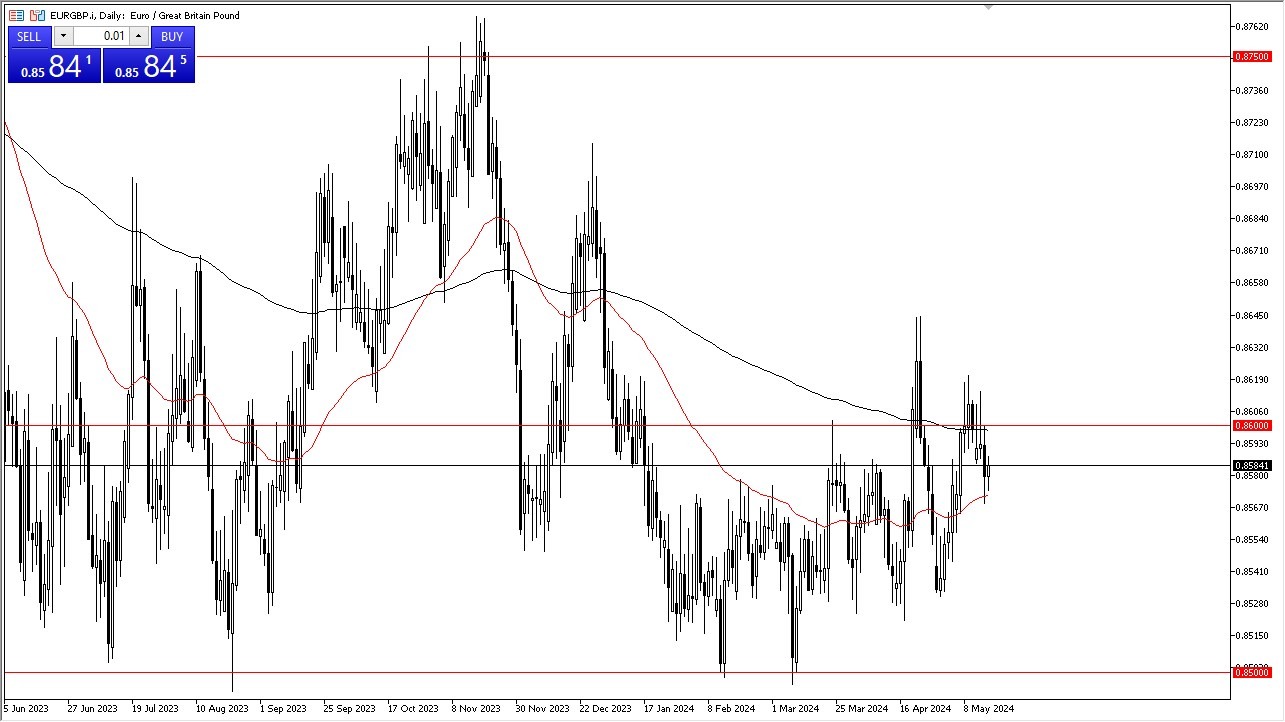

- The euro has bounced a bit after initially selling off on Thursday as the 50-day EMA continues to attract a certain amount of attention.

- That being said, the 200-day EMA above offers significant resistance, especially as it is sitting right at the 0.86 level.

- In general, this is a market that continues to squeeze, but I do think that we have built a fairly solid basing pattern.

- This is a pattern that has been playing out over the last several months, so I do think that it has a lot of validity due to the fact that we have simply shown it to be stable.

The upside

If we can break above the 0.86 level, then it opens up the possibility of moving to the 0.8650 level, and then possibly another 100 points to the 0.8750 level. Historically speaking, the 0.85 level underneath, which is where we bounced from, is a massive support level going back several years on the monthly chart. So, it does make a certain amount of sense that we would see a buy on the dips attitude every time we get close to that area. If we were to break down below the 0.85 level, it would be disastrous for the euro against the pound.

Top Forex Brokers

In general, I think both of these currencies are bouncing around against each other, and that is typical. It does tend to be a choppy market, but it looks like we are gradually grinding to the upside, and that's how you have to approach this market, but keep in mind that the PIP value in this pair tends to be much higher than what you're used to trading, so therefore, it doesn't need to move as far to bring in decent profits. Make sure to adjust your position size accordingly for this EUR/GBP currency pair, due to the fact that the value of each point is so much bigger.

In general, I am bullish, but I also recognize that you’re going to have to be somewhat patient with this move, as it could take a certain amount of time to truly bring in profit, but that’s the nature of this pair during most market conditions anyway.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.