- The British Pound has been somewhat noisy during the trading session on Wednesday, heading into the FOMC meeting, as you would expect.

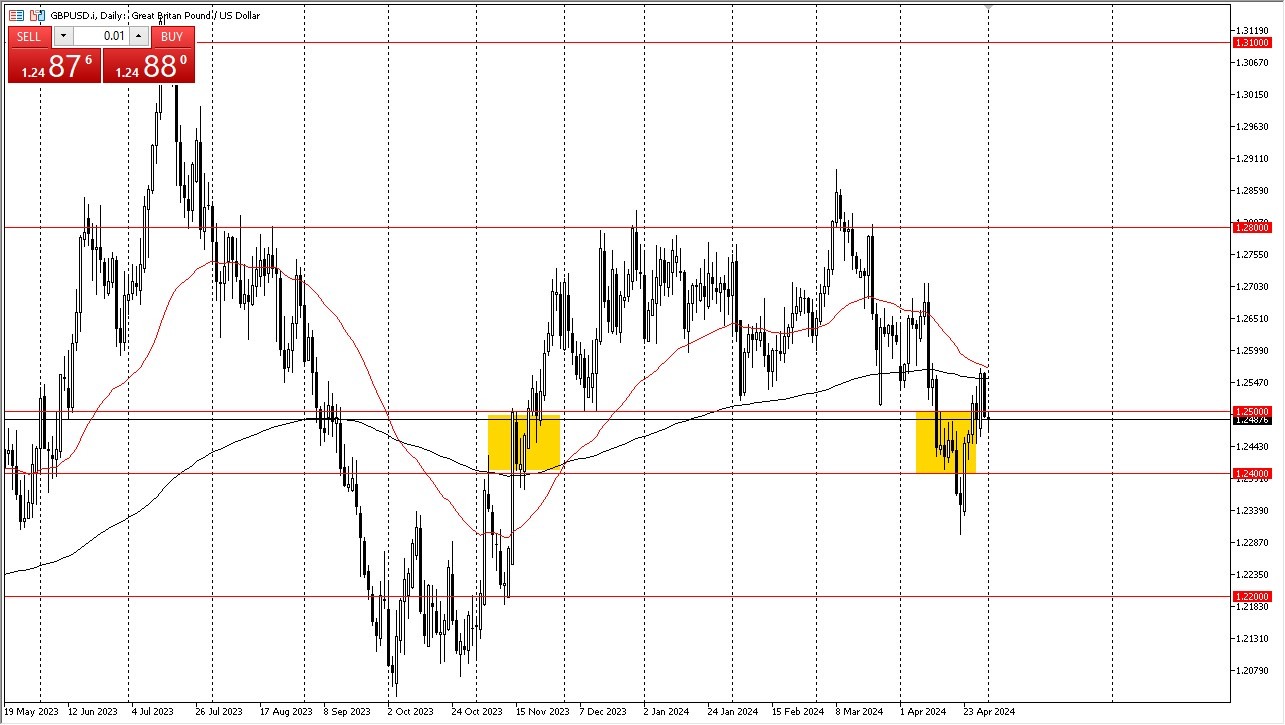

- We are currently hanging around the 1.25 level, an area that of course will attract a lot of attention in and of itself due to the fact that it is a large round, psychologically significant figure.

- It's also an area where we've seen a lot of market memory come into the picture from both the resistance and the support side.

At this point in time, I think we are on the precipice of a bigger move, but we obviously have to get through quite a few questions in the short term.

Therefore, we are just simply hanging around trying to figure out what the next move will be. If we can turn around and break above the top of the last couple of candlesticks, which ostensibly takes out the 200 day EMA and the 50 day EMA, it opens up the possibility of the British pound traveling to the 1.27 level. If we break down below the candlestick for the trading session, on Wednesday and perhaps even Monday, then the market could go down to the 1.24 level. In that scenario, it would essentially end up being “unchanged” from the last several weeks as the US dollar has been one of the strongest currencies in the world for some time now.

Top Forex Brokers

Technical Analysis and Levels to Watch

There is a lot of noise between 1.24 underneath and 1.25 above and therefore I think we are trying to figure out whether or not this is where we find a bottom. If we do break down below that 1.24 level, then it's likely that the GBP/USD will get crushed. It would also be more likely than not a situation where the US dollar strengthens against almost everything. It won't just be the British pound. Expect a lot of volatility as Jerome Powell obviously will have a lot to say when it comes to which direction we go based on the idea of whether or not the Federal Reserve remains hawkish or not.

Ready to trade our daily Forex analysis? Check out the best forex trading company in UK worth using.