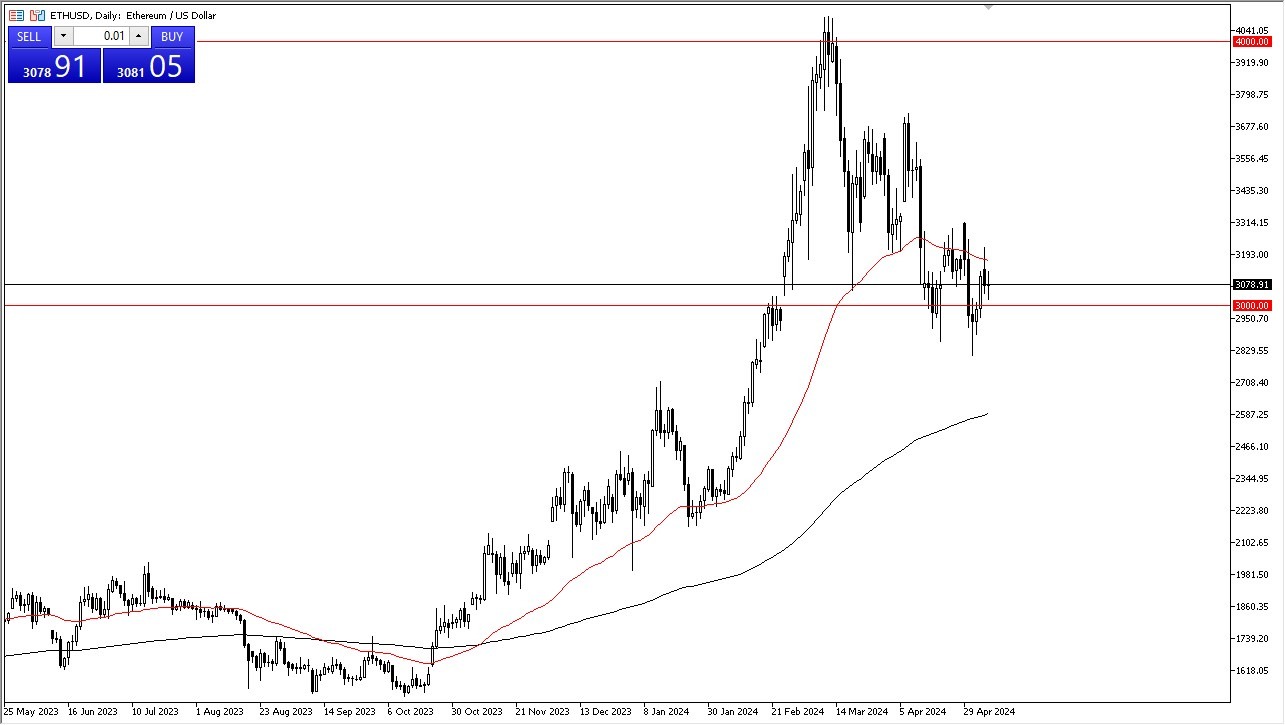

- Ethereum markets have gone back and forth during the trading session on Tuesday as we continue to look at the $3000 level with great interest.

- Ultimately, this is a market that I think continues to see a lot of support in this area as it is a large, round, psychologically significant figure, and I do think that you have to look at this is a market that is trying to find some type of bottom.

Bitcoin leads the way

Keep in mind that Bitcoin will continue to lead the way when it comes to anything crypto currency related, and that of course includes Ethereum. In general, this is a market that I think short-term pullbacks will continue to look attractive, and therefore it’s likely that we will continue to see plenty of buyers willing to step in and take advantage of “cheap Ethereum.” If we break above the 50-Day EMA, which sits just below the crucial $3200 level, then we could continue to go higher.

Top Forex Brokers

In general, this is a market that I think continues to be very noisy, and therefore I think you do have to look at dips as buying opportunities, but if we were to break down below the $2800 level, then we have to have a situation where we could drop down to the 200-Day EMA, but you also need to see the Bitcoin market drop down below its recent support level. All things being equal, this is a market that I think is noisy, and I do think that there are plenty of supporters here, but I also recognize that is not necessarily going to be an easy trade.

If we were to turn around a break above the $3325 level, then it’s likely that the market goes looking to the $3600 level, followed by the $4000 level. The $4000 level was a swing high, and although we have been there before, you have to keep in mind it would be a 25% gain from where we are right now, so it may take some effort to make that move. As things stand right now, I don’t have any interest in trying to short crypto in general.

For additional & up-to-date info on crypto brokers please see our best crypto brokers list.