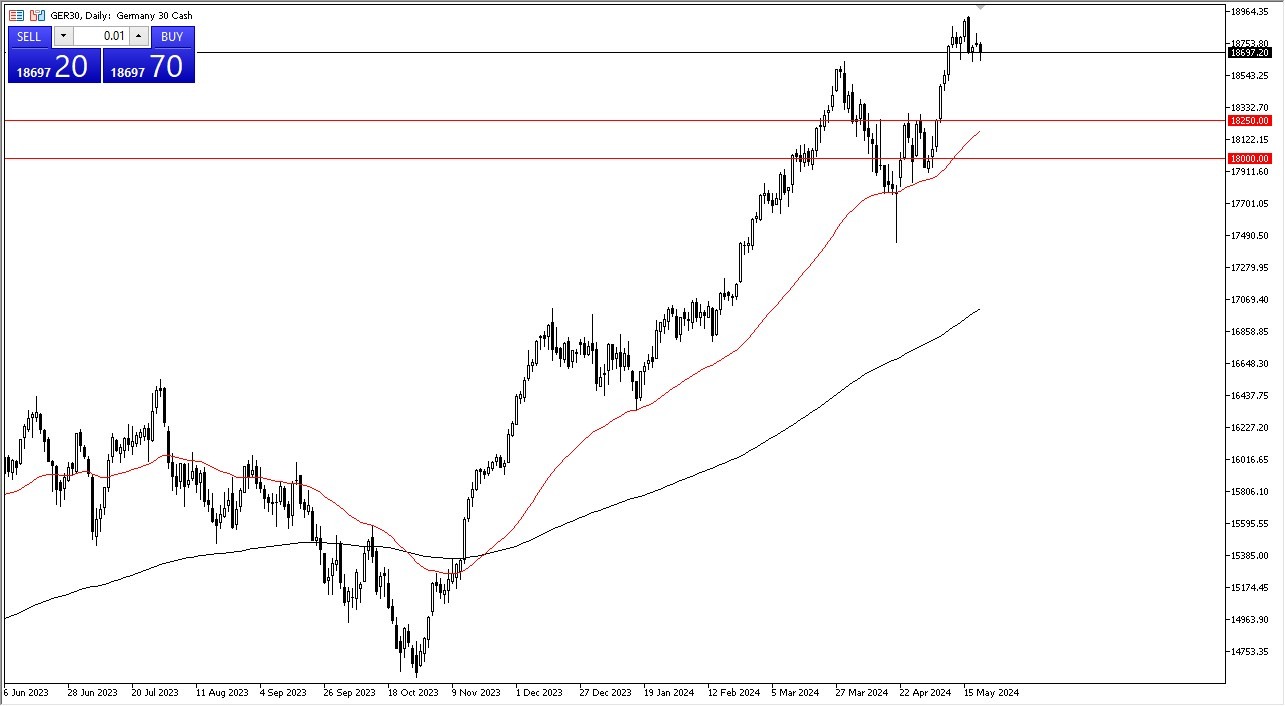

- The Dax initially pulled back a bit during the trading session on Tuesday.

- As it looks like we continued to threaten the €18,600 level.

- The market recently has made a fresh new high, and I think now is just simply trying to work off some of the excess froth.

Keep in mind that stocks in general look very strong, but at this juncture, indices around the world seem to be working off some of the excess. I do believe that the European indices will continue to do fairly well. The Dax, of course, is the first place that people put money to work when it comes to the EU, as it is, the Blue-chip index.

Breaking Higher?

Top Forex Brokers

If we break above the €18,950 level, then it's likely we will go to the €19,000 level, followed by the €20,000 level. In general, this is a market that I think continues to see plenty of buyers on dips. So even if we do break down from here, I think it's an opportunity to get long again. The €18,250 level is an area that previously had been resistance and should now offer support, especially now that the 50 day EMA is racing towards there.

You could even make an argument that perhaps are trying to form a little bit of a bullish flag. Either way, the whole thing looks bullish and as long as the euro is relatively cheap and it is, that helps German exports, which of course helps most of the multinational corporations that are on the Dax. So, I believe this remains very bullish.

If it pulls back, there will be plenty of people out there looking for value to take advantage of. Ultimately, this is a market that I think is going to continue to go higher regardless and if you get the opportunity to pick up cheap contracts, that's something that you need to do. I have no interest in getting short of this market, as it will almost certainly lead the rest of Europe higher.

Ready to trade our DAX analysis? Here are the best CFD brokers to choose from.