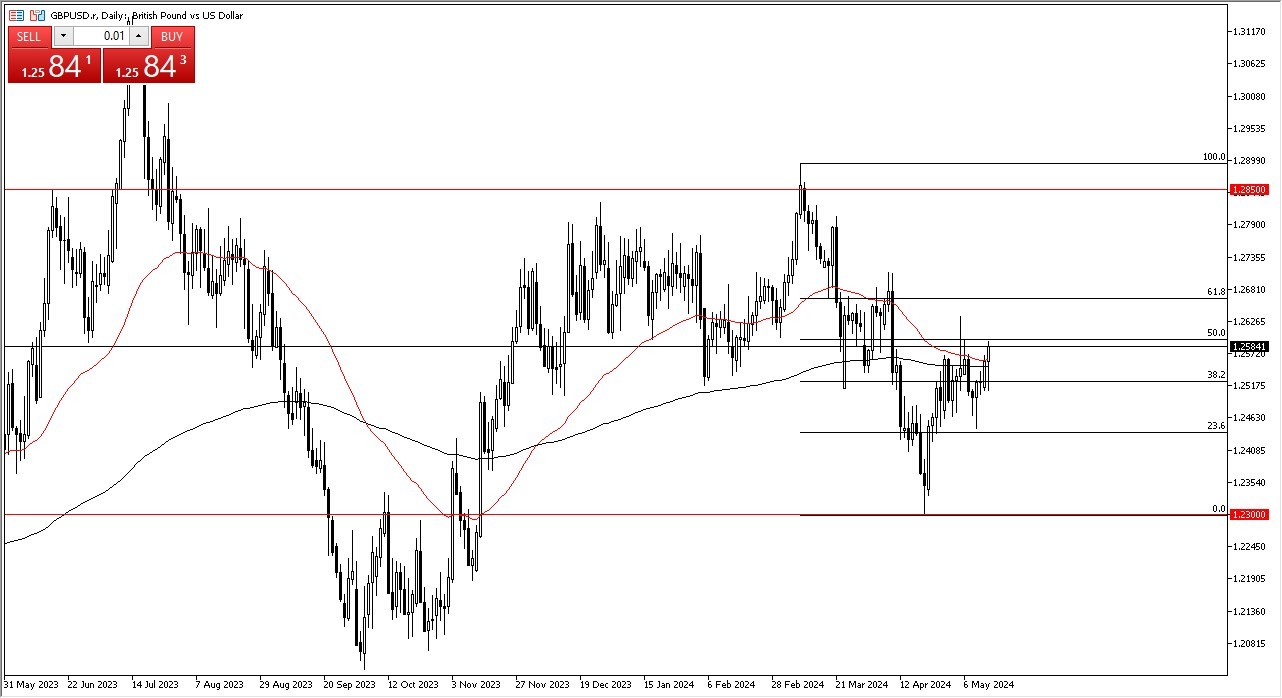

- The British pound initially fell during the trading session on Tuesday, reaching down toward the 1.25 level before turning around again.

- Ultimately, this is a market that is doing everything he can to rally, but we are also fighting a lot of technical levels.

- The 1.26 level is an area that has previously seen quite a bit of noise, and it is causing a bit of a headache for those wishing to get long of this market.

It is also worth noting that the 50% Fibonacci were to level since in the same area, and there I think a lot of people will be paying close attention to potential selling pressure as well. We are sitting just above the 50-Day EMA of the 200-Day EMA indicators, and therefore I think a lot of people will also be taking a look at that.

Top Forex Brokers

Federal Reserve

At the end of the day, the Federal Reserve is a major driver of where we go, because the Bank of England has already had its meeting, we are 2 of the members of the Monetary Policy Committee decided that they wanted to cut rates, so I think now we are paying attention to what the Federal Reserve may or may not do. At this point, the Federal Reserve is likely to remain very tight with monetary policy, so I think at this point it does make more sense than not that we would see some type of exhaustion. That being said, it’s also worth noting that we have seen a lot of resiliency here.

If we do break higher, I believe that the 1.2675 level, which subsequently is near the 61.8% Fibonacci retracement level, will offer a bit of resistance. All things being equal, and more comfortable shorting signs of exhaustion than anything else. On the other hand, if we were to break above the 1.27 level, then it’s possible that the market could go looking to the 1.2850 level above, an area that previously has offered quite a bit of resistance multiple times and is the top of the overall consolidation range that we have been in for months.

On the downside, if we break down below the hammer from last Thursday, then the market probably goes looking to the 1.23 level underneath, which of course is the bottom of the overall consolidation range that we have been in during that same timeframe.

Ready to trade our Forex daily analysis and predictions? Here’s the best forex trading company in UK to trade with.