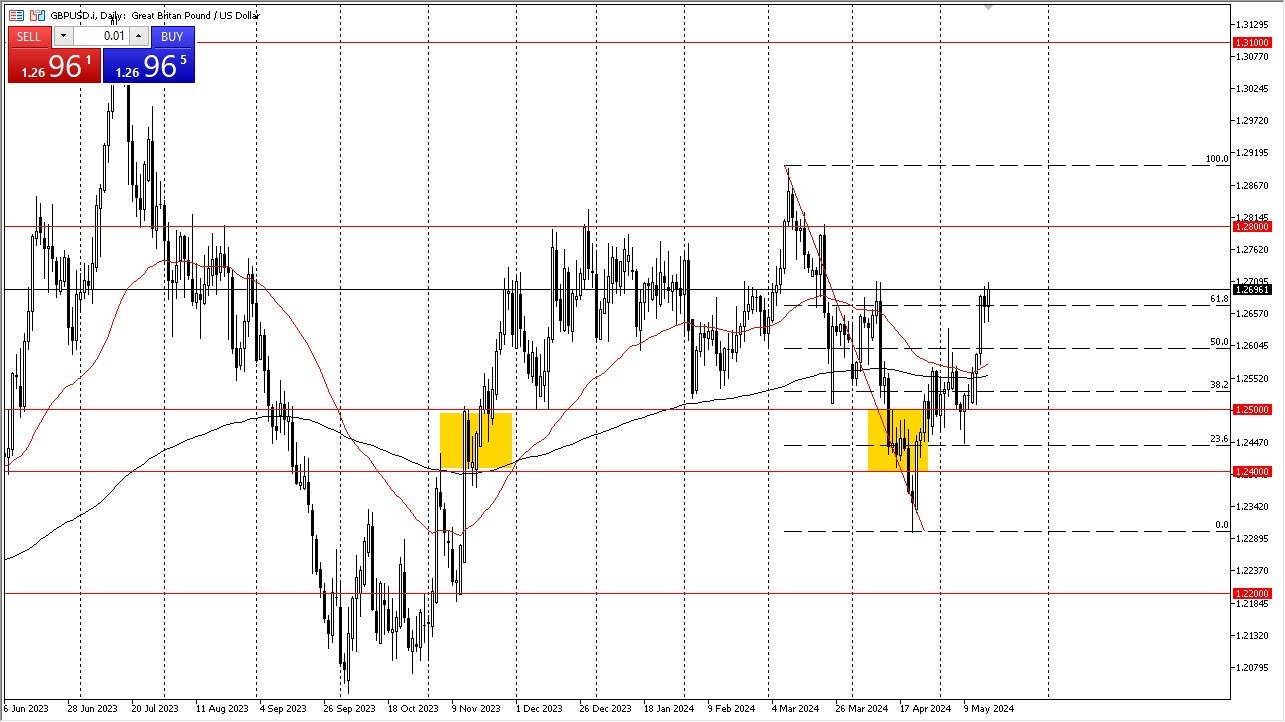

- The British pound has pulled back just a bit during the early hours on Friday, only to turn around and show signs of strength again.

- The 1.27 level is an area that we are threatening, and of course we have seen a lot of resistance, all things being equal.

The area is also around the 61.8% Fibonacci retracement level, so it all ties together for a potential resistance barrier. However, you cannot argue with the idea that it is very bullish, and I do think that it's more likely than not. We at least make an attempt to get to the 1.28 level. The 1.28 level, of course, is an area that is major resistance and has attracted a lot of attention in the past.

Top Forex Brokers

This Year Could Be Range Bound

Really, at this point in time, I think we are going to spend most of the year going back and forth and we are getting close to the top. That doesn't mean we can't get another 100 pips or so out of this move. It's just that I believe the upside is somewhat limited. If we were to turn around and take out the 1.2650 level to the downside, then I think it opens up a potential move down to the 50 day EMA, possibly even the 200 day EMA. In general, a lot of this comes down to the idea that perhaps the Federal Reserve may not be able to get through the year without cutting rates. I don't know if I buy that, because quite frankly, the inflation is still pretty hot. But momentum is momentum, and momentum is what drives most of the markets these days.

Signs of exhaustion near 1.28 could be a nice selling opportunity. We'll just have to wait and see if we can take that out. Then 1.29 will be targeted, followed by 1.31. That being said, this is a market that looks like it wants to go higher, but also has a lot of noise at the same time.

Ready to trade our daily Forex analysis? Check out the best forex trading company in UK worth using.