitable.

This is not to say that either one of these currencies are strong, because quite frankly, neither of them are. Both have central banks that are either going to loosen monetary policy, or just simply stay at a very loose level. For example, the Swiss National Bank has recently cut rates, and although that is a dovish move, the reality is that the Bank of Japan only offers 0.1% interest and, quite frankly, can't raise interest rates any higher.

Top Forex Brokers

They did intervene in the currency markets last week, but quite frankly, most currency interventions only end up slowing the rate of a move, not necessarily changing it. On this chart, I see the ¥167 level as a major support level, and that has proven itself to be important multiple times in the past. Furthermore, we also have the 200 day EMA sitting just below there, so that will bring in a certain amount of technical support as well.

We Still Look Bullish

There's nothing on this chart that suggests to me that we cannot revisit the ¥175 level, although I don't necessarily think it's going to be a shot straight up in the air. I think this is more or less going to be a grind higher, and you can either get long of this market or you can continue to monitor it and decide whether you are shorting the Swiss franc or the Japanese yen in other currency pairs.

Not sure which broker to choose? We've made a list of the best forex brokers for you.