West Texas Intermediate Crude Oil

The West Texas Intermediate Crude Oil Market reached below the $77 level, but now finds enough buyers to turn things around and perhaps form some type of hammer. We will have to wait and see how the day closes, but I think at this point in time, we are looking at a situation where buyers are licking their chops with the potential opportunity in this market.

That being said, if we were to rally from here and take out the 200 day EMA to the upside, a lot of traders would be very interested in getting involved in momentum trading. Alternatively, if we were to break down below the bottom of the candlestick for the trading session on Wednesday, that means we would probably more likely than not test the $75 level for support. This is an area that I think will be very cautious at this point, and therefore it is likely that we will see a huge fight in this region is we were to reach it.

Top Forex Brokers

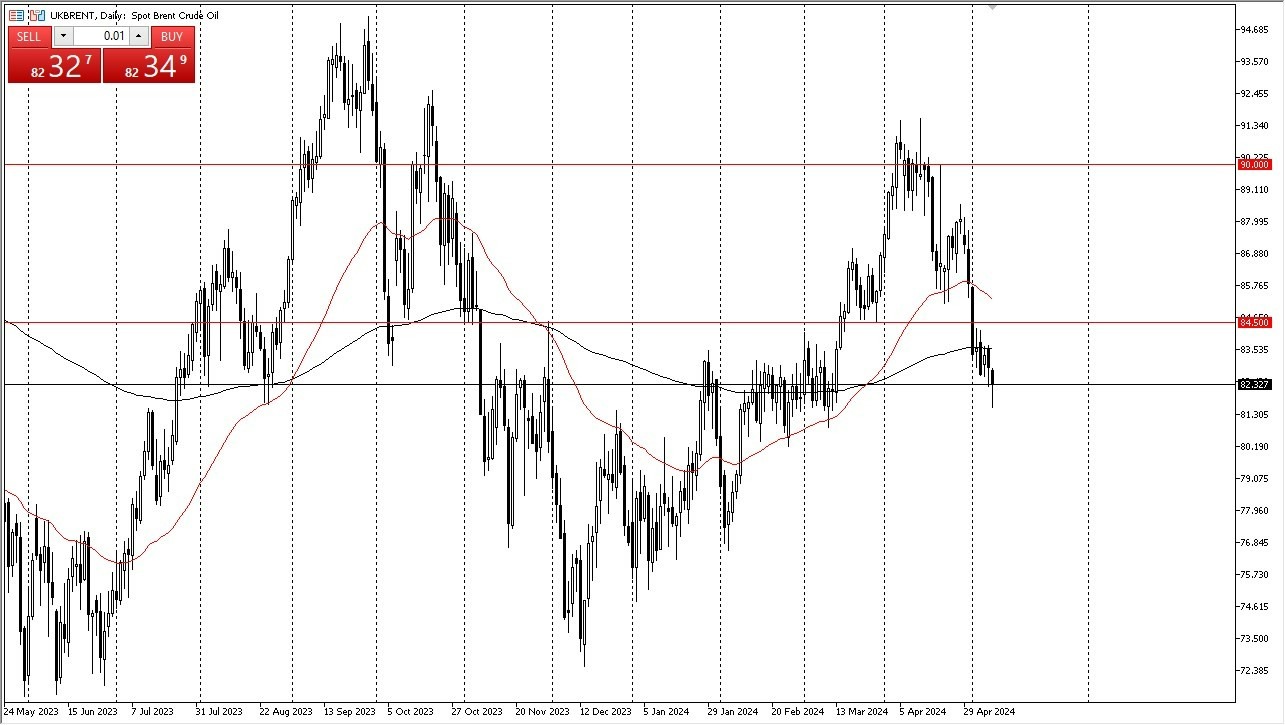

Brent Oil

Brent looks very much the same as we initially fell rather significantly during the day, but we have seen a fairly large pushback. With this being the case, the 200-day EMA is near the $83.50 level, and I think a major signal if and when we break above there. All things being equal, we are in the middle of a cluster in both grades of crude oil and there should be plenty of support.

- Furthermore, you have to keep in mind that geopolitical issues continue to be a major issue.

- And with that being the case, all it's going to take is one errant headline coming out of the Middle East, and you will see oil markets rally a dollar almost instantly.

- In general, this is a market that is very noisy, but it does look like it's in the midst of forming some type of basing pattern after what has been a significant pullback.

Ready to trade the WTI/USD exchange rate? Here’s a list of some of the best Oil trading platforms to check out.