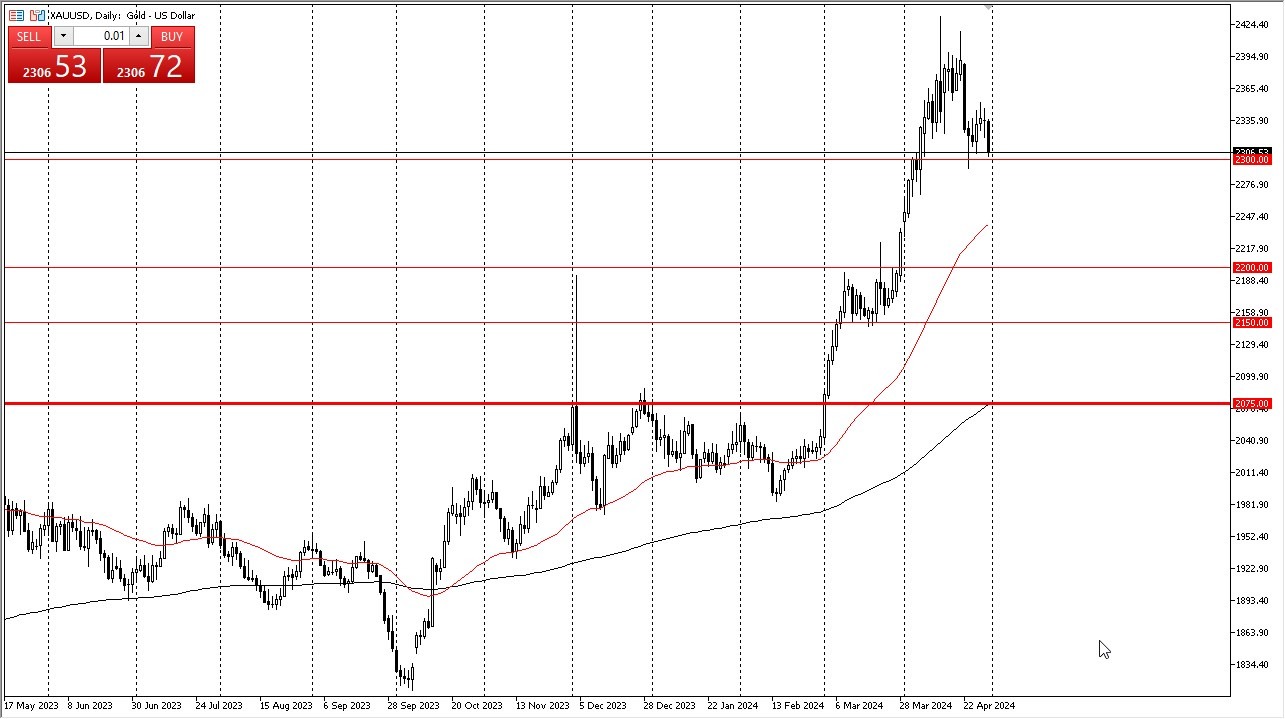

- The gold market has shown itself to be rather negative during the day.

- But I think at this point you have to look at it through the prism of a market that is now testing major support.

- The question is going to be whether or not we can continue to see buyers jump in at the $2,300 level, or if we have a situation where we break through there and go look into the 50 day EMA.

- This of course is an indicator that a lot of technical traders will pay close attention to, so therefore it’s worth noting.

It is worth noting, and it's probably not a significant accident that the FOMC meeting is today, Wednesday and that probably has a lot to do with what's going on here. If Jerome Powell is extremely hawkish, it could work against gold, although more likely than not in a temporary sense. More than anything else. So, with that being the case, I think it would just end up being a nice buying opportunity if we do break down on Wednesday. That being said, keep in mind that it will be extraordinarily volatile during the FOMC press conference, so you don’t want to jump in with a huge position right away. If you get it right, then you can start to add once things settle down, assuming of course that gold ends up rallying.

Top Forex Brokers

If We Break Higher…

On the other hand, we could just stay above the $2,300 level and consolidate between $2,300 on the bottom and $2,400 on the top. In other words, there really isn't a reason to start shorting this market, and I just don't see a scenario in which I do it. Ultimately, gold has seen a bit of a beating on Tuesday in the early hours, but it is still a situation where not only do we have various financial issues, but we also have to worry about the geopolitical ones as well. And then of course, is a major driver of people into the gold market.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.