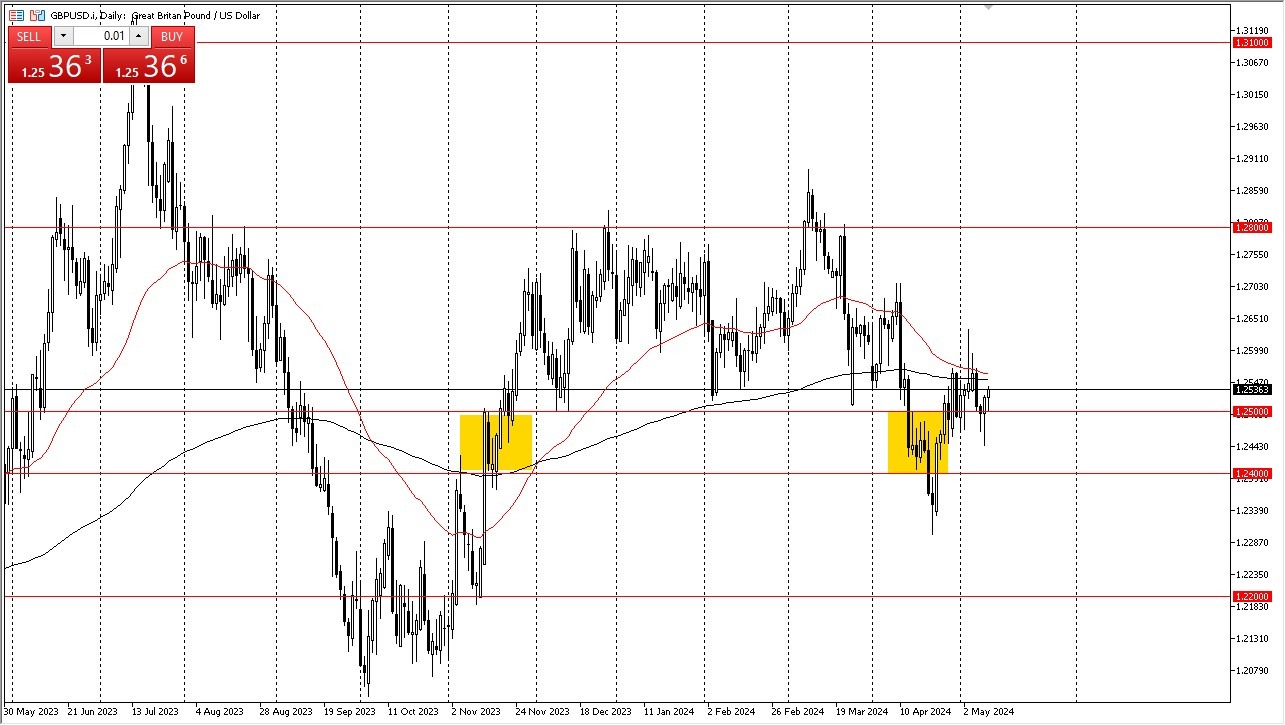

- The British pound initially pulled back during the trading session on Friday to test the crucial 1.25 level.

- The 1.25 level of course is a large, round, psychologically significant figure that a lot of people will be paying attention to, as it has been important multiple times. Now that we have bounce from there, it does suggest that perhaps we are going to continue to see a lot of momentum to the upside, and of course perhaps go looking to the moving averages above.

That being said, I also recognize that this is a market that will continue to be noisy, especially as the Monetary Policy Committee had two of its members vote for an interest rate cut this past week, so that does put a little bit of negativity into the British pound, but on Friday we have the market reacting to the University of Michigan Consumer Sentiment numbers coming out much lower than anticipated, and this course has people already starting to try to price in the idea of the Federal Reserve cutting rates. This of course is nonsense, but it was the catalyst on Friday.

Top Forex Brokers

Choppy Conditions Ahead

I suspect that we are going to continue to see a lot of choppy action in this pair, as well as the rest of the Forex world, as people simply have no idea where to price risk at the moment. Ultimately, the Federal Reserve is going to stay tighter for longer, despite the fact that we did see a crack in consumer confidence. Quite frankly, it’s going to take a lot more than that to get the Federal Reserve to start moving again.

In the short term, we have the 200-Day EMA and the 50-Day EMA just above, and then of course we have resistance near the 1.26 level. Any signs of exhaustion in that area would probably get jumped upon, as a potential shorting opportunity. If we can break above there, then the market could very well find its way back to the 1.27 level above. That being said, it’s going to be noisy regardless and you have to keep an eye on the fact that any geopolitical tension almost always favors the US dollar anyway.

Ready to trade our daily Forex analysis? We’ve made this UK forex brokers list for you to check out.