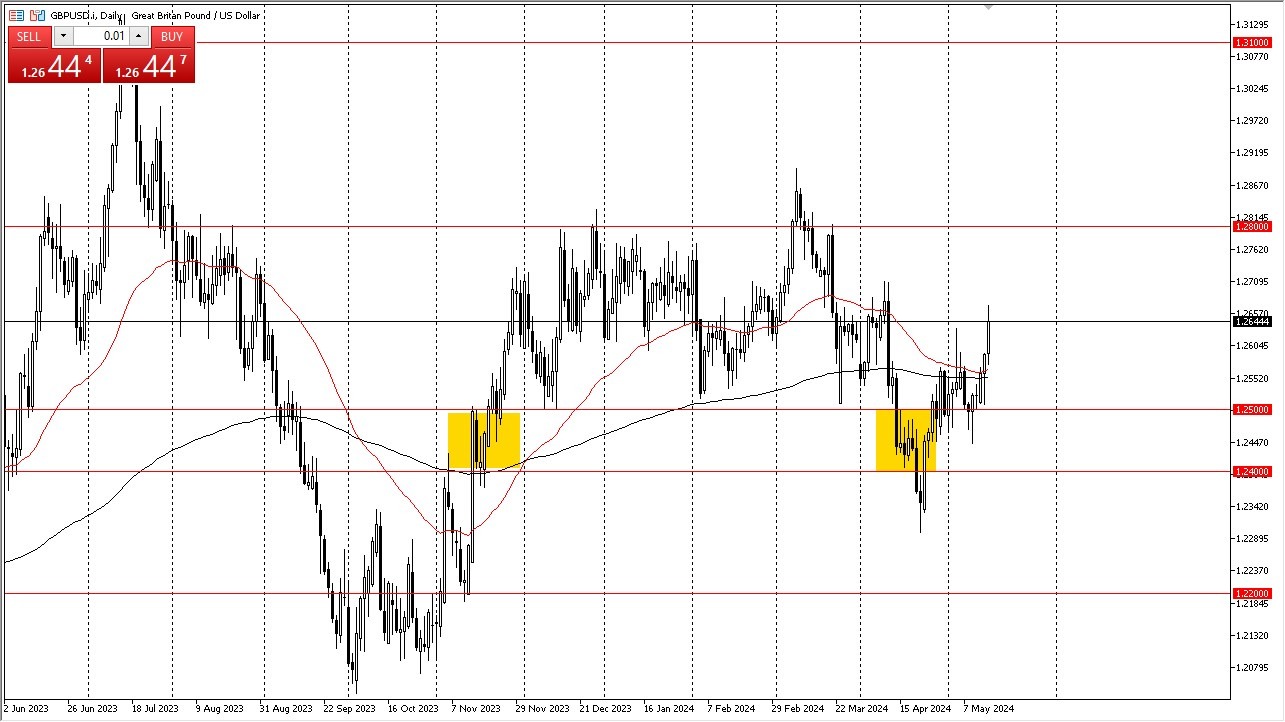

- The British pound has rallied significantly in the early hours on Wednesday, but now is facing a major resistance barrier against the greenback.

- The US dollar has been very strong until recently and therefore you have to question whether or not this bounce has been something that's sustainable, or if it's something that's just going to give those who want to buy us dollars a better price.

It looks to me as if the 1.27 level is an area that you have to pay close attention to, because we did sell off quite drastically from that level. We are struggling to get above there during the day, but it is still a very bullish day. So, I think we have a bit of a fight on our hands that could play out over the next several sessions.

I will be taking my time getting involved

Top Forex Brokers

It is because of this that I'm not jumping into the market right away. And I do think that ultimately, you're looking for signs of exhaustion to start selling, or you're looking at a move above the 1.2720 level to open up the next 80 pips, which would be the 1.28 level, an area that offered a lot of resistance previously right now.

It'll be interesting to see how this plays out, because we just got retail sales in the United States coming out much lower than anticipated. But again, you have to ask whether or not the Federal Reserve is going to loosen monetary policy anytime soon. And the answer is more likely than not going to be no. With this, I think you've got a situation where you are just simply looking to take advantage of whatever momentum enter the market.

But right now, we are essentially at a major decision point, and therefore we have to be very cautious, but also recognize that a lurch in one direction or the other could open up our next trading opportunity. I think it will show itself rather soon, but I want to make sure that it’s nice and obvious before I risk any of my hard earned trading capital.

Ready to trade our daily Forex forecast? Here’s some of the best forex broker UK reviews to check out.