- The crude oil markets initially tried to rally during the trading session on Friday, but then turned around to show signs of weakness.

- At this point, things are getting interesting as we are approaching rather significant potential support.

- That being said, the technical analysis suggests that we are at a major inflection point.

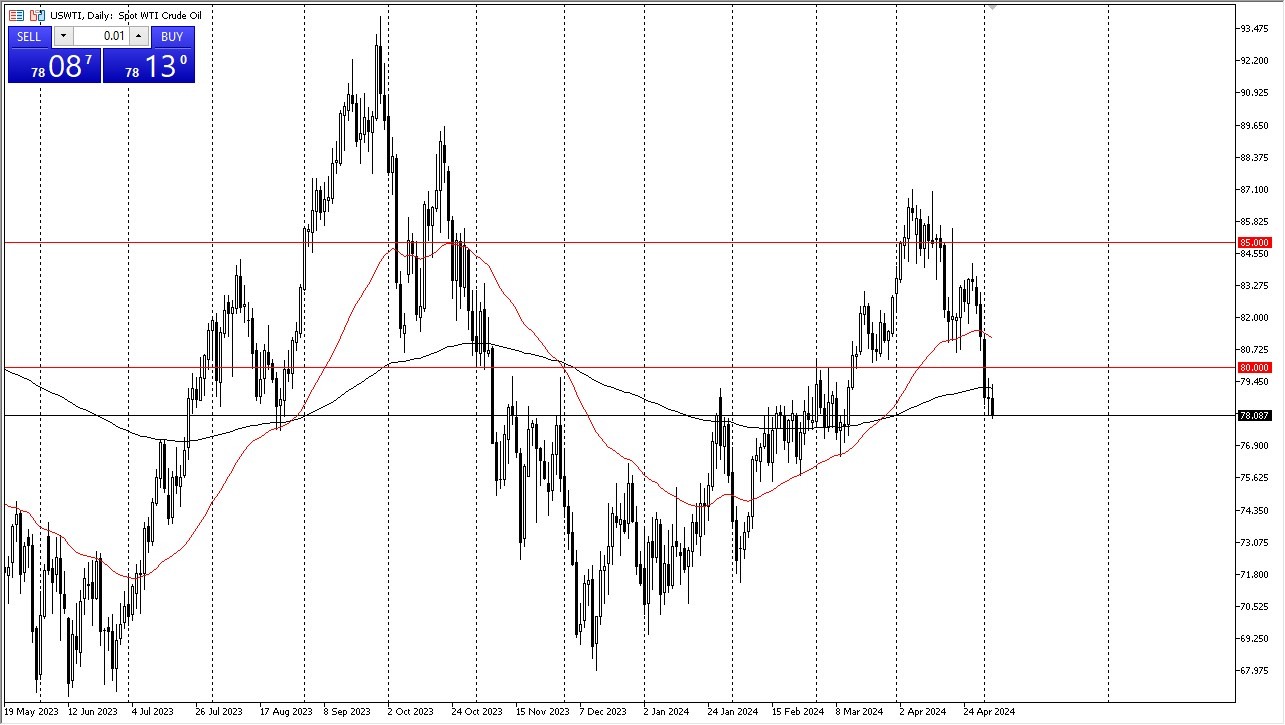

West Texas Intermediate Crude Oil

The West Texas Intermediate Crude Oil market initially tried to rally a bit during the trading session, and even managed to peak above the 200-Day EMA at one point. However, it could not continue that momentum and it looks as if the drop was almost instantaneous. At this point, we reach down to the $70 level, which is an area where we have seen a lot of noise previously. At this point, you have to wonder whether or not we will have buyers coming back into the market?

Top Forex Brokers

If the market were to turn around and jump above the last couple of candlestick, then it could open up the possibility of taking out the $80 level above, which obviously would put a lot of bullish attitude into this market and perhaps give a little bit of relief for those who are bit cautious about the crude oil market in and of itself.

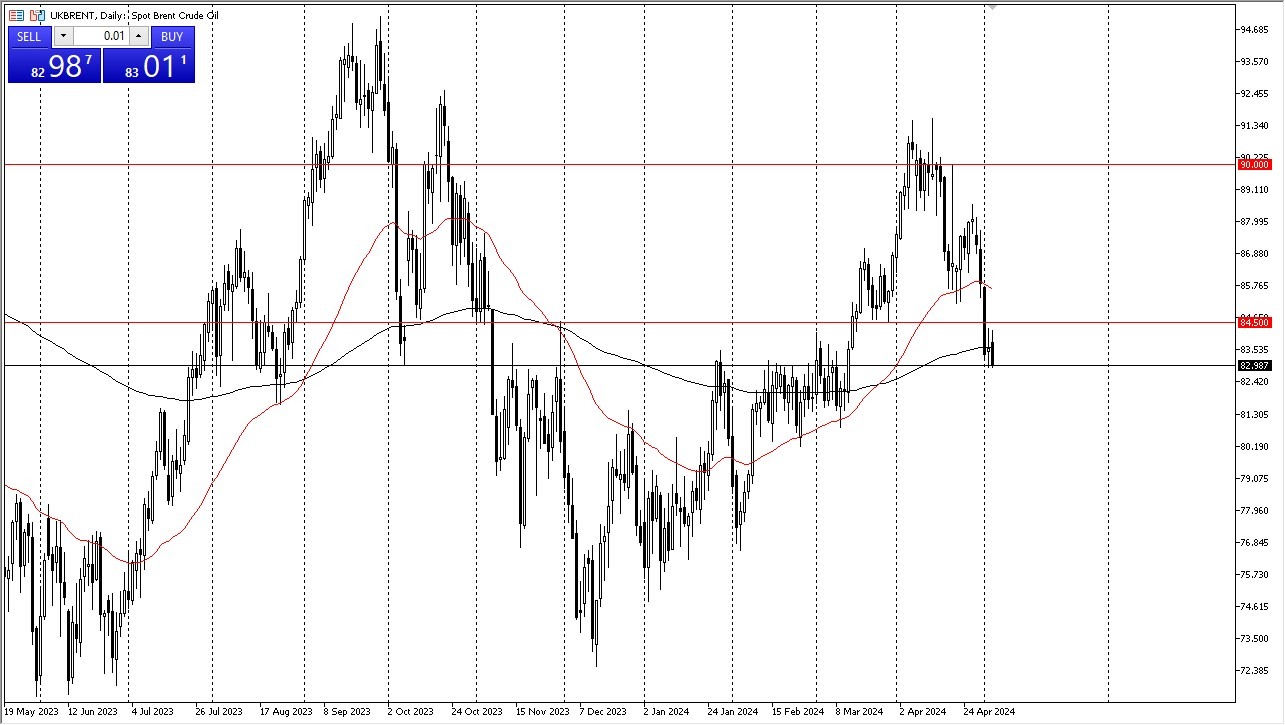

Brent

Brent initially tried to rally during the trading session as well, but it looks as if the $84.50 level is going to offer a significant amount of resistance. The 200-Day EMA is in this general vicinity, therefore I think you get a situation where we are going to see a lot of noisy behavior. Underneath, we have a lot of support, but at this point in time there is not much driving the market and at this point that suggests that we are ready to go higher. That being said, it’s not necessarily easy to go higher in this type of environment, but geopolitical noise could come into the picture in turn things around almost instantly.

That being said, keep in mind that cyclically speaking, this is typically a very bullish time of year as well. What does the oil market tell us about the overall economy? That could be the real question to ask at this point in time.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.