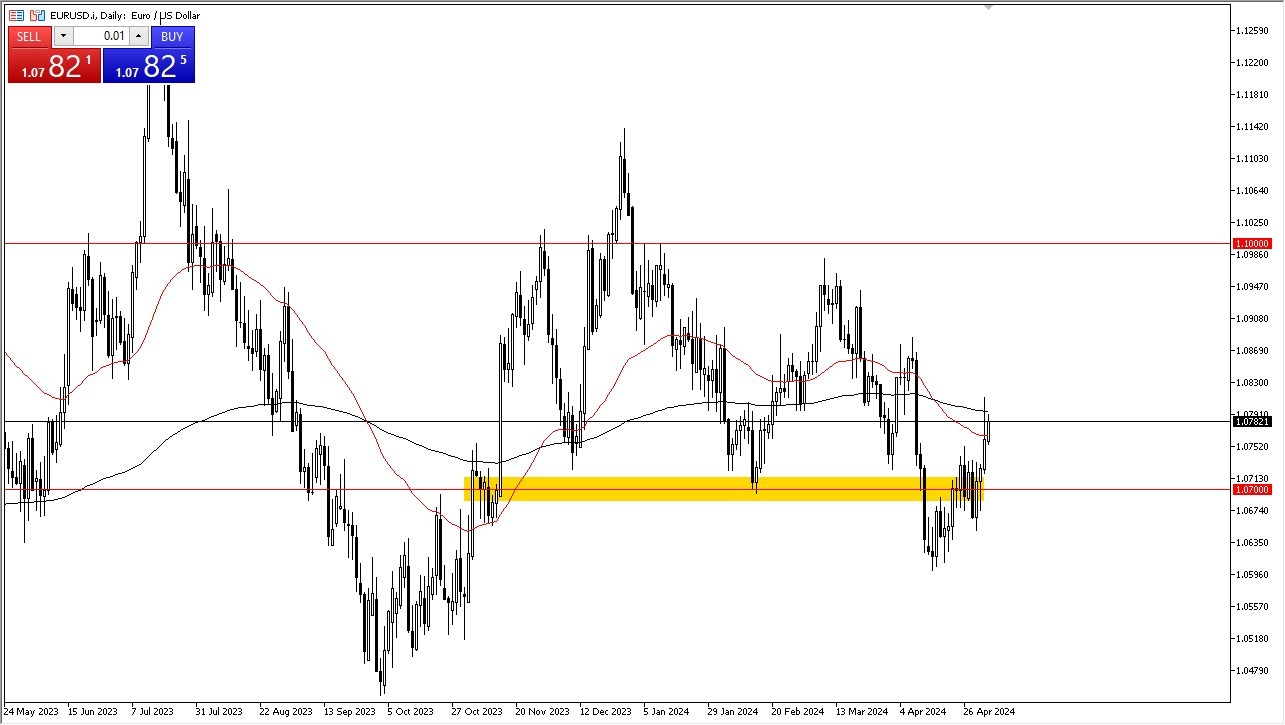

- The euro rallied slightly during the early hours on Monday as it looks like we are threatening the 200 day EMA.

- That being said, I do think that you have to pay close attention to this area because it is a potential resistance barrier that might be difficult to overcome.

- This is an area that I think could come into the picture as a major decision just waiting to happen at this point.

If we do, then the 1.0850 level gets targeted next. That being said, we also have to look at this through the prism of a market that if we fall, then the 1.07 level could be a target. Ultimately, this is a scenario where traders will probably look to the interest rates in America to see whether or not they continue to tick higher or if they sell off. With that being said, the market has been very sensitive to the idea of what's going on in the bond market. So do make sure to pay attention.

Top Forex Brokers

Central Bank Actions

The central banks both look likely to cut, but the Federal Reserve is going to be cutting much later than the ECB. And if that's the case, we're probably going to continue to see the US dollar strength. And with that being said, I'm looking for some type of value play based on a weak US dollar and then perhaps exhaustion in the euro. Over the longer term, if we were to break down below 1.07, then 1.06 gets targeted followed by 1.05. If we do rally, it's probably a general anti-US dollar trade. I don't like the euro. I don't like it here, but I don't have the price action to start shorting the EUR/USD pair quite yet.

That being said, the market will be one that we have to pay attention to, as it is also a scenario where we look at the action as a proxy for the strength or weakness of the United States Dollar, as the Euro is considered the “anti-dollar.” This market will continue to be one I watch to get a grip on the USD strength or weakness, and how it could come into play against various currencies around the world.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.