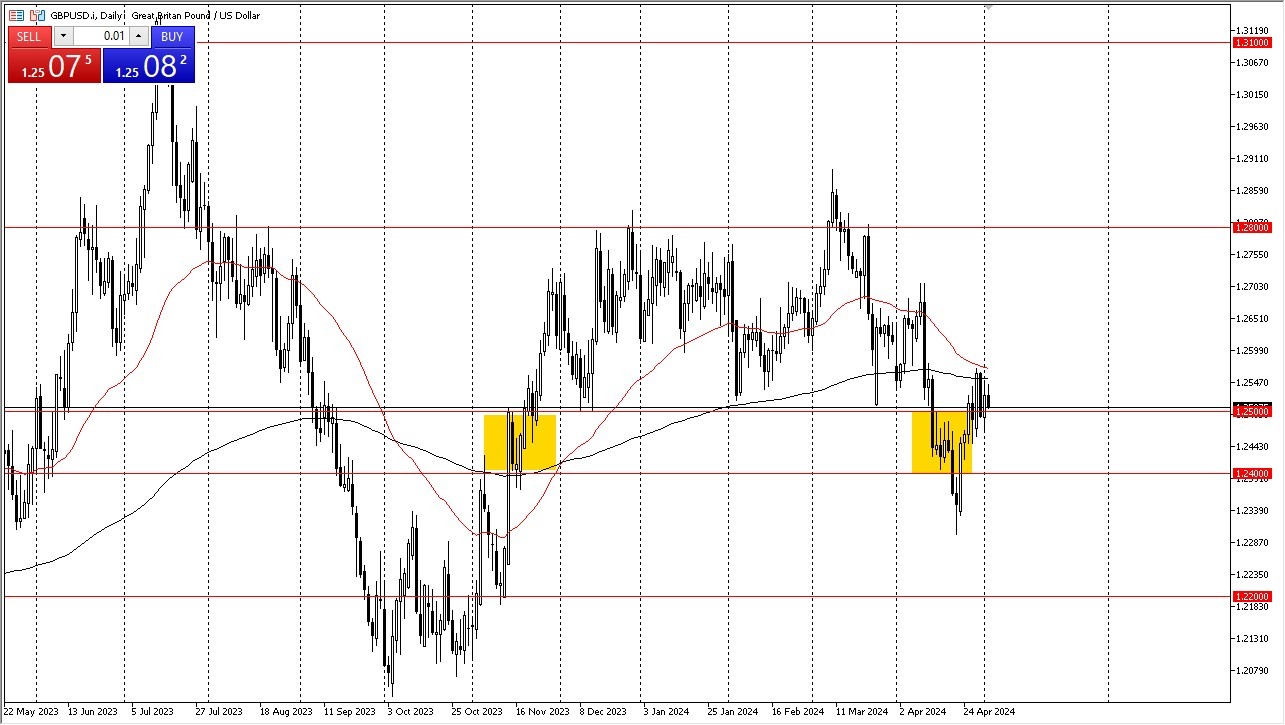

- The British Pound initially tried to rally during the day on Thursday but has pulled back a bit to show signs of hesitation.

- This is a market that I think is just killing time between now and the jobs number on Friday. It's worth noting that the 200 day EMAs is just above, and of course just above there we have the 50 day EMA.

- In other words, we have a couple of different things that could get in the way here and cause a bit of resistance.

If we turn around and break down below the bottom of the candlestick from the Wednesday session, then I think you could see the US dollar start to overwhelm the British pound, perhaps sending this pair down to the 1.24 level. In fact, I think that's the most likely of scenarios. However, I also recognize that if we were to turn around and break above the 50 day EMA above,

Top Forex Brokers

Can Cable Rise Further?

Then it opens up the possibility of the British pound trading all the way up to the 1.27 level. This is a play on interest rates, and although interest rates in the United Kingdom are respectable, a lot of this just comes down to the fact that the Federal Reserve looks nowhere near loosening monetary policy. As long as that's the case, you will see a lot of US dollar strength across the board, and that won't be any different here.

Any move below the 1.24 level could really turbocharge the selling and I suspect at this point you would probably see US dollar strength everywhere in the forex world and it would not just be a British pound situation. Keep in mind that Friday has the jobs report and that will throw a lot of volatility into the market. That being said, with all of that noise, the jobs report typically doesn't change whatever the overall trend is. Because of this, most of these trading days are better off being left alone, and not even traded at all.

Ready to trade our daily Forex analysis? Check out the best forex trading company in UK worth using.