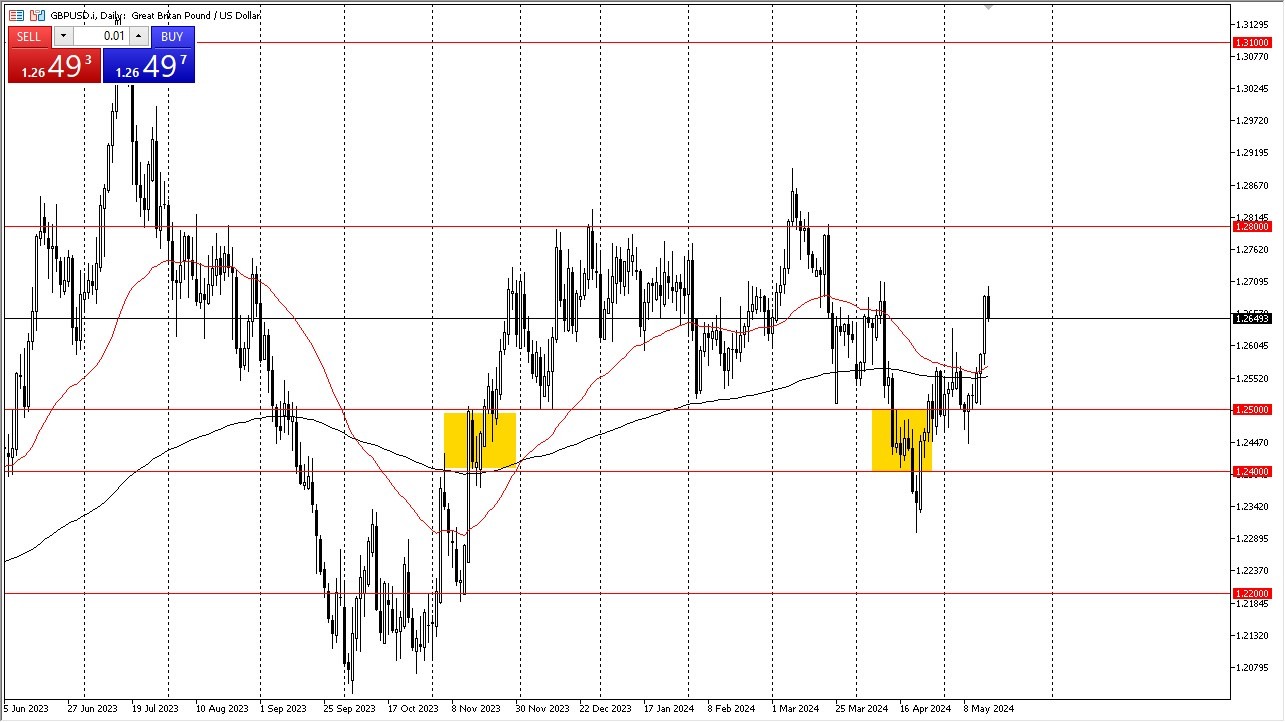

- The British pound initially trying to rally during the session in the early hours of Thursday but has turned back around to show signs of hesitation.

- Ultimately, I think this is a market that you will have to be very cautious of, as it looks like the 1.27 level has offered major resistance.

- This is an area that makes a certain amount of sense, considering that we have seen so much action at that level multiple times in the past, and it is of course a large, round, psychologically significant figure.

In general, I think this is a market that is probably going to be choppy, and perhaps we need to pay attention to the fact that the market has been a little overextended in the short term. So, with that, I would anticipate a little bit of a pullback, perhaps down to the 50 day EMA or, if you will, the 1.26 level. All things being equal, the most important thing you can do is keep your position size reasonable, due to the fact that there is so much uncertainty when it comes to where we are going to go next.

Top Forex Brokers

Interest rates will continue to be the main driver

The market participants out there continued to see a lot of volatility in the bond markets. And that, of course, is not helping anybody either. So, with that being the case, I am very cautiously trying to look for some longer term signal, which I just don't have quite yet. It is worth noting that the market stopped at the 61.8% Fibonacci retracement level and an area that previously had been resistance, so we'll see.

This could be the beginning of the market falling, but you would need to see the US dollar strengthen. In general, if we were to turn around and take out the 1.27 level to the upside, that opens up a move to the 1.28 level, which has been massive support and resistance in the past. Going back several years, as it has been a major part of the chart where people have fought in the pair.

Ready to trade our Forex daily analysis and predictions? Here are the best forex trading platforms UK to choose from.